Swift gpi code

Swift gpi code

SWIFT GPI

SWIFT global payments innovation (gpi)

Международная инициатива SWIFT по внедрению инновационной системы в области международных расчетов (gpi) значительно улучшает качество обслуживания клиентов при осуществлении международных платежей за счет повышения скорости, прозрачности и непрерывного отслеживания международных платежей.

На сегодняшний день более 660 финансовых институтов присоединились к инициативе gpi по всему миру. Тысячи международных платежей уже осуществляются с помощью нового стандарта, что дает банкам и их корпоративным клиентам неоспоримые преимущества.

SWIFT gpi направлен на улучшение расчетов между юридическими лицами. Инициатива создана для того, чтобы помочь компаниям развивать международную деятельность, улучшать отношения с поставщиками и совершенствовать контроль денежных потоков. Благодаря инициативе SWIFT gpi компании уже сегодня получают целый ряд возможностей в области расчетных услуг, такие как:

SWIFT gpi функционирует на основании ряда бизнес-правил, предусмотренных в многосторонних соглашениях об уровнях обслуживания (SLA), которые должны соблюдаться банками-участниками. Новая система создана для удовлетворения потребностей корпоративных клиентов, при этом позволяя самим банкам соблюдать нормативные требования, а также свои обязательства в отношении рыночных и кредитных рисков, а также риска утраты ликвидности. Система построена на надежной и устойчивой международной платформе SWIFT. Участником может стать любое регулируемое финансовое учреждение (группа 1 в системе SWIFT), которое входит в сообщество SWIFT и соблюдает предусмотренные инициативой правила ведения бизнеса.

В рамках внедрения gpi, SWIFT представляет специальные условия подписки на этот сервис для малых и средних пользователей, имеющих трафик до 300 сообщений в день.

ВОПРОСЫ и ОТВЕТЫ

1. В чем ключевые отличия технологии gpi от классической системы?

2. В чем заключаются преимущества для банков и клиентов?

3. Сравните стоимость двух систем для банков?

4. Как много банков уже подключились к gpi?

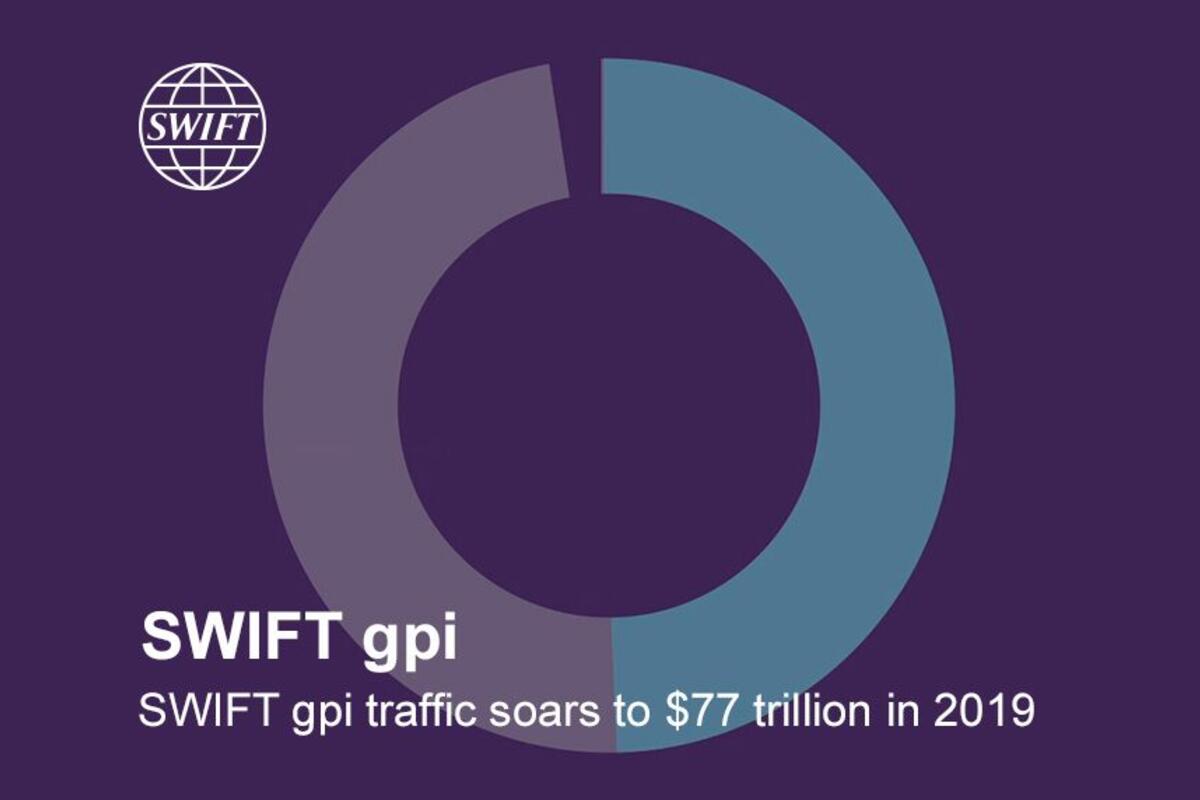

5. Сколько транзакций (количество и объем) уже прошли по gpi?

6. Одно из преимуществ технологии gpi – это возможность отслеживания транзакции на всем пути от отправителя до получателя. Как это работает на практике?

7. Как влияет участие в gpi на построение платежной цепочки?

8. Насколько быстрее обрабатываются платежи? Какие обязательства по скорости обработки появляются у банка, присоединившегося к сервису? Должно ли это проиcxодить мгновенно?

9. Как SWIFT gpi помогает соответствовать комплаенсу?

10. Существуют ли какие-либо ограничения по валютам? Можно ли включить рублевый платеж в gpi?

По вопросам, связанным с подпиской на сервис SWIFT gpi, а также о специальных условиях для российского сообщества, обращайтесь, пожалуйста, в РОССВИФТ. Контактные лица: Ольга Свирина, Алсу Миннибаева.

SWIFT gpi

The new norm

in cross-border payments

By embracing SWIFT gpi – the new standard in global payments – financial institutions are now sending and receiving funds quickly and securely to anyone, anywhere in the world, with full transparency over where a payment is at any given moment. SWIFT gpi dramatically improves cross-border payments across the correspondent banking network, and not least for corporates for whom speed, certainty and a smooth international payments experience is an absolute must.

SWIFT Platform evolution

Our vision is for instant and frictionless payments, from account to account, anywhere in the world.

A SOLUTION FOR EACH STEP OF THE TRANSACTION

Transactional services

Our core gpi services make sending cross-border payments fast, transparent and trackable.

Pre and post-transaction services

Our pre and in-flight payment services reduce friction and make your cross-border transactions even more seamless.

Services for corporates

Our services for corporates will deliver all the benefits of gpi directly to your corporate customers in their back office systems.

SWIFT gpi enables you to

Deliver a transformed customer experience

Your customers expect the best. Whether it’s a pizza, a parcel or a cross-border payment, they expect their payment to be trackable right to the beneficiary. That’s what you can deliver with SWIFT gpi.

Cut costs in your back office

How many man hours do you spend checking on the status of payments? With the gpi Tracker at your fingertips, you and your customers can access real-time payments data any time.

Reduce friction with your counterparts

When payment exceptions occur and an investigation is needed, you want to close the case as quickly as possible. Our transaction services enable you to automate many cumbersome manual processes.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

Delivering added-value

With more than 300 billion USD in messages being sent every day, SWIFT gpi is enabling payments to be credited to end beneficiaries within minutes and even seconds.

SWIFT gpi has a range of features that deliver added-value to both your bank and your customers.

