The world bank

The world bank

WHO WE ARE

With 189 member countries, staff from more than 170 countries, and offices in over 130 locations, the World Bank Group is a unique global partnership: five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries.

Our Mission

To end extreme poverty:

By reducing the share of the global population that lives in extreme poverty to 3 percent.

To promote shared prosperity:

By increasing the incomes of the poorest 40 percent of people in every country.

The World Bank Group is one of the world’s largest sources of funding and knowledge for developing countries. Its five institutions share a commitment to reducing poverty, increasing shared prosperity, and promoting sustainable development.

ICSID

Our Core Values

Our core values embody what is most important to us as an institution, and in how we work with each other, our clients and our partners. They guide the decisions we make and the actions we take in carrying out our mission.

Partnering with Governments

Together, IBRD and IDA form the World Bank, which provides financing, policy advice, and technical assistance to governments of developing countries. IDA focuses on the world’s poorest countries, while IBRD assists middle-income and creditworthy poorer countries.

Partnering with the Private Sector

IFC, MIGA, and ICSID focus on strengthening the private sector in developing countries. Through these institutions, the World Bank Group provides financing, technical assistance, political risk insurance, and settlement of disputes to private enterprises, including financial institutions.

One World Bank Group

While our five institutions have their own country membership, governing boards, and articles of agreement, we work as one to serve our partner countries. Today’s development challenges can only be met if the private sector is part of the solution. But the public sector sets the groundwork to enable private investment and allow it to thrive. The complementary roles of our institutions give the World Bank Group a unique ability to connect global financial resources, knowledge, and innovative solutions to the needs of developing countries.

Resources

World Bank Annual Report

The Annual Report focuses on how the World Bank is partnering with countries to end extreme poverty by 2030, promote shared prosperity, and support the global sustainable development agenda.

Food Security Update: Food Price Inflation Remains High

Our latest food security update shows high inflation continuing in most low- and middle-income countries. The share of high-income countries facing high inflation has also increased sharply. Learn More.

World Water Week 2022

World Water Week, organized each year by the Stockholm International Water Institute (SIWI), brings together experts, professionals, innovators and entrepreneurs from various sectors and countries with the aim of developing solutions for water-related challenges. The theme of this year’s event is «Seeing the Unseen: The Value of Water,» with a focus on the diverse aspects of water, how others view and value water, and the exploration of water’s full value to society.

A New Tool in the Fight Against Climate Change

Our new Country Climate and Development Reports provide analytical, country-specific roadmaps to a green, resilient and inclusive future.

The World Bank and Ukraine

Join Us

Newsletter

Our Mission

The World Bank Group has two goals,

to end extreme poverty and promote shared prosperity in a sustainable way

We engage the development community with real-world statistics

Agriculture is crucial to economic growth: in 2018, it accounted for 4% of global gross domestic product (GDP) and in some least developing countries, it can account for more than 25% of GDP.

But agriculture-driven growth, poverty reduction, and food security are at risk: Multiple shocks – from COVID-19 related disruptions to extreme weather, pests and conflicts – are impacting food systems, resulting in higher food prices and growing hunger. Read more

Many countries are facing growing levels of food insecurity, reversing years of development gains, and threatening the achievement of Sustainable Development Goals by 2030. Even before COVID-19 reduced incomes and disrupted supply chains, chronic and acute hunger were on the rise due to various factors, including conflict, socio-economic conditions, natural hazards, climate change and pests. The impact of the war in Ukraine adds risk to global food security, with food prices likely to remain high for the foreseeable future and expected to push millions of additional people into acute food insecurity. Read more

While the outlook for global food supplies remains favorable, food prices increased sharply due to elevated input prices which, combined with high transport costs and trade disruptions due to the war in Ukraine, are raising import bills. That hits poor and developing countries hardest, as they depend on food imports the most. Read more

World Bank Open Data

Free and open access to global development data

MOST RECENT

Improved governance and increased investment needed to tackle world water crisis

Measuring Individuals’ Rights to Land: A Companion Guide for Cognitive Interviewing

Precious metal prices pressured by rising interest rates and weaker economic activity

Data brings new perspectives to watershed conservation

Extreme Poverty

The proportion of the world’s population living in extreme poverty has dropped significantly

Over 3 billion people cannot afford a healthy diet and most live in lower-middle-income countries.

RECENTLY UPDATED DATASETS

Global Flood Exposure: Gridded exposure headcounts by country

More Resources

Open Data Catalog

Provides a listing of available World Bank datasets, including databases, pre-formatted tables, reports, and other resources.

DataBank

An analysis and visualisation tool that contains collections of time series data on a variety of topics.

Microdata Library

Provides access to data collected through sample surveys of households, business establishments or other facilities.

Atlas of Sustainable Development Goals

Guides readers through the Sustainable Development Goals using interactive storytelling and innovative data visualizations.

International Debt Statistics

Provides access to comprehensive annual statistics on external debt stocks and flows for 120 developing countries.

International Comparison Program

Explore purchasing power parities (PPPs), price levels, economic data and the methodology behind the world’s largest statistical partnership.

World Development Indicators

The primary World Bank collection of development indicators, compiled from officially-recognized international sources.

Open Finances

Explore raw data about the World Bank Group’s finances, including disbursements and management of global funds.

Projects & Operations

Provides access to basic information on all of the World Bank’s lending projects from 1947 to the present.

Open Data Toolkit

Provides an understanding of Open Data and how to get «up to speed» in planning and implementing an open data program.

Living Standards Measurement Study

Supports countries in conducting multi-topic household surveys to generate high-quality data, improve survey methods and build capacity.

Global Consumption Database

A one-stop source of data on household consumption patterns in developing countries.

WHAT WE DO

The World Bank Group works in every major area of development. We provide a wide array of financial products and technical assistance, and we help countries share and apply innovative knowledge and solutions to the challenges they face.

Development Projects

RELATED

Since 1947, the World Bank has funded over 12,000 development projects, via traditional loans, interest-free credits, and grants.

Projects

Access the World Bank’s lending portfolio of more than 12,000 development projects, including current and historical data since 1947.

Priorities

RELATED

Three priorities guide our work with countries to end poverty and boost prosperity for the poorest people. Helping create sustainable economic growth, investing in people and building resilience to shocks and threats that can roll back decades of progress.

Human Capital Project

We can end extreme poverty and create more inclusive societies by developing human capital. This requires investing in people through nutrition, health care, quality education, jobs and skills.

Research and Publications

Featured

Global Findex Database

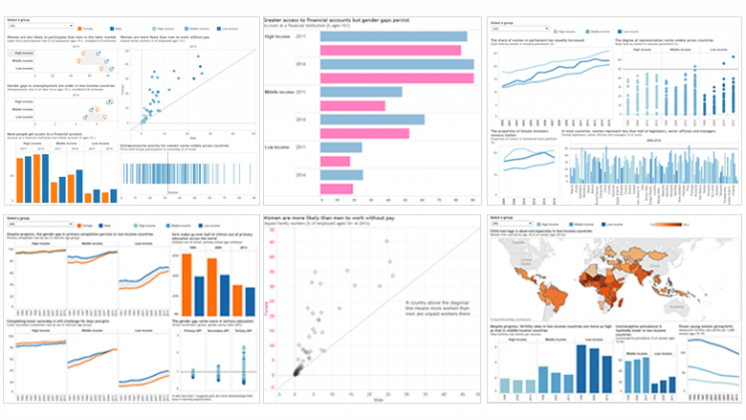

The COVID-19 pandemic has spurred financial inclusion – driving a large increase in digital payments amid the global expansion of formal financial services. This expansion created new economic opportunities, narrowing the gender gap in account ownership, and building resilience at the household level to better manage financial shocks, according to the Global Findex 2021 database.

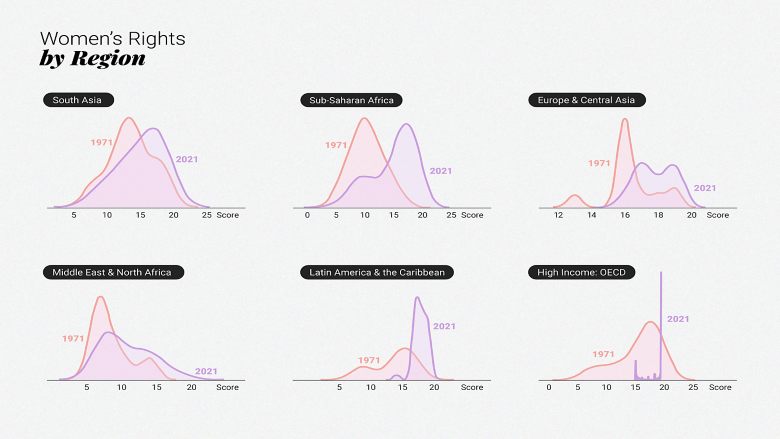

Women, Business and the Law 2022

Legal reforms to encourage and incentivize women’s work strengthen communities and economies. In 86 countries, women face some form of job restriction and 95 countries do not guarantee equal pay for equal work, according to the World Bank’s Women, Business and the Law 2022 report.

World Development Report 2022: Finance for an Equitable Recovery

The 2022 World Development Report (WDR) examines the financial and economic risks that have been created or exacerbated by the pandemic, and outlines policy measures governments should take now to avoid major financial upheaval.

Open Knowledge Repository

Select works from over 30,000 World Bank publications

The world economy continues to suffer from a series of destabilizing shocks. After more than two years of pandemic, the Russian Federation’s invasion of Ukraine and its global effects on commodity markets, supply chains, inflation, and financial conditions have steepened the slowdown in global growth. In particular, the war in Ukraine is leading to soaring prices and volatility in energy markets, with improvements in activity in energy exporters more than offset by headwinds to activity in most other economies.

For thousands of years, migration has been a source of social and economic well-being for people living on different shores of the Mediterranean Sea. Whether through higher earnings for migrants, access to labor for receiving countries, or remittances for sending communities, migration has been an important driver of development in the Mediterranean region. The COVID-19 (coronavirus) pandemic has severely disrupted this complex web of movements, raising questions about whether migration will continue to be an important driver of the region’s well-being. As time passed, it became clear that the drivers of migration are so strong that mobility restrictions can only reduce movements, not halt them entirely. Building Resilient Migration Systems in the Mediterranean Region: Lessons from COVID-19 presents evidence on the implications of the COVID-19 pandemic on mobility in the region to inform policy responses that can help countries restart migration safely and better respond to future shocks.

The COVID-19 pandemic has exposed the upsides and downsides of international trade in medical goods and services. Open trade can increase access to medical services and goods (and the critical inputs needed to manufacture them), improve quality and variety, and reduce costs. But excessive concentration of production, restrictive trade policies, supply chain disruptions, and regulatory divergence can jeopardize the ability of public health systems to respond to pandemics and other health crises. This report, coordinated by Nadia Rocha and Michele Ruta at the World Bank and Marc Bacchetta and Joscelyn Magdeleine at the WTO, provides new data on trade in medical goods and services and medical value chains; surveys the evolving policy landscape before and during the pandemic; and proposes an action plan to improve trade policies and deepen international cooperation to deal with future pandemics.

Where Is the Value in the Chain? Pathways out of Plastic Pollution aims to support policy makers in their efforts to address plastic pollution. By examining the economic and financial implications of plastic management, the report provides key recommendations on how to create a comprehensive approach to addressing plastic pollution and to help policy makers make informed decisions for plastic pollution management. The report brings together new evidence from three analytical undertakings

International economic integration offers unexploited opportunities to Latin America and the Caribbean. This report studies how the region’s countries can leverage trade agreements to promote their economies’ participation in global value chains (GVCs).The gaps between potential and actual GVC integration follow from the region’s Economic fundamentals, such as geography, market size, institutions, and factor endowments. But policy choices matter as well. The report, based on new data and evidence, shows that trade agreements can drive policy reforms and help the region overcome some of its disadvantageous fundamentals.

History

Contacts

Headquarters

1818 H Street, NW Washington, DC 20433 USA (202) 473-1000

Stay Connected

The past 70 years have seen major changes in the world economy. Over that time, the World Bank Group—the world’s largest development institution—has worked to help more than 100 developing countries and countries in transition adjust to these changes by offering loans and tailored knowledge and advice. The Bank Group works with country governments, the private sector, civil society organizations, regional development banks, think tanks, and other international institutions on issues ranging from climate change, conflict, and food security to education, agriculture, finance, and trade. All of these efforts support the Bank Group’s twin goals of ending extreme poverty by 2030 and boosting shared prosperity of the poorest 40 percent of the population in all countries.

Founded in 1944, the International Bank for Reconstruction and Development—soon called the World Bank—has expanded to a closely associated group of five development institutions. Originally, its loans helped rebuild countries devastated by World War II. In time, the focus shifted from reconstruction to development, with a heavy emphasis on infrastructure such as dams, electrical grids, irrigation systems, and roads. With the founding of the International Finance Corporation in 1956, the institution became able to lend to private companies and financial institutions in developing countries. And the founding of the International Development Association in 1960 put greater emphasis on the poorest countries, part of a steady shift toward the eradication of poverty becoming the Bank Group’s primary goal. The subsequent launch of the International Centre for Settlement of Investment Disputes and the Multilateral Investment Guarantee Agency further rounded out the Bank Group’s ability to connect global financial resources to the needs of developing countries.

Today the Bank Group’s work touches nearly every sector that is important to fighting poverty, supporting economic growth, and ensuring sustainable gains in the quality of people’s lives in developing countries. While sound project selection and design remain paramount, the Bank Group recognizes a wide range of factors that are critical to success—effective institutions, sound policies, continuous learning through evaluation and knowledge-sharing, and partnership, including with the private sector. The Bank Group has long-standing relationships with more than 180 member countries, and it taps these to address development challenges that are increasingly global. On critical issues like climate change, pandemics, and forced migration, the Bank Group plays a leading role because it is able to convene discussion among its country members and a wide array of partners. It can help address crises while building the foundations for longer-term, sustainable development.

The evolution of the Bank Group has also been reflected in the diversity of its multidisciplinary staff, who include economists, public policy experts, sector experts, and social scientists, based at headquarters in Washington, D.C., and in the field. Today, more than a third of staff are based in country offices.

WHERE WE WORK

The World Bank Group works in more than 170 countries, working with partners in the public and private sectors in their efforts to end poverty and tackle some of the most pressing development challenges.

Browse Our Locations

In Depth

Find a Project

Search our project database by keyword or browse by country, sector, and theme.

Development Data and Statistics

Download World Bank data and statistics for over 200 countries and 1,200 indicators on development topics.

Country Partnership Framework

Learn how the World Bank Group focuses its programs of investment and support with its partner countries.

Results That Change Lives

This series highlights the projects that have made a real difference on the ground, and the people who have benefitted.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Organization

Contacts

Headquarters

1818 H Street, NW Washington, DC 20433 USA (202) 473-1000

Stay Connected

The World Bank is like a cooperative, made up of 189 member countries. These member countries, or shareholders, are represented by a Board of Governors, who are the ultimate policymakers at the World Bank. Generally, the governors are member countries’ ministers of finance or ministers of development. They meet once a year at the Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund.

The governors delegate specific duties to 25 Executive Directors, who work on-site at the Bank. The five largest shareholders appoint an executive director, while other member countries are represented by elected executive directors.

The World Bank operates day-to-day under the leadership and direction of the president, management and senior staff, and the vice presidents in charge of Global Practices, Cross-Cutting Solutions Areas, regions, and functions.

Food Security Update: Food Price Inflation Remains High

Our latest food security update shows high inflation continuing in most low- and middle-income countries. The share of high-income countries facing high inflation has also increased sharply. Learn More.

World Water Week 2022

World Water Week, organized each year by the Stockholm International Water Institute (SIWI), brings together experts, professionals, innovators and entrepreneurs from various sectors and countries with the aim of developing solutions for water-related challenges. The theme of this year’s event is «Seeing the Unseen: The Value of Water,» with a focus on the diverse aspects of water, how others view and value water, and the exploration of water’s full value to society.