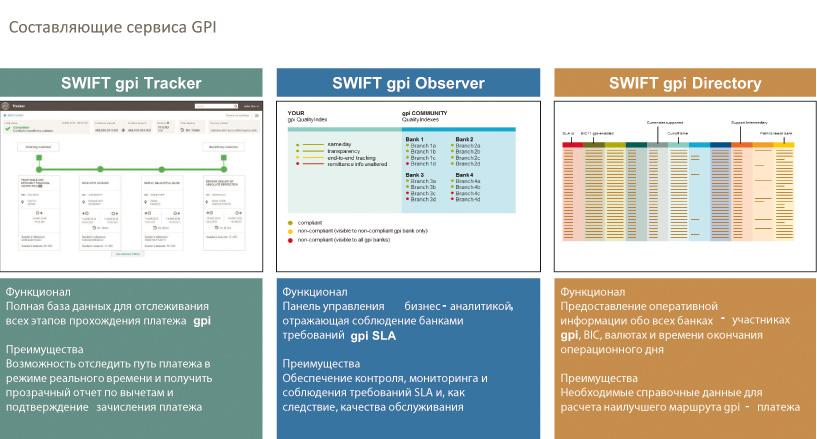

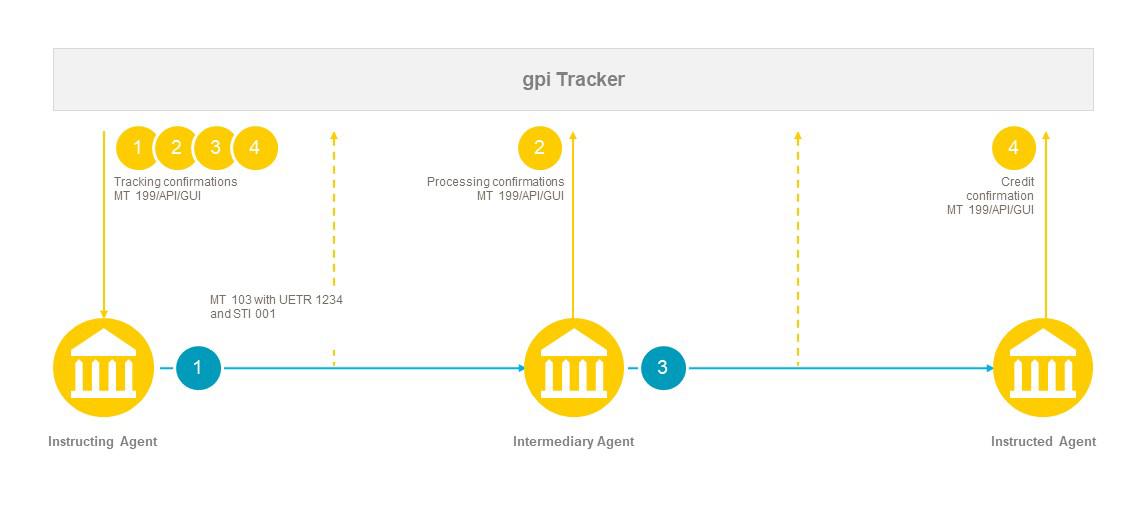

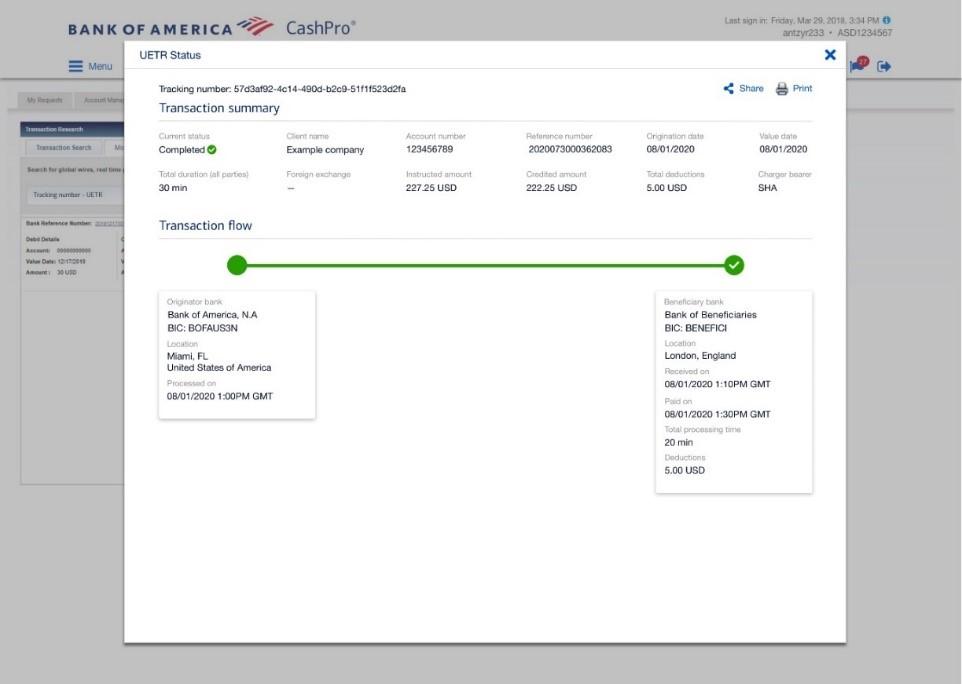

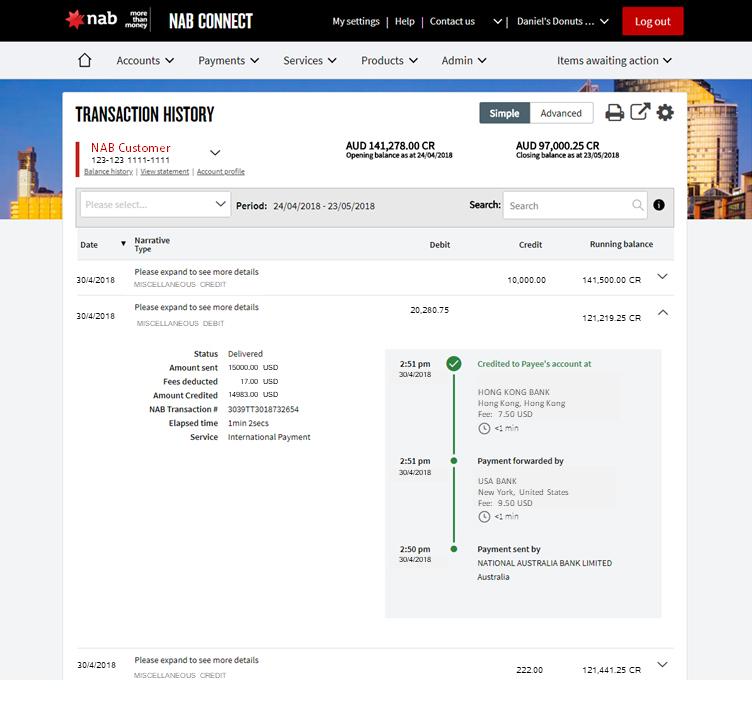

The gpi Tracker

End-to-end payments tracking

In today’s world, customers expect greater transparency. When they send a payment, they want to know what is happening with it and when it has been received. Until now, this has not been possible in cross-border payments as each bank has only been able to guarantee and share information on its own leg of the payment.

SWIFT gpi now enables banks to provide end-to-end payments tracking to their customers. The SWIFT Tracker – ‘in the cloud’ and securely hosted at SWIFT – gives end-to-end visibility on the status of a payment transaction from the moment it is sent right up to when it is confirmed.

SWIFT gpi banks are able to log in to the Tracker to instantly check the status of the payments sent, in progress and received. They can even improve their liquidity management by having visibility on initiated payments already on their way.