A New Tool in the Fight Against Climate Change

Our new Country Climate and Development Reports provide analytical, country-specific roadmaps to a green, resilient and inclusive future.

The World Bank and Ukraine

Join Us

Newsletter

Our Mission

The World Bank Group has two goals,

to end extreme poverty and promote shared prosperity in a sustainable way

We engage the development community with real-world statistics

Agriculture is crucial to economic growth: in 2018, it accounted for 4% of global gross domestic product (GDP) and in some least developing countries, it can account for more than 25% of GDP.

But agriculture-driven growth, poverty reduction, and food security are at risk: Multiple shocks – from COVID-19 related disruptions to extreme weather, pests and conflicts – are impacting food systems, resulting in higher food prices and growing hunger. Read more

Many countries are facing growing levels of food insecurity, reversing years of development gains, and threatening the achievement of Sustainable Development Goals by 2030. Even before COVID-19 reduced incomes and disrupted supply chains, chronic and acute hunger were on the rise due to various factors, including conflict, socio-economic conditions, natural hazards, climate change and pests. The impact of the war in Ukraine adds risk to global food security, with food prices likely to remain high for the foreseeable future and expected to push millions of additional people into acute food insecurity. Read more

While the outlook for global food supplies remains favorable, food prices increased sharply due to elevated input prices which, combined with high transport costs and trade disruptions due to the war in Ukraine, are raising import bills. That hits poor and developing countries hardest, as they depend on food imports the most. Read more

The World Bank Group and the International Monetary Fund (IMF)

What is the difference between the World Bank Group and the IMF?

Founded at the Bretton Woods conference in 1944, the two institutions have complementary missions. The World Bank Group works with developing countries to reduce poverty and increase shared prosperity, while the International Monetary Fund serves to stabilize the international monetary system and acts as a monitor of the world’s currencies. The World Bank Group provides financing, policy advice, and technical assistance to governments, and also focuses on strengthening the private sector in developing countries. The IMF keeps track of the economy globally and in member countries, lends to countries with balance of payments difficulties, and gives practical help to members. Countries must first join the IMF to be eligible to join the World Bank Group; today, each institution has 189 member countries.

The World Bank Group

The World Bank Group is one of the world’s largest sources of funding and knowledge for developing countries. Its five institutions share a commitment to reducing poverty, increasing shared prosperity, and promoting sustainable development.

Together, IBRD and IDA form the World Bank, which provides financing, policy advice, and technical assistance to governments of developing countries. IDA focuses on the world’s poorest countries, while IBRD assists middle-income and creditworthy poorer countries.

IFC, MIGA, and ICSID focus on strengthening the private sector in developing countries. Through these institutions, the World Bank Group provides financing, technical assistance, political risk insurance, and settlement of disputes to private enterprises, including financial institutions.

The International Monetary Fund

The IMF works to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

The IMF’s primary purpose is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries and their citizens to transact with each other. It does so by keeping track of the global economy and the economies of member countries, lending to countries with balance of payments difficulties, and giving practical help to members.

Search

Thank you for participating in this survey! Your feedback is very helpful to us as we work to improve the search functionality on worldbank.org.

With 189 member countries, staff from more than 170 countries, and offices in over 130 locations, the World Bank Group is a unique global partnership: five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries.

Merchandise Trade statistics data for RUSSIA (RUSSIA) including exports and imports, applied tariffs, top exporting and importing countries, effectively applied and MFN tariff along with most exported and imported product groups, along with development indicators such as GDP, GNI per capita, trade balance and trade as percentage of GDP for Most Recent Year.

Russia and the World Bank: International Development Assistance

Housing sector in Russia currently accounts for approximately one quarter of all energy consumed in the country. Being the second largest consumer of energy in the country (second to industry), there is an enormous potential for energy savings and Greenhouse Gas (GHG) emissions reductions in the housing sector.

In Russia, a child born today can expect to achieve 68 percent of the productivity of a fully educated adult in optimal health. It is at the average level for Europe and Central Asia countries and the third result globally among the countries of the same income group. There is a stark contrast between education and health subscales in Russia.

World Bank

Contents

Areas of Focus

The World Bank’s activities are focused on developing countries, in the fields of human development (education, health), agriculture and rural development (irrigation, rural services), environmental protection (pollution reduction, establishing and enforcing regulations), infrastructure (roads, urban regeneration, electricity), and good governance (anti-corruption, legal institutions development). The IBRD and IDA provide loans at preferential rates to member countries, as well as grants to the poorest countries. Loans or grants for specific projects are often linked to wider policy changes in the sector or the economy. For example, a loan to improve coastal environmental management may be linked to development of new environmental institutions at national and local levels and to implementation of new regulations to limit pollution.

The activities of the International Finance Corporation and Multilateral Investment Guarantee Agency include investment in the private sector and providing insurance.

The World Bank Institute is the capacity development branch of the World Bank, which provides training and other capacity building programs to member countries.

Organizational Structure

Five affiliated agencies created between 1956 and 1988 make up the World Bank Group. The Group’s headquarters are in Washington, D.C. It is an international organization owned by member governments. It makes a profit, but the profit is used to support continued efforts in poverty reduction.

Technically, the World Bank is part of the United Nations system, but its governance structure is different. Each institution in the World Bank Group is owned by its member governments, which subscribe to its basic share capital, with votes proportional to shares held. Membership gives certain voting rights that are the same for all countries but there are additional votes which depend on financial contributions to the organization.

As of November 1, 2006 the United States held 16.4 percent of total votes, Japan 7.9 percent, Germany 4.5 percent, and the United Kingdom and France each held 4.3 percent. As major decisions require an 85 percent super-majority, the U.S. can block any such major change.

World Bank Group Agencies

The Five World Bank Group agencies are:

Governments can choose which of these agencies to join as members. The IBRD has 185 member governments, and the other institutions have between 140 and 176 members. The institutions of the World Bank Group are all run by a Board of Governors that meet once a year. [4] Each member country appoints a governor, generally its Minister of Finance.

Presidency

By convention, the Bank President has always been nominated by the U.S. President and is a US citizen. [7] By the same convention, the Managing Director of the IMF has been a European. Although nominated by the US Government, the World Bank President is subject to confirmation by the Board of Governors. The World Bank President serves a term of five years, which may be renewed.

The World Bank Group was recently headed by Paul Wolfowitz. He was appointed on June 1, 2005 but was forced to resign on May 17, 2007. Wolfowitz, a former United States Deputy Secretary of Defense, was nominated by George W. Bush to replace James D. Wolfensohn. It came to light that Wolfowitz had used his influence to transfer his girlfriend out of the World Bank to the State Department for a significantly higher income job. The controversy surrounding this decision and other criticism about his aloof leadership style brought him down.

On May 30, 2007, U.S. President George W. Bush nominated Robert Zoellick to be the next President of the World Bank. Zoellick is a former U.S. Trade Representative and former U.S. Deputy Secretary of State. At the time of his nomination, he was an executive with Goldman Sachs. The nomination is subject to approval by the World Bank Board of Directors.

List of Presidents

List of Chief Economists

List of World Bank Directors-General of Evaluation

Criticism

The World Bank has long been criticized by a range of nongovernmental organizations and academics, notably including its former Chief Economist Joseph Stiglitz, who is equally critical of the International Monetary Fund, the US Treasury Department, and US and other developed country trade negotiators. [8] The Bank’s own internal evaluations have drawn negative conclusions. Critics argue that the so-called free market reform policies — which the Bank advocates in many cases — are often harmful to economic development if implemented badly, too quickly («shock therapy (economics)»), in the wrong sequence, or in very weak, uncompetitive economies. [9] In Russia, for example, some have suggested that it was an apparent shock therapy policy that has significantly raised the number of people living in poverty from 2 million to 60 million, a 3000 percent increase.

Following decolonization, many African countries were ruled by dictators. Some corrupt dictators are alleged to have stolen much of the financial support lent by the World Bank, IMF, and other lenders, suggesting a lack of oversight by the World Bank and leaving a legacy of enormous national debt in these recipient nations.

However, World Bank standards and methods such as transparent procedures for competitive procurement and environmental standards for project evaluation are highly valued by some, and have been adopted successfully in some areas.

Although relied upon by poor countries as a contributor of development finance, the World Bank is often criticized, primarily by opponents of corporate «neo-colonial» globalization. These advocates of alter-globalization fault the bank for what they believe are policies and procedures that undermine national sovereignty of recipient countries.

A related accusation is that the Bank operates under essentially «neo-liberal» principles. In this perspective, reforms born of «neo-liberal» inspiration are not always suitable for nations experiencing conflicts (ethnic wars, border conflicts, etc.), or that are long-oppressed (dictatorship or colonialism) and do not have stable, democratic political systems.

There is suspicion in some circles that the Bank is under the marked political influence of certain countries (notably, the United States) that would profit from advancing their interests. Those who hold this view suspect the World Bank would favor the installation of foreign enterprises, to the detriment of the development of the local economy and the people living in that country.

In her book Masters of Illusion: The World Bank and the Poverty of Nations (1996), author Catherine Caufield makes a sharp criticism of the assumptions and structure of the World Bank operation, arguing that it harms southern nations rather than promoting them. Caufield criticizes the highly homogenized and Western recipes of “development” held by the Bank. Caufield takes the stand that, to the World Bank, different nations and regions are indistinguishable, and ready to receive the “uniform remedy of development.” The danger of this assumption is that to attain even small portions of success, western approaches to life are adopted and traditional economic structures and values are abandoned. Caufield presents a second assumption held by the World Bank, that poor countries cannot modernize without money and advice from abroad. She suggests that this generates a cycle of indebtedness that with the payment of interest means a huge net transfer from the poor to the rich nations each year.

Caufield criticizes two elements in the structure of the World Bank. First, the structure of repayment; the Bank is a lender of foreign currency and demands to be repaid in the same currency. The borrower countries, in order to obtain the currencies to repay the loans, must sell to the rich countries more than they buy from them. However, the rich countries want to be net exporters, not importers. This generates “the transfer problem,” often the only way of repaying loans is to engage in other loans, resulting in an accumulation of debts. Second, she criticizes the high influence of the bank over national sovereignty. As a condition of the credit, the Bank offers advice on how countries should manage their finances, make their laws, provide services, and conduct themselves in the international market. The Bank has great power of persuasion, because if it decides to ostracize a borrower, other major international powers will follow the lead. On top of this, by excessive lending, the Bank has added to its own power and depleted that of its borrowers, generating a blatant inconsistency with its stated mission.

Defenders of the World Bank contend that no country is forced to borrow its money. The Bank provides both loans and grants. Even the loans are concessional since they are given to countries that have no access to international capital markets. Furthermore, the loans, both to poor and middle-income countries, are at below market-value interest rates. The World Bank argues that it can help development more through loans than grants, because money repaid on the loans can then be lent for other projects.

AIDS Controversy

In debates about the World Bank’s role, the arguments are complex and often rely as much upon political judgment as economic proof. For example, in the 2005 Massey Lecture, entitled «Race Against Time,» Stephen Lewis argued that the structural adjustment policies of the World Bank and the International Monetary Fund have aggravated and aided the spread of the AIDS pandemic by limiting the funding allowed to health and education sectors. However, it should also be noted that, although finances hardly help stop the spread of the AIDS pandemic, the World Bank is a major source of funding for combating AIDS in poor countries, and in the past six years it has committed about US$ 2 billion through grants, loans and credits for programs to fight HIV/AIDS.

Evaluation at the World Bank

Social and environmental concerns

Throughout the period from 1972 to 1989, the Bank did not conduct its own environmental assessments and did not require assessments for every project that was proposed. Assessments were required only for a varying, small percentage of projects, with the environmental staff, in the early 1970s, sending check-off forms to the borrowers and, in the latter part of the period, sending more detailed documentation and suggestions for analysis.

During this same period, the Bank’s failure to adequately consider social environmental factors was most evident in the 1976 Indonesian Transmigration program (Transmigration V). This project was funded after the establishment of the Bank’s OESA (environmental) office in 1971. According to the Bank critic Le Prestre, Transmigration V was the “largest resettlement program ever attempted… designed ultimately to transfer, over a period of twenty years, 65 million of the nation’s 165 million inhabitants from the overcrowded islands of Java, Bali, Madura, and Lombok…” (175). The objectives were: relief of the economic and social problems of the inner islands, reduction of unemployment on Java, relocation of manpower to the outer islands, the “strengthen[ing of] national unity through ethnic integration, and improve[ment of] the living standard of the poor” (ibid, 175).

Putting aside the possibly Machiavellian politics of such a project, it otherwise failed as the new settlements went out of control. Local populations fought with the migrators and the tropical forest was devastated (destroying the lives of indigenous peoples). Also, “[s]ome settlements were established in inhospitable sites, and failures were common;” these concerns were noted by the Bank’s environmental unit whose recommendations (to Bank management) and analyses were ignored (Le Prestre, 176). Funding continued through 1987, despite the problems noted and despite the Bank’s published stipulations (1982) concerning the treatment of groups to be resettled.

More recent authors have pointed out that the World Bank learned from the mistakes of projects such as Transmigration V and greatly improved its social and environmental controls, especially during the 1990s. It has established a set of «Safeguard Policies» that set out wide ranging basic criteria that projects must meet to be acceptable. The policies are demanding, and as Mallaby (reference below) observes: «Because of the combined pressures from Northern NGOs and shareholders, the Bank’s project managers labor under «safeguard» rules covering ten sensitive issues … no other development lender is hamstrung in this way» (page 389). The ten policies cover: Environmental Assessment, Natural Habitats, Forests, Pest Management, Cultural Property, Involuntary Resettlement, Indigenous Peoples, Safety of Dams, Disputed Areas, and International Waterways [9].

The Independent Evaluation Group

The Independent Evaluation Group (IEG) (formerly known as the Operations Evaluation Department (OED)) plays an important check and balance role in the World Bank. Similar in its role to the US Government’s Government Accountability Office (GAO), it is an independent unit of the World Bank that reports evaluation findings directly to the Bank’s Board of Executive Directors. IEG evaluations provide an objective basis for assessing the results of the Bank’s work, and ensuring accountability of World Bank management to the member countries (through the World Bank Board) in the achievement of its objectives.

Extractive Industries Review

Impact evaluations

In recent years there has been an increased focus on measuring results of World Bank development assistance through impact evaluations. An impact evaluation assesses the changes in the well-being of individuals that can be attributed to a particular project, program or policy. Impact evaluations demand a substantial amount of information, time and resources. Therefore, it is important to select carefully the public actions that will be evaluated. One of the important considerations that could govern the selection of interventions (whether they be projects, programs or policies) for impact evaluation is the potential of evaluation results for learning. In general, it is best to evaluate interventions that maximize the possibility of learning from current poverty reduction efforts and provide insights for midcourse correction, as necessary.

Other Information

The World Bank provides summer internships to local DC students at its headquarters every year. This youth development program is a large investment in the city’s youth and the World Bank partners with a local nonprofit, Urban Alliance Foundation, to provide this opportunity.

Notes

References

External links

All links retrieved October 10, 2020.

Credits

New World Encyclopedia writers and editors rewrote and completed the Wikipedia article in accordance with New World Encyclopedia standards. This article abides by terms of the Creative Commons CC-by-sa 3.0 License (CC-by-sa), which may be used and disseminated with proper attribution. Credit is due under the terms of this license that can reference both the New World Encyclopedia contributors and the selfless volunteer contributors of the Wikimedia Foundation. To cite this article click here for a list of acceptable citing formats.The history of earlier contributions by wikipedians is accessible to researchers here:

The history of this article since it was imported to New World Encyclopedia:

Note: Some restrictions may apply to use of individual images which are separately licensed.

Search

Thank you for participating in this survey! Your feedback is very helpful to us as we work to improve the search functionality on worldbank.org.