The Tracker can be updated by FIN message or via API. It can be accessed via a graphic user interface (GUI) and also via API calls to allow the service to be embedded in other back-office systems.

The gpi Observer Insights

A global view of banks’ adherence to the gpi rulebook

SWIFT’s Business Intelligence gpi Observer Insights monitors your adherence to the gpi rulebook – the ‘business rules’.

Gpi banks can quickly pinpoint areas for improvement and work collaboratively towards better implementation of SLAs.

Also, with Observer Insights, all gpi banks have a global view of other gpi banks’ adherence to these SLAs.

Through these business insights, it is easier to have fact-based discussions with your correspondents, to select new payment routings and explore opportunities to develop new ones. Learn more about gpi Observer Insights and gpi Observer Analytics.

The gpi Directory

A complete list of all gpi members

All member banks are listed in the gpi Directory. This includes details such as: which banks can send and receive gpi payments by business identifier code (BIC); in which currencies; reachable through which channels; cut-off times; and if a bank acts as an intermediary for gpi payments.

The Directory benefits all banks involved by enabling comprehensive end-to-end path finding for gpi payments. It is available in a wide variety of formats and accessible via automated delivery channels.

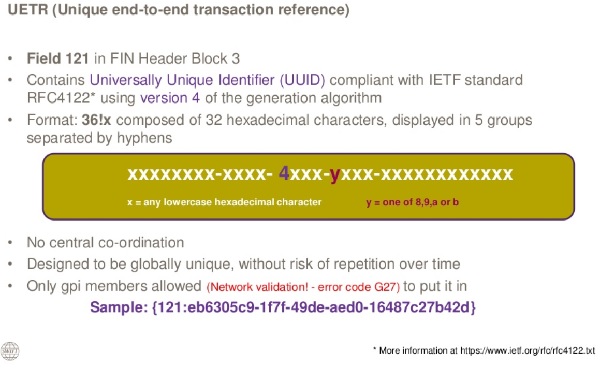

Explained: SWIFT gpi UETR – Unique End-to-End Transaction Reference 12

At the heart of the SWIFT gpi initiative is something called the UETR. In this post, i will share everything i know and likely you need to know about the UETR. So let’s jump straight into it…

What is SWIFT gpi?

Before we delve into the UETR, we need to know what the SWIFT gpi is. In a nutshell SWIFT gpi refers to SWIFT’s Global Payments Innovation initiative, enabling:

As mentioned above, driving the SWIFT gpi initiative is the UETR….

What is the UETR – Unique End-to-End Transaction Reference?

As stated already the UETR is a Unique End-to-End Transaction Reference. The UETR is:

Which Message Types Require the UETR – Unique End to End Transaction Reference?

The SWIFT Standard MT Release 2018 requires you to populate (it is currently optional) the UETR in the FIN user header (block 3) for the following MT messages:

What are the UETR SWIFT Format Requirements?

As stated above, the SWIFT Standard MT Release 2018 makes it mandatory for you to add the UETR in field 121 within block 3 of the FIN header.

The UETR (Unique End to End Transaction Reference) must be:

Where to indicate the UETR Field 121 in the SWIFT Header Block 3

If you’re new to SWIFT formatting, i would recommend having a read of my earlier post The Structure Of A SWIFT Message, Explained! That post deals with a MT101 header, but the idea is the same. Note, below i have indicated in bold the message type (103). Here is what your existing MT103 header looks like:

and now with the UETR you must generate something like this:

When SWIFT gpi is released to the broader corporate user base, you’ll indicate field 121 in your MT101 header in exactly the same way. Easy peasey, eh?

What is the Service Type Identifier Field 111?

Field 111 is to be placed in the header section block 3, and is to be used as indicated below by SWIFT gpi members only:

Couple of things to note:

Okay, I have a generated the UETR – What Next?

Further information can be found at:

Related posts:

12 thoughts on “ Explained: SWIFT gpi UETR – Unique End-to-End Transaction Reference ”

I believe this article has incorrect information.

Prior to MT standards 2018 it is not allowed to use the 111 and 121 tags if not part of the gpi Closed User Group (error code G27).

The doc below for MT Standards 2017 states:

Field 111 and field 121 must both be present or both absent (error code U12)

What if as a intermediary bank i change the UETR value and payment get failed.

If a bank creates a fresh payment UETR, it will be tracked as a new and a separate payment. The previous one will be continued to be shown as with this bank.

Where and how can one find a swift gpi code for top 25 banks

can anyone please please uploaded SWIFT Standard Release SR 2019 changes documents / pdf

can any one please share me the SWIFT standard release SR 2019 changes?

Can anyone please share me the SWIFT SR 2019 changes?

Hello guys, I need a serious sender of MT103 direct, Plus or Manual download. Receiver is ready. Contact me via : tracyallen358@gmail.com

Can no GPI banks still receive money sent through GPI

What if a GPI enabled Bank does not send Service Type Identifier but send just a UETR for some payments. Will that bank will receive Updates of those Payments via SWIFTgpi tracker?

Leave a Reply Cancel Reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

SWIFT GPI

SWIFT global payments innovation (gpi)

Международная инициатива SWIFT по внедрению инновационной системы в области международных расчетов (gpi) значительно улучшает качество обслуживания клиентов при осуществлении международных платежей за счет повышения скорости, прозрачности и непрерывного отслеживания международных платежей.

На сегодняшний день более 785 финансовых институтов присоединились к инициативе gpi по всему миру. Тысячи международных платежей уже осуществляются с помощью нового стандарта, что дает банкам и их корпоративным клиентам неоспоримые преимущества.

SWIFT gpi направлен на улучшение расчетов между юридическими лицами. Инициатива создана для того, чтобы помочь компаниям развивать международную деятельность, улучшать отношения с поставщиками и совершенствовать контроль денежных потоков. Благодаря инициативе SWIFT gpi компании уже сегодня получают целый ряд возможностей в области расчетных услуг, такие как:

SWIFT gpi функционирует на основании ряда бизнес-правил, предусмотренных в многосторонних соглашениях об уровнях обслуживания (SLA), которые должны соблюдаться банками-участниками. Новая система создана для удовлетворения потребностей корпоративных клиентов, при этом позволяя самим банкам соблюдать нормативные требования, а также свои обязательства в отношении рыночных и кредитных рисков, а также риска утраты ликвидности. Система построена на надежной и устойчивой международной платформе SWIFT. Участником может стать любое регулируемое финансовое учреждение (группа 1 в системе SWIFT), которое входит в сообщество SWIFT и соблюдает предусмотренные инициативой правила ведения бизнеса.

В рамках внедрения gpi, SWIFT представляет специальные условия подписки на этот сервис для малых и средних пользователей, имеющих трафик до 300 сообщений в день.

ВОПРОСЫ и ОТВЕТЫ

1. В чем ключевые отличия технологии gpi от классической системы?

2. В чем заключаются преимущества для банков и клиентов?

3. Сравните стоимость двух систем для банков?

4. Как много банков уже подключились к gpi?

5. Сколько транзакций (количество и объем) уже прошли по gpi?

6. Одно из преимуществ технологии gpi – это возможность отслеживания транзакции на всем пути от отправителя до получателя. Как это работает на практике?

7. Как влияет участие в gpi на построение платежной цепочки?

8. Насколько быстрее обрабатываются платежи? Какие обязательства по скорости обработки появляются у банка, присоединившегося к сервису? Должно ли это проиcxодить мгновенно?

Банки, подписавшиеся на сервис gpi, принимают на себя обязательство обрабатывать платежи на транзакционном уровне в течение 24 часов. Если это в силу объективных причин невозможно, банк должен уведомить об этом Тracker соответствующим кодом, предусмотренным в SLA. Статистика живого трафика уже сегодня показывает, что это возможно: около 50% всех транзакций обрабатываются за 30 минут. При различии временных зон между банками-корреспондентами Tracker автоматически переводит время платежа в UTC в целях соответствия правилам SLA.