Population. Improvements in national averages for life expectancy, fertility, migration, and other indicators have been seen across the globe. However, there are still considerable variations within countries stemming from disparities in income, availability of and access to services, social practices, and conflict. Access data CSV Databank.

Population, male. Population, male (% of total population) International migrant stock, total. International migrant stock (% of population) Population ages 25-29, female (% of female population) Age dependency ratio (% of working-age population)

World Bank Open Data | Data

World Bank Open Data | Data

World Development Indicators | The World Bank

Average annual population growth %. Population age composition. Dependency ratio. Crude death rate. Crude birth rate. Ages 0-14. Ages 15-64. Ages 65+.

Всемирный банк

Информация об организации

Цели и задачи Всемирного банка

Главной целью деятельности Всемирного банка является поддержка всеобъемлющего и устойчивого развития в глобальном масштабе. Всемирный банк также стремится способствовать преодолению экономического разрыва между бедными и богатыми странами, сокращению бедности во всём мире, улучшению качества жизни людей посредством укрепления экономики стран-членов и содействия их устойчивому экономическому росту. В настоящее время Всемирный банк является одним из наиболее важных источников финансовой и технической помощи, оказываемой развивающимся странам мира. Банк предоставляет долгосрочные займы, гранты и техническую помощь развивающимся странам в реализации их стратегий сокращения масштабов бедности и ускорения экономического роста. В дополнение к финансированию, Банк предоставляет консультации и иные виды помощи развивающимся странам на почти каждый аспект экономического развития.

Особое внимание Всемирный банк уделяет следующим стратегическим направлениям:

Структура организации Всемирного банка

В процессе своего развития Всемирный банк претерпевал различные структурные изменения и в настоящее время представляет собой систему из пяти связанных между собой организаций развития, которые называются «Группа организаций Всемирного банка» (World Bank Group).

В состав Группы организаций Всемирного банка входят пять организаций:

Следует учитывать, что технически термин «Всемирный банк» относится только к Международному банку реконструкции и развития (МБРР) и Международной ассоциации развития (МАР), а термин «Группа организаций Всемирного банка» охватывает все пять подразделений: Всемирный банк (МБРР и МАР) и три другие учреждения — Международную финансовую корпорацию (МФК), Многостороннее агентство по гарантированию инвестиций (МАГИ) и Международный центр по урегулированию инвестиционных споров (МЦУИС).

Структура управления Всемирного банка

Структура управления Группы организаций Всемирного банка состоит из следующих элементов:

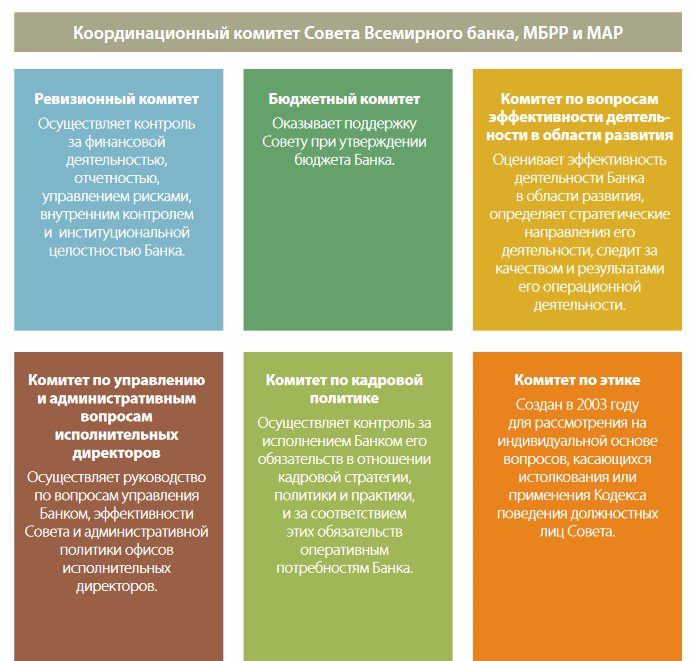

Всемирный банк подотчётен правительствам государств-членов. На верхнем уровне его организационной структуры находится Совет управляющих, который является высшим органом, принимающим решения и определяющим политику Банка. Как правило, управляющими являются министры финансов или развития государств-членов организации. Совет управляющих собирается один раз в год на Ежегодных совещаниях Всемирного банка и Международного валютного фонда. Поскольку управляющие проводят свои совещания не чаще, чем раз в год, конкретные полномочия переданы 25 исполнительным директорам, работающим непосредственно в штаб-квартире Банка в Вашингтоне. Пять исполнительных директоров представляют пять крупнейших государств-членов (Соединённые Штаты Америки, Германия, Великобритания, Франция и Япония), а остальные 20 исполнительных директоров представляют группы стран.

Повседневная деятельность Всемирного банка осуществляется под руководством Президента, высшего руководства организации и вице-президентов, отвечающих за конкретные регионы, сектора, направления деятельности и выполняющих конкретные функции. Президент Всемирного банка председательствует на совещаниях Совета директоров и отвечает за общее руководство деятельностью Банка. Президент избирается Советом управляющих на пятилетний срок и может быть переизбран. По традиции Президентом Всемирного банка становится гражданин США — страны, являющейся крупнейшим акционером Банка. Исполнительные директора образуют Совет директоров Всемирного банка. Обычно они проводят свои совещания два раза в неделю и осуществляют общее руководство работой организации, в том числе отвечают за утверждение всех займов и принятие политических решений, затрагивающих деятельность Банка, в том числе за утверждение займов и гарантий, новых принципов деятельности, административного бюджета, стратегий содействия странам, а также решений, касающихся заимствований и финансовой деятельности.

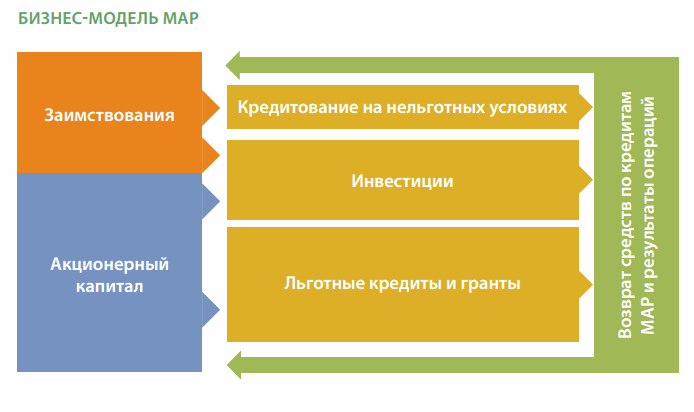

Политика кредитования Всемирного банка

Всемирный банк — международная финансовая организация, ведущая кредитную деятельность через два учреждения — МБРР и МАР, которые действуют сообща, но каждое из них играет особую роль в процессе. Целью МБРР является сокращение масштабов бедности в странах со средним уровнем дохода и в кредитоспособных странах с низким уровнем дохода, в то время как внимание МАР сосредоточено на беднейших странах мира.

Совместно эти учреждения предоставляют развивающимся странам займы по низким ставкам, беспроцентные кредиты и гранты, помогая им решать стоящие перед ними задачи в различных областях деятельности, таких как образование, здравоохранение, государственное управление, инфраструктура, развитие корпоративного и частного секторов, сельское хозяйство, охрана окружающей среды и управление природными ресурсами. Некоторые из таких проектов могут софинансироваться правительствами, другими многосторонними организациями, коммерческими банками и частными инвесторами. МБРР кредитует страны со средним уровнем дохода по процентным ставкам, соответствующим уровню рынка этих стран, а МАР кредитует страны с низким уровнем дохода по минимальным процентным ставкам или без процентов. Займы Всемирного банка беднейшим странам предоставляются на беспроцентной основе и имеют срок погашения до 50 лет. Развивающиеся страны и страны с переходной экономикой получают займы на срок от 15 до 20 лет, причём процентная ставка по ним ниже ставок, взимаемых коммерческими банками.

Всемирный банк осуществляет финансовую поддержку в форме низкопроцентных и беспроцентных займов (кредитов) и грантов. Банк предоставляет кредиты двух основных видов: инвестиционные кредиты и кредиты на цели развития. Инвестиционные кредиты предоставляются для финансирования производства товаров, работ и услуг в рамках проектов социально-экономического развития в различных секторах экономики. Кредиты на цели развития предоставляются в целях поддержки политических и институциональных реформ. Гранты предоставляются для финансирования разработки проектов путём стимулирования нововведений, сотрудничества между организациями и участия местных заинтересованных сторон в работе над проектами.

Объёмы кредитов Всемирного банка достигают десятков миллиардов долларов США в год. Банк финансирует конкретные проекты экономического и социального развития, оказывает техническое содействие и консультационную помощь, а также служит своего рода «катализатором» для привлечения инвестиций и заемных средств из других источников. Займы для осуществления конкретных проектов и программ в той или иной стране зачастую связаны с определёнными требованиями к заёмщику по проведению экономических и институциональных изменений. Каждые три года Группа Всемирного банка разрабатывает рамочный документ: «Стратегия деятельности Группы Всемирного банка», который используется как основа сотрудничества с той или иной страной. Стратегия помогает увязать программы Банка как по предоставлению займов, так и аналитических и консультационных услуг, с конкретными целями развития каждой страны-заёмщика. В стратегию входят проекты и программы, которые могут максимально повлиять на решение проблемы бедности и способствовать динамичному социально-экономическому развитию. До подачи на рассмотрение Совету директоров Всемирного банка стратегия обсуждается с правительством страны-заёмщика и с другими заинтересованными структурами.

Источники финансовых ресурсов Всемирного банка

Всемирный банк мобилизует денежные средства несколькими различными способами для поддержки кредитов и грантов, которые организация (МБРР и МАР) предоставляет странам-заёмщикам. Займы МБРР для развивающихся стран финансируются, главным образом, путём продажи на мировых финансовых рынках облигаций с рейтингом «ААА». Облигации МБРР приобретает широкий круг частных и институциональных инвесторов в странах Северной Америки, Европы и Азии. МБРР получает небольшой процентный доход от таких кредитных операций, и основную часть своего дохода он получает путём кредитования собственного капитала. Этот капитал состоит из накопленных с течением времени резервов и средств, внесённых 188 государствами-акционерами организации. Из дохода МБРР оплачиваются также операционные расходы Всемирного банка и осуществляются взносы в МАР и на цели облегчения бремени задолженности ряда стран.

Большое значение для Всемирного банка имеет поддержка государств-акционеров. Она выражается в предоставлении ими капитала для выполнения обязательств по обслуживанию задолженности перед МБРР. Кроме того, Банк располагает 193 миллиардами долларов США так называемого «востребуемого капитала», который может быть получен от акционеров в качестве резерва, если когда-нибудь в нём возникнет необходимость для выполнения обязательств МБРР по его заимствованиям (облигациям) или гарантиям. Однако Банку ещё ни разу не потребовалось воспользоваться этим ресурсом.

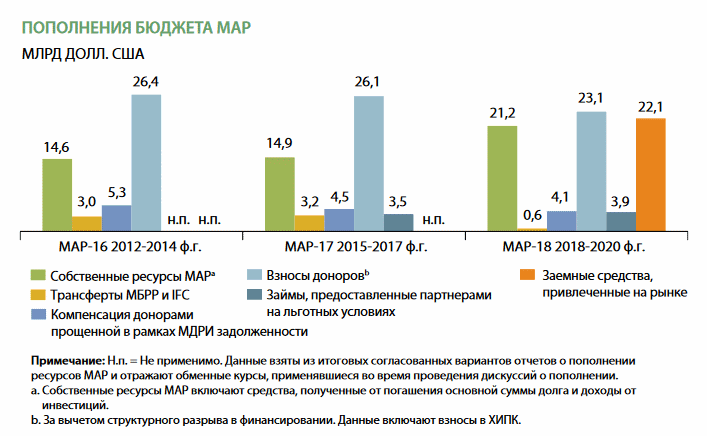

МАР, крупнейший в мире источник помощи в виде беспроцентных займов и грантов для наиболее бедных стран, пополняется каждые три года сорока государствами-донорами. Дополнительные ресурсы вновь создаются в процессе погашения основной суммы займов, которые выдаются сроком на лет, и беспроцентных займов, которые затем становятся доступны для перекредитования.

В конце финансового года Всемирный банк, как правило, имеет положительное сальдо, которое получает за счёт процентов, взимаемых по некоторым займам, а также сборов за некоторые оказываемые услуги. Часть прибыли перечисляется МАР, остальная часть положительного сальдо используется для облегчения долгового бремени бедных стран с высоким уровнем задолженности, переводится в финансовый резерв или используется для урегулирования чрезвычайных гуманитарных кризисов.

World Bank

Our editors will review what you’ve submitted and determine whether to revise the article.

Our editors will review what you’ve submitted and determine whether to revise the article.

Read a brief summary of this topic

World Bank, in full World Bank Group, international organization affiliated with the United Nations (UN) and designed to finance projects that enhance the economic development of member states. Headquartered in Washington, D.C., the bank is the largest source of financial assistance to developing countries. It also provides technical assistance and policy advice and supervises—on behalf of international creditors—the implementation of free-market reforms. Together with the International Monetary Fund (IMF) and the World Trade Organization, it plays a central role in overseeing economic policy and reforming public institutions in developing countries and defining the global macroeconomic agenda.

Origins

Founded in 1944 at the UN Monetary and Financial Conference (commonly known as the Bretton Woods Conference), which was convened to establish a new, post-World War II international economic system, the World Bank officially began operations in June 1946. Its first loans were geared toward the postwar reconstruction of western Europe. Beginning in the mid-1950s, it played a major role in financing investments in infrastructural projects in developing countries, including roads, hydroelectric dams, water and sewage facilities, maritime ports, and airports.

The World Bank Group comprises five constituent institutions: the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), and the International Centre for Settlement of Investment Disputes (ICSID). The IBRD provides loans at market rates of interest to middle-income developing countries and creditworthy lower-income countries. The IDA, founded in 1960, provides interest-free long-term loans, technical assistance, and policy advice to low-income developing countries in areas such as health, education, and rural development. Whereas the IBRD raises most of its funds on the world’s capital markets, the IDA’s lending operations are financed through contributions from developed countries. The IFC, operating in partnership with private investors, provides loans and loan guarantees and equity financing to business undertakings in developing countries. Loan guarantees and insurance to foreign investors against loss caused by noncommercial risks in developing countries are provided by the MIGA. Finally, the ICSID, which operates independently of the IBRD, is responsible for the settlement by conciliation or arbitration of investment disputes between foreign investors and their host developing countries.

From 1968 to 1981 the president of the World Bank was former U.S. secretary of defense Robert S. McNamara. Under his leadership the bank formulated the concept of “ sustainable development,” which attempted to reconcile economic growth and environmental protection in developing countries. Another feature of the concept was its use of capital flows (in the form of development assistance and foreign investment) to developing countries as a means of narrowing the income gap between rich and poor countries. The bank has expanded its lending activities and, with its numerous research and policy divisions, has developed into a powerful and authoritative intergovernmental body.

Organization

The World Bank is related to the UN, though it is not accountable either to the General Assembly or to the Security Council. Each of the bank’s more than 180 member states are represented on the board of governors, which meets once a year. The governors are usually their countries’ finance ministers or central bank governors. Although the board of governors has some influence on IBRD policies, actual decision-making power is wielded largely by the bank’s 25 executive directors. Five major countries—the United States, Japan, Germany, the United Kingdom, and France—appoint their own executive directors. The other countries are grouped into regions, each of which elects one executive director. Throughout the World Bank’s history, the bank president, who serves as chairman of the Executive Board, has been an American citizen.

Voting power is based on a country’s capital subscription, which is based in turn on its economic resources. The wealthier and more developed countries constitute the bank’s major shareholders and thus exercise greater power and influence. For example, in the early 21st century the United States exercised nearly one-sixth of the votes in the IBRD, more than double that of Japan, the second largest contributor. Because developing countries hold only a small number of votes, the system does not provide a significant voice for these countries, which are the primary recipients of World Bank loans and policy advice.