9. Существуют ли какие-либо ограничения по валютам? Можно ли включить рублевый платеж в gpi?

По вопросам, связанным с подпиской на сервис SWIFT gpi, а также о специальных условиях для российского сообщества, обращайтесь, пожалуйста, в РОССВИФТ. Контактные лица: Ольга Свирина, Алсу Миннибаева.

SWIFT GPI: как с ним работать и как с его помощью улучшить банковские продукты

В методическом журнале «Международные банковские операции» опубликована подробная статья о сервисе Global Payments Innovation (GPI).

SWIFT gpi – Universal Confirmations (Basic Tracker)

Начиная с ноября 2020 года (с выпуском Standard Release 2020), все пользователи SWIFT (FIN) будут обязаны вносить информацию о статусе входящих сообщений MT 103 в упрощенную версию gpi Tracker.

What is a Unique End-to-end Transaction Reference (UETR)?

A Unique End-to-end Transaction Reference (commonly known as a UETR) is a string of 36 unique characters featured in all payment instruction messages carried over SWIFT.

What is a UETR?

A Unique End-to-end Transaction Reference (commonly known as a UETR) is a string of 36 unique characters featured in all payment instruction messages carried over SWIFT.

UETRs are designed to act as a single source of truth for a payment and provide complete transparency for all parties in a payment chain, as well as enable functionality from SWIFT gpi, such as the payment Tracker.

How do they work?

A UETR is very much like the tracking number couriers use when you send or receive a parcel. The sender issues a unique, unalterable reference which allows a payment to be located at any time, by any of the parties in the chain. UETRs are fully digitised and totally transparent − leading to fast, efficient processing. The sender is also automatically notified of any status changes applied by any banks handling the payment and − crucially − confirmation that the funds have been credited to the beneficiary or rejected at any point in the payment chain.

Why are UETRs so important?

In today’s digital world, banking services are being driven by developments in the consumer space. People now expect clear, accurate and real-time payment information.

UETRs are fundamental to meeting these demands by delivering genuine transparency and true end-to-end tracking of international payments.

When a payment is delayed, the beneficiary needs and expects to be able to find out quickly where the funds are and why that delay has occurred. The consequence of not having this visibility is a series of frustrating manual interventions, friction, and delays to the flow of goods and services. For beneficiary banks, UETRs drastically reduce exceptions and investigations as banks involved earlier in the process can view, in real-time, the latest payment status – meaning they no longer have to contact the beneficiary bank.

Who should provide a UETR?

All SWIFT users (whether gpi members or non-gpi members) originating payments must provide a UETR as standard for each of the following message types:

What benefits do UETRs bring?

UETRs allow banks to easily trace their payments in real-time, regardless of complexity or the number of counterparties involved.

They also remove the need for a chain of references between the originating, intermediary and beneficiary banks, ensuring that all parties are using the same end-to-end reference. This reduces errors and the likelihood of conflict, saving time and money on reconciliation.

They also provide a number of other benefits, including:

How do I ensure compliance?

When ordering institutions generate a payment message, their internal systems are required to generate and include a UETR for all of the message types (listed above) in the 121 field of the message.

Intermediary institutions must not generate a new UETR when routing payments, but their internal systems must be able to receive, copy and pass on the code that was present in the received message to other parties in the chain. Therefore, intermediary bank systems must also be able to handle UETRs.

Likewise, beneficiary banks (even if they are not gpi customers), must be able to receive and process UETRs to reconcile payments.

Institutions issuing cover payments must be able to create a copy of the original UETR and pass it over to the cover payment message.

Universal confirmations

From the end of 2020, all SWIFT member banks will be required to provide confirmation of payments status to the Tracker once they have been credited to the end beneficiary’s account − this must include whether payments have been rejected. As of Standards MT release 2020, universal confirmations will apply to every single customer payment (MT 103 on FIN).

SWIFT also recommends providing a status update if the payment is transferred to an agent outside of FIN or when the payment cannot be processed immediately. This will give customers certainty on the status of their payments, a demand that is being intensified by the proliferation of domestic real-time payment infrastructures and consumer pressure for payments to be delivered in real-time.

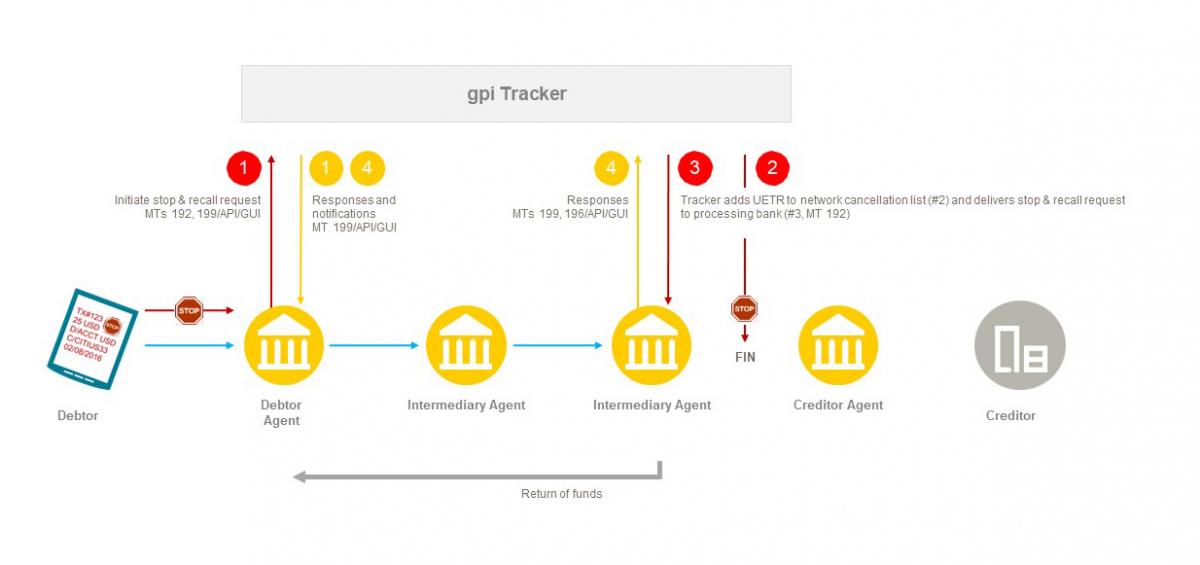

The Basic Tracker

Finally, to extend the benefit of payments tracking and confirmations to all SWIFT financial institutions, we are introducing the Basic Tracker. Our free Basic Tracker enables financial institutions to track all their payments from end to end in real time. It also allows banks to manually confirm payments and meet the requirements around universal confirmations. It does though lack the advanced features of the UETR leveraging, paid-for SWIFT gpi Tracker, such as the tracking of intermediary routing, cover payments and value-added services − such as being able to stop and recall payments through the Tracker.

SWIFT GPI

Covid-19

Leader speak

Technology

Industries

I have an Idea

Guest Blogs

SWIFT GPI

Current Problem Statement

The cross border transactions have historically been a puzzle for most of the banks as they cannot predict the exact time and fees to complete the transaction. Moreover, it becomes very difficult to track the payment once it goes out of the processing bank. The involvement of multiple banks (generally referred as correspondent banks) across countries in a single transaction makes it difficult to manage due to lack of common standards and regulation.

In today’s world, where consumers from all segments are time sensitive it has been a constant demand from the banks and corporates to realize the cross border funds quickly, easily and relatively inexpensively.