The bank obtains its funds from the capital subscriptions of member countries, bond flotations on the world’s capital markets, and net earnings accrued from interest payments on IBRD and IFC loans. Approximately one-tenth of the subscribed capital is paid directly to the bank, with the remainder subject to call if required to meet obligations.

The World Bank is staffed by more than 10,000 people, roughly one-fourth of whom are posted in developing countries. The bank has more than 100 offices in member countries, and in many countries staff members serve directly as policy advisers to the ministry of finance and other ministries. The bank has consultative as well as informal ties with the world’s financial markets and institutions and maintains links with nongovernmental organizations in both developed and developing countries.

Debt and policy reform

The debt crisis of the early 1980s—during which many developing countries were unable to service their external debt to multilateral lending institutions, because of a slowdown in the world economy, high interest rates, a decline in commodity prices, and wide fluctuations in oil prices, among other factors—played a crucial role in the evolution of World Bank operations. The bank had become increasingly involved in shaping economic and social policies in indebted developing countries. As a condition of receiving loans, borrowing countries were required to implement stringent “structural adjustment programs,” which typically included severe cuts in spending for health and education, the elimination of price controls, the liberalization of trade, the deregulation of the financial sector, and the privatization of state-run enterprises. Although intended to restore economic stability, these programs, which were applied in a large number of countries throughout the developing world, frequently resulted in increased levels of poverty, mounting unemployment, and a spiraling external debt. In the wake of the debt crisis, the World Bank focused its efforts on providing financial assistance in the form of balance-of-payments support and loans for infrastructural projects such as roads, port facilities, schools, and hospitals. Although emphasizing poverty alleviation and debt relief for the world’s least developed countries, the bank has retained its commitment to economic stabilization policies that require the implementation of austerity measures by recipient countries.

The World Bank and the IMF played central roles in overseeing free-market reforms in eastern and central Europe after the fall of communism there in the 1980s and ’90s. The reforms, which included the creation of bankruptcy and privatization programs, were controversial because they frequently led to the closure of state-run industrial enterprises. “Exit mechanisms” to allow for the liquidation of so-called “problem enterprises” were put into place, and labour laws were modified to enable enterprises to lay off unneeded workers. The larger state enterprises often were sold to foreign investors or divided into smaller, privately owned companies. In Hungary, for example, some 17,000 businesses were liquidated and 5,000 reorganized in 1992–93, leading to a substantial increase in unemployment. The World Bank also provided reconstruction loans to countries that suffered internal conflicts or other crises (e.g., the successor republics of former Yugoslavia in the late 1990s). This financial assistance did not succeed in rehabilitating productive infrastructure, however. In several countries the macroeconomic reforms resulted in increased inflation and a marked decline in the standard of living.

The World Bank is the world’s largest multilateral creditor institution, and as such many of the world’s poorest countries owe it large sums of money. Indeed, for dozens of the most heavily indebted poor countries, the largest part of their external debt—in some cases constituting more than 50 percent—is owed to the World Bank and the multilateral regional development banks. According to some analysts, the burden of these debts—which according to the bank’s statutes cannot be canceled or rescheduled—has perpetuated economic stagnation throughout the developing world.

EREPORT.RU

The World Economy

The World Bank Group

The World Bank Group is a group of five international organizations responsible for providing finance and advice to countries for the purposes of economic development and poverty reduction, and for encouraging and safeguarding international investment. The group and its affiliates have their headquarters in Washington, D.C., with local offices in 124 member countries.

Together with the separate International Monetary Fund, the World Bank organizations are often called the «Bretton Woods» institutions, after Bretton Woods, New Hampshire, where the United Nations Monetary and Financial Conference that led to their establishment took place (1 July-22 July 1944).

The Bank came into formal existence on 27 December 1945 following international ratification of the Bretton Woods agreements. Commencing operations on 25 June 1946, it approved its first loan on 9 May 1947 ($250m to France for postwar reconstruction, in real terms the largest loan issued by the Bank to date). Its five agencies are the International Bank for Reconstruction and Development (IBRD), the International Finance Corporation (IFC), International Development Association (IDA), Multilateral Investment Guarantee Agency (MIGA), and the International Centre for Settlement of Investment Disputes (ICSID).

The World Bank’s activities are focused on developing countries, in fields such as human development (e.g. education, health), agriculture and rural development (e.g. irrigation, rural services), environmental protection (e.g. pollution reduction, establishing and enforcing regulations), infrastructure (e.g. roads, urban regeneration, electricity), and governance (e.g. anti-corruption, legal institutions development). It provides loans at preferential rates to member countries, as well as grants to the poorest countries. Loans or grants for specific projects are often linked to wider policy changes in the sector or the economy. For example, a loan to improve coastal environmental management may be linked to development of new environmental institutions at national and local levels and to implementation of new regulations to limit pollution.

Organizational structure

Together with four affiliated agencies created between 1956 and 1988, the IBRD is part of the World Bank Group. The Group’s headquarters are in Washington, D.C.. It is a non-profit-making international organisation owned by member governments.

Technically the World Bank is part of the United Nations system, but its governance structure is different: each institution in the World Bank Group is owned by its member governments, which subscribe to its basic share capital, with votes proportional to shareholding. Membership gives certain voting rights that are the same for all countries but there are also additional votes which depend on financial contributions to the organization.

As a result, the World Bank is controlled primarily by developed countries, while clients have almost exclusively been developing countries. Some critics argue that a different governance structure would take greater account of developing countries’ needs. As of November 1, 2004 the United States held 16.4% of total votes, Japan 7.9%, Germany 4.5%, and the United Kingdom and France each held 4.3%. As major decisions require an 85% super-majority, the US can block any change.

World Bank Group agencies. The World Bank Group consists of the International Bank for Reconstruction and Development (IBRD), established in 1945, the International Finance Corporation (IFC), established in 1956, the International Development Association (IDA), established in 1960, the Multilateral Investment Guarantee Agency (MIGA), established in 1988 and the International Centre for Settlement of Investment Disputes (ICSID), established in 1966. Governments can choose which of these agencies they sign up to individually. The IBRD has 184 member governments, and the other institutions have between 140 and 176 members. The institutions of the World Bank Group are all run by a Board of 24 Executive Directors, with each Director representing either one country (for the largest countries), or a group of countries. Directors are appointed by their respective governments or the constituencies.

The agencies of the World Bank are each governed by their Articles of Agreement that serve as the legal and institutional foundation for all of their work. The Bank also serves as one of several Implementing Agencies for the UN Global Environment Facility (GEF).

Presidency. The World Bank Group is headed by Paul Wolfowitz, appointed on June 1, 2005. Wolfowitz, a former United States Deputy Secretary of Defense and well-known neo-conservative, was nominated by George W. Bush to replace James D. Wolfensohn. By convention, the Bank President has always been a US citizen, while the Managing Director of the IMF has been a European. Although nominated by the US Government, the World Bank President is subject to confirmation by the Board of Directors. The President serves a term of five years, which may be renewed.

Goals

The World Bank Group’s mission is to fight poverty and improve the living standards of people in the developing world. It provides long term loans, grants, and technical assistance to help developing countries implement their poverty reduction strategies. As such, World Bank financing is used in many different areas, from reforms in health and education to environmental and infrastructure projects, including dams, roads, and national parks. In addition to financing, the World Bank Group provides advice and assistance to developing countries on almost every aspect of economic development.

Since 1996, with the appointment of James Wolfensohn as Bank President, the World Bank Group has been focused on combating corruption in the countries that it works in. This is outlined in the World Bank report ‘Helping countries combat corruption: progress at the World Bank since 1997. This has been seen by some observers as a potential conflict with Article 10 Section 10 of the World Bank’s Articles of Agreement which outlines the ‘non-political’ mandate of the Bank1. The World Bank’s view is that reduced corruption and improved governance are not so much political as economic goals and are crucial for sustainable development and poverty reduction («Governance Matters IV: Governance Indicators for 1996–2004», D. Kaufmann, A. Kraay, M. Mastruzzi (World Bank 2005))

In recent years the World Bank Group has been moving from targeting economic growth in aggregate, to aiming specifically at poverty reduction. It has also become more focused on support for small scale local enterprises. It has embraced the idea that clean water, education, and sustainable development are essential to economic growth and has begun investing heavily in such projects. In response to external critics, the World Bank Group’s institutions have adopted a wide range of environmental and social safeguard policies, designed to ensure that their projects do not harm individuals or groups in client countries. Despite these policies, World Bank Group projects are frequently criticized by non-governmental organizations (NGOs) for alleged environmental and social damage and for not achieving their intended goal of poverty reduction.