How SWIFT GPI works

To address the above challenges, SWIFT has introduced an initiative called SWIFT’s Global Payments Innovation (SWIFT GPI). By joining all participants in a payment chain through a Unique End to End Tracking Reference (UETR), SWIFT GPI can improve the availability, transparency and tracking of payments. This UETR is a 36 figure long globally unique identifier open source code which has to be included in the header of the messages by all the banks in the payment chain. Banks can request the status of the payment through an API call or MT199 to the SWIFT cloud along with the UETR to track the payment in real time.

Business Benefits

Services delivered by SWIFT currently:

SWIFT GPI Instant

SWIFT has successfully tested a trial recently on SWIFT GPI Instant for cross border payments in FAST which is Singapore`s domestic instant payment service. It involved 11 countries where the payment was sent to six banks in Singapore and the payments were processed domestically through FAST system.

All the cross border payments settled within 25 seconds of the initiation.

How HCL can help

SWIFT GPI will be the standard for all cross-border payments by the end of 2020 and it has already mandated to include the GPI information for all SWIFT users regardless of the GPI membership. Despite the huge benefits and regulatory compliance, Banks would find difficult to implement the change due to upgrade in the back office legacy systems and support of the workflow.

With a dedicated Payment Solutions team of more than 150 experts, HCL has helped banks and financial services of all sizes in implementing GPI as per the rule book, helping them significantly reduce time to market. HCL provides a comprehensive solution to build overlay services and integrate with the existing infrastructure.

Some of the key offerings of HCL:

| Integration Partner | Build strong business case | Creating strong business cases for the internal stake holders to generate short term and long term strategic opportunity |

| Understanding of GPI Rule Book | In depth understanding of SWIFT GPI as per the rulebook to comply with the regulation. | |

| Define the implementation strategy | Defining the implementation strategy based on the size and complexity of the bank and FIs. | |

| Provide and Support IT delivery | Gathering requirement, design, development and testing activities (including automation) of the implementation. |

| Solution Partner | Develop user friendly interface | Developing simple user friendly interface in-house which will help to track all the payments through single interface |

| Enquire functionality with enhanced search parameters | Additional parameters to expand the search criteria for operations and customers | |

| Channel agnostic solution | Access GPI information through any channels of the banks through API | |

| Build new workflows | New additional workflow for different payment scenarios | |

| Status updates reconciliation | Different status updates from the GPI tracker is reconciled with the original payment and statuses are mapped to user understandable formats. | |

| Bespoke and configurable GPI reports | Wide range of GPI reports for customer, back office and management | |

| Bespoke and configurable notifications | Configurable notifications for the payments which are struck in SWIFT Alliance Access (SAA), SWIFT Alliance Gateway (SAG) and other SWIFT infrastructure during payment processing |

Future Roadmap

The current and future functionalities, including those involving distributed ledger technology, would immensely help the entire ecosystem and HCL would continue to be a pivotal integration and solution partner of SWIFT global payments innovation.

SWIFT global payments innovation (gpi)

Global banks are working together to make a dramatic change in cross-border payments

In today’s digital world, when you make a cross-border payment you expect the service to be delivered at the touch of a button. Yet, in reality, cross-border payments can take days, can’t be tracked, there’s a lack of transparency on fees and remittance data can get altered in the process.

Today, SWIFT gpi is transforming the cross-border payment experience entirely, by:

SWIFT gpi has already been adopted by more than 150 banks around the world and more than 100 billion USD in SWIFT gpi messages are being sent every day – enabling payments to be credited to end beneficiaries within minutes or seconds. SWIFT gpi payments now represent nearly 10% of SWIFT’s cross-border payments traffic, sent daily across 220 international payment corridors.

SWIFT gpi is set to be the standard for all cross-border payments by the end of 2020.

Value for gpi banks

SWIFT gpi enables banks to:

Value for corporates

SWIFT gpi enables bank’s corporate customers to:

The digital transformation of cross-border payments

Facilitating a seamless payments experience

Fast, transparent and trackable payments

The future of cross-border payments

In a world of interconnected global commerce, paying for goods and services across borders has become standard practice. For businesses, it is key that international trade be as frictionless as possible.

That’s why corporates are insisting their banks provide a faster, simpler, and more transparent cross-border payments experience, making them as seamless as domestic payments.

Through SWIFT gpi, banks and financial institutions are now able to deliver this.

SWIFT gpi lets you make high-speed cross-border payments in minutes or seconds.

Nearly 50% of gpi payments are credited to end beneficiaries within 30 minutes, 40% in under 5 minutes, and almost 100% of gpi payments are credited within 24 hours.

This brings immediate benefits to global trade – corporates can take advantage of easier cash flow management and more predictable budgeting, spending, and investing.

Trackable

We are used to tracking everything from a parcel to a pizza in real time, so why not a payment?

Bank customers want to know when a payment is sent, where it is, and when it reaches the end recipient.

With gpi, banks can track their payment flows end-to-end and in real time.

This provides maximum visibility on ongoing cross-border transactions. And when problems occur or customers have a question, banks can intervene faster to resolve any issues or enquires in a timely and efficient way.

Transparent

Transparency on fees and processing times is a vital requirement for any business that relies on making or receiving international payments. A lack of visibility on costs leads to uncertainty for corporates making payments and time spent trying to reconcile unclear debits.

Through gpi, banks can provide their customers with full visibility on processing fees, exchange rate costs and processing times, meaning all parties can manage their finances and relationships accordingly – and make better decisions faster.

Complete

Data integrity is central to meeting customer needs in international payments. Without reliable and consistent remittance data, it can be difficult to keep track of payments or reconcile invoices and final settlement can be delayed.

With SWIFT gpi, the remittance data that corporates send with their payments is guaranteed to be unaltered when it arrives with the end beneficiary. Beneficiaries can then easily reconcile gpi payments against invoices, speeding up their supply cycles.

Secure

Sending international payments presents various challenges, including variations in national banking rules and systems, import and export restrictions, foreign exchange controls, and regulatory compliance.

SWIFT’s compliance and security controls mean your payments business can stand up to the rapidly evolving nature of digital threats and regulatory reforms, whilst maintaining the high level of speed that customers have come to expect.

The SWIFT gpi customer credit transfer

Changing the world to make cross-border payments faster, transparent and traceable

The SWIFT gpi customer credit transfer

Key features

The gpi customer credit transfer SLA dramatically improves the business-to-business cross-border payments experience for corporate customers. It commits participating banks to deliver on four core principles:

Faster, same-day use of funds *

Same day use of funds is increasingly the norm for domestic payments systems and corporates are naturally demanding similar service levels for their cross-border payments.

Corporates want the ability to pay with precision, according to their trading agreements, without having cash trapped in the payment cycle – and without risk of penalties for late payments.

The gpi customer credit transfer delivers same day use with certainty. The benefits are clear – improved liquidity, reduced cost of working capital and reduced risks.

(*) within the timezone of the receiving gpi member

Traceability

Transparency

Lack of transparency around fee deducts also reduces efficiency for corporates and can lead to supplier disputes and reconciliation issues when payments are not received in full. The gpi customer credit transfer puts an end to these uncertainties by delivering full transparency of fees.

Remittance information transferred unaltered

The gpi customer credit transfer enables corporates to include up to 140 characters of remittance information which is carried unaltered across the payments process. This facilitates reconciliation of payments and prompt posting to accounts, improving working capital efficiency and reducing errors and investigations.

SWIFT gpi for corporates

Pay for your international goods and services in minutes or seconds and track your payments.

SWIFT gpi features for Corporates

Community of thousands of banks

Thousands of banks, including all of the major cash management banks, are committed to adopting SWIFT gpi.

gpi for Corporates banking groups signed up

Bank of America

National Australia Bank

Saudi British Bank

Standard Chartered

SMBC

Turkiye Vakiflar Bankasi

UBS

UniCredit

Western Union

Yapi Kredi

Zhejiang E-Commerce Bank

Pay and trace

Our solution for multi-banked corporates enables the initiation and tracking of all your payment flows across all of your banking partners. This service can be integrated directly into your treasury management or ERP system, and uses the latest standards, including ISO 20022.