Criticism

Although relied upon by poor countries as a contributor of development finance, the World Bank is often criticized, primarily by opponents of corporate «neo-colonial» globalization. These advocates of alter-globalization fault the bank for undermining the national sovereignty of recipient countries through various structural adjustment programs that pursue economic liberalization and de-emphasize the role of the state.

A related critique is that the Bank operates under essentially «neo-liberal» principles. In this perspective, reforms born of «neo-liberal» inspiration are not always suitable for nations experiencing conflicts (ethnic wars, border conflicts, etc.), or that are long-oppressed (dictatorship or colonialism) and do not have stable, democratic political systems.

One general critique is that the Bank is under the marked political influence of certain countries (notably, the United States) that would profit from advancing their interests. In this point of view, the World Bank would favor the installation of foreign enterprises, to the detriment of the development of the local economy and the people living in that country.

Furthermore, it is frequently suggested that the Bank intervenes in order to salvage irresponsible loans from private institutions to third world governments (and which are also often corrupt and non-representative), and thus shifts the risk from the original risk-takers to the public of the rich countries, who ultimately must back the Bank.

John Perkins in Confessions of an Economic Hit Man sees the World Bank as an instrument of American imperial policy, providing loans to developing countries for projects that benefit a bribed ruling elite as well as American companies and making such countries subject to American influence and pressure.

Defenders of the World Bank contend that no country is forced to borrow its money. The Bank provides both loans and grants. Even the loans are concessional since they are given to countries that have no access to international capital markets. Furthermore, the loans, both to poor and middle-income countries, are at below market-value interest rates. The World Bank argues that it can help development more through loans than grants, because money repaid on the loans can then be lent for other projects. Finally, it has made a major effort in recent years to address criticism, particularly regarding the environment and corruption.

Evaluation at the World Bank

Social and environmental concerns. Throughout the period from 1972 to 1989, the Bank did not conduct its own environmental assessments and did not require assessments for every project that was proposed. Assessments were required only for a varying, small percentage of projects, with the environmental staff, in the early 1970s, sending check-off forms to the borrowers and, in the latter part of the period, sending more detailed documentation and suggestions for analysis.

During this same period, the Bank’s failure to adequately consider social environmental factors was most evident in the 1974 Indonesian Transmigration program (Transmigration V). This project was funded after the establishment of the Bank’s OESA (environmental) office in 1971. According to the Bank critic Le Prestre, Transmigration V was the “largest resettlement program ever attempted. designed ultimately to transfer, over a period of twenty years, 65 million of the nation’s 165 million inhabitants from the overcrowded islands of Java, Bali, Madura, and Lombok. ”. The objectives were: relief of the economic and social problems of the inner islands, reduction of unemployment on Java, relocation of manpower to the outer islands, the “strengthening of national unity through ethnic integration, and improvement of the living standard of the poor”.

Putting aside the possibly Machiavellian politics of such a project, it otherwise failed as the new settlements went out of control; local populations fought with the migrators and the tropical forest was devastated (destroying the lives of indigenous peoples). Also, “some settlements were established in inhospitable sites, and failures were common;” these concerns were noted by the Bank’s environmental unit whose recommendations (to Bank management) and analyses were ignored. Funding continued through 1987, despite the problems noted and despite the Bank’s published stipulations (1982) concerning the treatment of groups to be resettled.

More recent authors have pointed out that the World Bank learned from the mistakes of projects such as Transmigration V and greatly improved its social and environmental controls, especially during the 1990s. It has established a set of «Safeguard Policies» that set out wide ranging basic criteria that projects must meet to be acceptable. The policies are demanding, and as Mallaby (reference below) observes: «Because of the combined pressures from Northern NGOs and shareholders, the Bank’s project managers labor under «safeguard» rules covering ten sensitives issues. no other development lender is hamstrung in this way» (page 389). The ten policies cover: Environmental Assessment, Natural Habitats, Forests, Pest Management, Cultural Property, Involuntary Resettlement, Indigenous Peoples, Safety of Dams, Disputed Areas, and International Waterways.

The Independent Evaluation Group. The Independent Evaluation Group (IEG) (formerly known as the Operations Evaluation Department (OED)) plays an important check and balance role in the World Bank. Similar in its role to the US Government’s Government Accountability Office (GAO), it is an independent unit of the World Bank that reports evaluation findings directly to the Bank’s Board of Executive Directors. IEG evaluations provide an objective basis for assessing the results of the Bank’s work, and accountability of World Bank management to the member countries (through the World Bank Board) in the achievement of its objectives.

Impact Evaluations. In recent years there has been an increased focus on measuring results of World Bank development assistance through impact evaluations. An impact evaluation assesses the changes in the well-being of individuals that can be attributed to a particular project, program or policy. Impact evaluations demand a substantial amount of information, time and resources. Therefore, it is important to select carefully the public actions that will be evaluated. One of the important considerations that could govern the selection of interventions (whether they be projects, programs or policies) for impact evaluation is the potential of evaluation results for learning. In general, it is best to evaluate interventions that maximize the learning from current poverty reduction efforts and provide insights for midcourse correction, as necessary.

The world bank

The 2022 update of the Worldwide Governance Indicators (WGI), with data through 2021, will be available on Friday September 23

These aggregate indicators combine the views of a large number of enterprise, citizen and expert survey respondents in industrial and developing countries. They are based on over 30 individual data sources produced by a variety of survey institutes, think tanks, non-governmental organizations, international organizations, and private sector firms.

What is Governance?

Governance consists of the traditions and institutions by which authority in a country is exercised. This includes the process by which governments are selected, monitored and replaced; the capacity of the government to effectively formulate and implement sound policies; and the respect of citizens and the state for the institutions that govern economic and social interactions among them.

The WGI are produced by:

World Bank Group Archives

The Archives preserves the institutional memory of the World Bank Group and provides public access to records of the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA).

Planting the Seeds of Social Development

In the second installment of our Development Reflections Series, former World Bank Group staff member Dr. Maritta Koch-Weser reflects on the emergence of social development in the World Bank Group’s work and her contributions as one of the Bank’s first social scientists.

A Bold Vision to Defeat River Blindness

In March 1972, World Bank Group President Robert S. McNamara travelled to Upper Volta (now Burkina Faso) to see first-hand the devastation wrought by onchocerciasis, or river blindness. Soon after, the Bank Group and its partners created the Onchocerciasis Control Program (OCP) which was the Bank Group’s first foray into the health sector.

Ms. Thelma D. Jones: Model, Spirit of Volunteerism

In this article, her third contribution in a series that celebrates Black History Month, World Bank Group archivist Bertha F. Wilson highlights former Bank Group staff member Thelma D. Jones. Jones has a long history of commitment to volunteerism and passion for creating opportunities for others.

WBG Archives Featured on EABH Podcast

WBG Archives Manager April Miller joined the European Association for Banking and Financial History (EABH) podcast to discuss how the World Bank Group has evolved over time and what makes the Bank’s Archives unique. Take a listen!

A Conversation: Robert S. McNamara at the World Bank

On February 15th, Olivier Lafourcade, former personal assistant to WBG President Robert S. McNamara, joined moderator John Heath to discuss a new book on McNamara authored by McNamara’s former assistants. Learn more about the publication and watch a video recording of the event.

WBG Archives Reading Room Closed until Further Notice

Due to the COVID-19 public health emergency, the World Bank Group Archives Reading Room will be closed to external visitors until further notice. The Archives will continue to respond to Access to Information requests during this time.

The World Bank

Its Purpose, History, Duties, and Mission

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.