Inbound tracking

We’re closing the payments loop by offering banks full traceability on incoming gpi payments, bringing new visibility on liquidity and freeing up funds faster.

Request to pay

Modern commerce demands fast supply chains and simple procurement and payment flows. Equipping banks with the tools to provide their corporates with a fully integrated and automated procure-to-pay engine through gpi will provide better predictability, more certainty and greater traceability on transactions.

Link with trade ecosystems

For participants in closed trade ecosystems, being able to provide fast, transparent and trackable off-ledger payment settlement in a fiat currency brings significant benefits. Our service to link gpi with these systems will unlock new possibilities for corporates to settle their payment obligations.

The digital transformation of cross-border payments

Facilitating a seamless payments experience

SWIFT gpi document centre

On this page you will find all the documents available on this topic

Hear from Raouf Soussi, BBVA.

Hear from Isabel Schmidt, BNY Mellon.

Hear from Jean-François Mazure, Société Générale.

Find out how J.P. Morgan is leveraging SWIFT’s stop and recall service to streamline and automate the halting of.

Download this ebook to learn how financial institutions can deliver a better payments experience.

First National Bank of Omaha leverages SWIFT gpi payments data to support international business growth across the.

Find out how China Minsheng Bank is delivering value-added services for its corporate customers using the gpi Stop and.

Imagine a world where cross-border payments could be made by consumers and small businesses in an easy, predictable.

Cross-border payments are fast, transparent and fully traceable thanks to SWIFT gpi. Now a new phase of innovation is.

Find out how one of Russia’s leading banks is delivering a transformed payments experience for its corporate customers.

Swift gpi code

\u041c\u043e\u044f \u043a\u043e\u043b\u043b\u0435\u0433\u0430 \u0414\u0430\u0440\u044c\u044f \u0443\u0442\u043e\u0447\u043d\u0438\u0442 \u0438\u043d\u0444\u043e\u0440\u043c\u0430\u0446\u0438\u044e \u043f\u043e \u0432\u0430\u0448\u0435\u043c\u0443 \u043e\u0431\u0440\u0430\u0449\u0435\u043d\u0438\u044e \u0438 \u0441\u043e\u043e\u0431\u0449\u0438\u0442 \u0440\u0435\u0437\u0443\u043b\u044c\u0442\u0430\u0442.

\u041c\u043e\u044f \u043a\u043e\u043b\u043b\u0435\u0433\u0430 \u0414\u0430\u0440\u044c\u044f \u0443\u0442\u043e\u0447\u043d\u0438\u0442 \u0438\u043d\u0444\u043e\u0440\u043c\u0430\u0446\u0438\u044e \u043f\u043e \u0432\u0430\u0448\u0435\u043c\u0443 \u043e\u0431\u0440\u0430\u0449\u0435\u043d\u0438\u044e \u0438 \u0441\u043e\u043e\u0431\u0449\u0438\u0442 \u0440\u0435\u0437\u0443\u043b\u044c\u0442\u0430\u0442.

\u041f\u043e \u0441\u0434\u0435\u043b\u0430\u043d\u043d\u043e\u043c\u0443 \u0432 \u0413\u041f\u0411 \u0441\u0432\u0438\u0444\u0442 \u043f\u0435\u0440\u0435\u0432\u043e\u0434\u0443 \u0431\u0430\u043d\u043a \u043f\u0440\u0435\u0434\u043e\u0441\u0442\u0430\u0432\u0438\u043b \u0442\u043e\u043b\u044c\u043a\u043e \u0440\u0430\u0441\u043f\u0435\u0447\u0430\u0442\u043a\u0443 \u043f\u043e\u0440\u0443\u0447\u0435\u043d\u0438\u044f \u043d\u0430 \u043f\u0435\u0440\u0435\u0432\u043e\u0434 \u0432 \u0444\u043e\u0440\u043c\u0430\u0442\u0435 MT-103. \u041d\u043e \u0434\u043b\u044f \u043e\u0442\u0441\u043b\u0435\u0436\u0438\u0432\u0430\u043d\u0438\u044f \u043f\u0440\u043e\u0445\u043e\u0436\u0434\u0435\u043d\u0438\u044f \u043f\u043b\u0430\u0442\u0435\u0436\u0430 \u043c\u043d\u0435 \u043d\u0443\u0436\u043d\u043e \u043f\u043e\u043b\u0443\u0447\u0438\u0442\u044c SWIFT GPI \u043a\u043e\u0434 (\u043e\u043d \u0436\u0435 UETR \u043a\u043e\u0434). \u0413\u0430\u0437\u043f\u0440\u043e\u043c\u0431\u0430\u043d\u043a \u043a \u044d\u0442\u043e\u0439 \u0441\u0438\u0441\u0442\u0435\u043c\u0435 \u043f\u043e\u0434\u043a\u043b\u044e\u0447\u0435\u043d, \u043e\u0442\u043f\u0440\u0430\u0432\u0438\u043b \u043f\u0435\u0440\u0435\u0432\u043e\u0434 \u0447\u0435\u0440\u0435\u0437 \u043d\u0435\u0435 \u0438 \u0435\u0441\u0442\u0435\u0441\u0442\u0432\u0435\u043d\u043d\u043e \u0438\u043c\u0435\u0435\u0442 \u0438\u043d\u0444\u043e\u0440\u043c\u0430\u0446\u0438\u044e \u043f\u043e \u043a\u043e\u0434\u0443\/\u0438\u0434\u0435\u043d\u0442\u0438\u0444\u0438\u043a\u0430\u0442\u043e\u0440\u0443 \u043e\u0442\u0441\u043b\u0435\u0436\u0438\u0432\u0430\u043d\u0438\u044f \u043f\u043b\u0430\u0442\u0435\u0436\u0430. \u0412 \u0447\u0435\u043c \u043f\u0440\u043e\u0431\u043b\u0435\u043c\u0430 \u0435\u0433\u043e \u043f\u0440\u0435\u0434\u043e\u0441\u0442\u0430\u0432\u0438\u0442\u044c \u043a\u043b\u0438\u0435\u043d\u0442\u0443. \u0412 \u0422\u0438\u043d\u044c\u043a\u043e\u0432\u0435 \u044f \u044d\u0442\u043e\u0442 \u043a\u043e\u0434 \u0432\u0438\u0436\u0443 \u0432 \u043e\u0434\u0438\u043d \u043a\u043b\u0438\u043a \u0432 \u043f\u0440\u0438\u043b\u043e\u0436\u0435\u043d\u0438\u0438, \u0430 \u0432 \u0413\u041f\u0411 \u043d\u0435 \u043f\u043e\u043c\u043e\u0433\u0430\u0435\u0442 \u0438 \u043b\u0438\u0447\u043d\u043e\u0435 \u043e\u0431\u0440\u0430\u0449\u0435\u043d\u0438\u0435 \u043a \u0434\u0438\u0440\u0435\u043a\u0442\u043e\u0440\u0443 \u043f\u043e \u043f\u0440\u0435\u043c\u0438\u0430\u043b\u044c\u043d\u043e\u043c\u0443 \u043e\u0431\u0441\u043b\u0443\u0436\u0438\u0432\u0430\u043d\u0438\u044e \u0432 \u043e\u0444\u0438\u0441\u0435. \u041d\u0438\u043a\u0430\u043a\u0438\u0435 \u0440\u043e\u0437\u044b\u0441\u043a\u0438 \u043f\u043b\u0430\u0442\u0435\u0436\u0430 \u0434\u043b\u044f \u044d\u0442\u043e\u0433\u043e \u043d\u0435 \u043d\u0443\u0436\u043d\u044b. \u0411\u0430\u043d\u043a, \u043f\u043e\u0434\u043a\u043b\u044e\u0447\u0435\u043d\u043d\u044b\u0439 \u043a \u0441\u0435\u0440\u0432\u0438\u0441\u0443 SWIFT GPI \u0432\u0438\u0434\u0438\u0442 \u043f\u0440\u043e\u0445\u043e\u0436\u0434\u0435\u043d\u0438\u0435 \u0441\u0432\u043e\u0435\u0433\u043e \u043f\u043b\u0430\u0442\u0435\u0436\u0430 (SWIFT list) \u0437\u0430 \u043e\u0434\u043d\u043e \u043d\u0430\u0436\u0430\u0442\u0438\u0435 \u043a\u043b\u0430\u0432\u0438\u0448\u0438 \u043c\u044b\u0448\u043a\u043e\u0439 \u043d\u0430 \u0442\u0435\u0440\u043c\u0438\u043d\u0430\u043b\u0435 SWIFT. \u0412 \u0447\u0435\u043c \u0432\u043e\u043e\u0431\u0449\u0435 \u043f\u0440\u043e\u0431\u043b\u0435\u043c\u0430 \u0432 \u043f\u0435\u0440\u0435\u0434\u0430\u0447\u0435 \u044d\u0442\u043e\u0439 \u0438\u043d\u0444\u043e\u0440\u043c\u0430\u0446\u0438\u0438 \u043a\u043b\u0438\u0435\u043d\u0442\u0443. \u0418\u043b\u0438 \u0432\u044b \u0434\u0443\u043c\u0430\u0435\u0442\u0435, \u0447\u0442\u043e \u0441\u043f\u0438\u0441\u0430\u043b\u0438 \u0434\u0435\u043d\u044c\u0433\u0438 \u0441\u043e \u0441\u0447\u0435\u0442\u0430, \u0432\u0437\u044f\u043b\u0438 \u043d\u0435\u043c\u0430\u043b\u0443\u044e \u043a\u043e\u043c\u0438\u0441\u0441\u0438\u044e \u0437\u0430 \u043f\u0435\u0440\u0435\u0432\u043e\u0434 \u0438 \u0432\u0441\u0435? \u0414\u0430\u043b\u044c\u0448\u0435 \u044d\u0442\u043e \u043f\u0440\u043e\u0431\u043b\u0435\u043c\u044b \u043a\u043b\u0438\u0435\u043d\u0442\u0430? «,»userName»:»s*******@mts»,»parentId»:null,»infoForBank»:null>,<"id":445148,"createdAt":"2022-07-07T20:24:25+03:00","updatedAt":"2022-07-13T14:03:40+03:00","answeredAt":"2022-07-08T16:53:50+03:00","answerText":"

\u041c\u043e\u0438 \u043a\u043e\u043b\u043b\u0435\u0433\u0438 \u0432\u0435\u0440\u043d\u0443\u0442\u0441\u044f \u043a \u0432\u0430\u043c \u0441 \u043e\u0442\u0432\u0435\u0442\u043e\u043c \u043f\u043e \u0444\u0430\u043a\u0442\u0443 \u043f\u043e\u043b\u0443\u0447\u0435\u043d\u0438\u044f \u0432\u0441\u0435\u0445 \u0434\u0430\u043d\u043d\u044b\u0445.

\u0411\u043b\u0430\u0433\u043e\u0434\u0430\u0440\u044e \u0432\u0430\u0441 \u0437\u0430 \u043e\u0431\u0440\u0430\u0442\u043d\u0443\u044e \u0441\u0432\u044f\u0437\u044c.

\u041c\u044b \u0432\u043d\u0438\u043c\u0430\u0442\u0435\u043b\u044c\u043d\u044b\u043c \u043e\u0431\u0440\u0430\u0437\u043e\u043c \u043e\u0442\u043d\u043e\u0441\u0438\u043c\u0441\u044f \u043a \u043e\u0431\u0440\u0430\u0449\u0435\u043d\u0438\u044f\u043c \u043a\u043b\u0438\u0435\u043d\u0442\u043e\u0432 \u0438 \u043d\u0430 \u043f\u043e\u0441\u0442\u043e\u044f\u043d\u043d\u043e\u0439 \u043e\u0441\u043d\u043e\u0432\u0435 \u043f\u0440\u043e\u0432\u043e\u0434\u0438\u043c \u043c\u0435\u0440\u043e\u043f\u0440\u0438\u044f\u0442\u0438\u044f, \u043d\u0430\u043f\u0440\u0430\u0432\u043b\u0435\u043d\u043d\u044b\u0435 \u043d\u0430 \u043f\u043e\u0432\u044b\u0448\u0435\u043d\u0438\u0435 \u043a\u0430\u0447\u0435\u0441\u0442\u0432\u0430 \u043f\u0440\u0435\u0434\u043e\u0441\u0442\u0430\u0432\u043b\u044f\u0435\u043c\u043e\u0433\u043e \u0441\u0435\u0440\u0432\u0438\u0441\u0430.\u00a0

\u0413\u0430\u0437\u043f\u0440\u043e\u043c\u0431\u0430\u043d\u043a \u043e\u043f\u043b\u0430\u0447\u0438\u0432\u0430\u0435\u0442 \u0441\u0430\u043c\u0443\u044e \u0434\u043e\u0440\u043e\u0433\u0443\u044e \u043f\u043e\u0434\u043f\u0438\u0441\u043a\u0443 swift live gpi. \u0413\u043b\u0430\u0432\u043d\u044b\u0439 \u0441\u043c\u044b\u0441\u043b \u044d\u0442\u043e\u0439 \u043f\u043e\u0434\u043f\u0438\u0441\u043a\u0438 \u0432 \u043c\u0433\u043d\u043e\u0432\u0435\u043d\u043d\u043e\u043c \u043f\u043e\u043b\u0443\u0447\u0435\u043d\u0438\u0438 \u0434\u0430\u043d\u043d\u044b\u0445 \u043f\u043e \u043f\u0440\u043e\u0445\u043e\u0436\u0434\u0435\u043d\u0438\u044e \u043f\u043b\u0430\u0442\u0435\u0436\u0435\u0439 \u0431\u0435\u0437 \u043e\u0431\u0440\u0430\u0449\u0435\u043d\u0438\u044f \u0432 \u0431\u0430\u043d\u043a\u0438 \u043a\u043e\u0440\u0440\u0435\u0441\u043f\u043e\u043d\u0434\u0435\u043d\u0442\u044b. \u0414\u0430 \u043d\u0430 \u0441\u0435\u0433\u043e\u0434\u043d\u044f \u0412\u0421\u0415 \u0431\u0430\u043d\u043a\u0438-\u0447\u043b\u0435\u043d\u044b swift \u0438 \u0431\u0435\u0437 \u043f\u043e\u0434\u043a\u043b\u044e\u0447\u0435\u043d\u043d\u044b\u0435 \u043a \u0434\u0430\u0436\u0435 \u043a \u0431\u0430\u0437\u043e\u0432\u043e\u043c\u0443 \u0441\u0435\u0440\u0432\u0438\u0441\u0443 gpi, \u043f\u043e\u043b\u0443\u0447\u0430\u044e\u0442 web \u0434\u043e\u0441\u0442\u0443\u043f \u043a \u0411\u0415\u0421\u041f\u041b\u0410\u0422\u041d\u041e\u041c\u0423 swift gpi tracker \u043d\u0430 \u0441\u0430\u0439\u0442\u0435 \u0441\u0432\u0438\u0444\u0442\u0430. \u0413\u043b\u0430\u0432\u043d\u0430\u044f \u0438\u0434\u0435\u044f \u0432 \u0440\u0435\u043a\u043b\u0430\u043c\u0435 \u0442\u0440\u0435\u043a\u0435\u0440\u0430 \u0441\u0432\u0438\u0444\u0442\u043e\u043c \u044d\u0442\u043e \u0443\u043c\u0435\u043d\u044c\u0448\u0435\u043d\u0438\u0435 \u0437\u0430\u0442\u0440\u0430\u0442 \u0432\u0440\u0435\u043c\u0435\u043d\u0438 \u0438 \u0440\u0430\u0441\u0445\u043e\u0434\u043e\u0432 \u0431\u0430\u043d\u043a\u0430 \u043d\u0430 \u043e\u0431\u0440\u0430\u0431\u043e\u0442\u043a\u0443 \u043a\u043b\u0438\u0435\u043d\u0442\u0441\u043a\u0438\u0445 \u0437\u0430\u043f\u0440\u043e\u0441\u043e\u0432 \u0442\u0438\u043f\u0430 \»\u0433\u0434\u0435 \u043c\u043e\u0438 \u0434\u0435\u043d\u044c\u0433\u0438?\».

\u0413\u0430\u0437\u043f\u0440\u043e\u043c\u0431\u0430\u043d\u043a \u0436\u0435 \u043d\u0430 \u0443\u0440\u043e\u0432\u043d\u0435 \u043a\u043b\u0438\u0435\u043d\u0442\u043e\u0432 \u043f\u0440\u0435\u0434\u043b\u0430\u0433\u0430\u0435\u0442 \u0441\u0435\u0440\u0432\u0438\u0441 \u0443\u0440\u043e\u0432\u043d\u044f 90\u0445 \u0433\u043e\u0434\u043e\u0432 \u0441 \u043f\u043b\u0430\u0442\u043d\u044b\u043c\u0438(!) \u0437\u0430\u043f\u0440\u043e\u0441\u0430\u043c\u0438 \u043d\u0430 \u0440\u043e\u0437\u044b\u0441\u043a \u043f\u043b\u0430\u0442\u0435\u0436\u0430. \u0412\u0441\u0435 \u044d\u0442\u043e \u0432\u043c\u0435\u0441\u0442\u043e \u0442\u043e\u0433\u043e, \u0447\u0442\u043e\u0431\u044b \u0434\u0430\u0442\u044c \u043a\u043b\u0438\u0435\u043d\u0442\u0443 \u043f\u0440\u043e\u0441\u0442\u043e\u0439 \u0438 \u043f\u0440\u044f\u043c\u043e\u0439 \u0441\u043f\u043e\u0441\u043e\u0431 \u043f\u043e\u043b\u0443\u0447\u0438\u0442\u044c \u0442\u0440\u0435\u043a. \u0418 \u043f\u0440\u0438 \u0432\u0441\u0435\u043c \u043f\u0440\u0438 \u044d\u0442\u043e\u043c \u0433\u043f\u0431 \u043f\u043b\u0430\u0442\u0438\u0442 \u0437\u0430 \u0441\u0430\u043c\u044b\u0439 \u0434\u043e\u0440\u043e\u0433\u043e\u0439 swift live gpi. \u0412\u0438\u0434\u0438\u043c\u043e \u043f\u043e\u0442\u043e\u043c\u0443 \u0447\u0442\u043e \u044d\u0442\u043e \u043d\u0435 \u043a\u043e\u043c\u043c\u0435\u0440\u0447\u0435\u0441\u043a\u0430\u044f \u043e\u0440\u0433\u0430\u043d\u0438\u0437\u0430\u0446\u0438\u044f, \u0433\u0434\u0435 \u0434\u0443\u043c\u0430\u044e\u0442 \u043e \u043f\u0440\u0438\u0431\u044b\u043b\u0438, \u0430 \u0447\u0442\u043e-\u0442\u043e \u043f\u0440\u043e\u0442\u0438\u0432\u043e\u043f\u043e\u043b\u043e\u0436\u043d\u043e\u0435. \u0425\u043e\u0442\u0435\u043b\u043e\u0441\u044c \u0431\u044b \u0447\u0442\u043e\u0431 \u044d\u0442\u0438 \u043c\u044b\u0441\u043b\u0438 \u043f\u0440\u043e\u0447\u043b\u0438 \u043e\u0442\u0432\u0435\u0442\u0441\u0442\u0432\u0435\u043d\u043d\u044b\u0435 \u043b\u0438\u0446\u0430 \u0432 \u0413\u041f\u0411 \u0438 \u0441\u0434\u0435\u043b\u0430\u043b\u0438 \u043f\u0440\u0430\u043a\u0442\u0438\u0447\u0435\u0441\u043a\u0438\u0435 \u0432\u044b\u0432\u043e\u0434\u044b. \u0412 \u0442\u0430\u043a\u0438\u0445 \u0431\u0430\u043d\u043a\u0430\u0445 \u043a\u0430\u043a standard chartered, DB, citi, jpmorgan \u0431\u0435\u0441\u043f\u043b\u0430\u0442\u043d\u044b\u0439 \u0441\u0435\u0440\u0432\u0438\u0441 \u043f\u043e \u043e\u0442\u0441\u043b\u0435\u0436\u0438\u0432\u0430\u043d\u0438\u044e \u0441\u0432\u0438\u0444\u0442 \u043f\u043b\u0430\u0442\u0435\u0436\u0435\u0439 \u043f\u0440\u0435\u0434\u043e\u0441\u0442\u0430\u0432\u043b\u044f\u0435\u0442\u0441\u044f \u0432\u043e\u043e\u0431\u0449\u0435 \u0432\u0441\u0435\u043c \u0436\u0435\u043b\u0430\u044e\u0449\u0438\u043c, \u0430 \u043d\u0435 \u0442\u043e\u043b\u044c\u043a\u043e \u043a\u043b\u0438\u0435\u043d\u0442\u0430\u043c \u0431\u0430\u043d\u043a\u043e\u0432. \u0412\u0441\u0435 \u044d\u0442\u043e \u043f\u043e\u0442\u043e\u043c\u0443 \u0447\u0442\u043e \u0440\u0430\u0441\u0445\u043e\u0434\u043e\u0432 \u0441\u043e \u0441\u0442\u043e\u0440\u043e\u043d\u044b \u0431\u0430\u043d\u043a\u0430 \u043d\u0430 \u044d\u0442\u043e 0, \u0430 \u043f\u043e\u043b\u044c\u0437\u0430 \u043e\u0433\u0440\u043e\u043c\u043d\u0430\u044f. «,»userName»:»s*******@mts»,»parentId»:445148,»infoForBank»:null>],»isMobile»:false,»isDesktop»:true,»questionList»:<"data":[<"id":450189,"title":"\u0421\u043f\u0438\u0441\u0430\u043d\u0438\u0435 \u0434\u0435\u043d\u0435\u0433","topicId":107,"hotLine":<"bankId":null>,»topic»:<"id":107,"name":"\u042d\u043a\u0441\u043f\u0435\u0440\u0442\u044b \u0411\u0430\u043d\u043a\u0438.\u0440\u0443">,»createdAt»:»2022-08-29T09:25:05+03:00″,»status»:1,»userName»:»user-71388832016″,»questionText»:»

\u0417\u0434\u0440\u0430\u0441\u0442\u0432\u0443\u0439\u0442\u0435, \u0432\u043e\u0437\u043c\u043e\u0436\u043d\u043e \u043b\u0438 \u0433\u0440\u0430\u0436\u0434\u0430\u043d\u0438\u043d\u0443 \u0423\u0437\u0431\u0435\u043a\u0438\u0441\u0442\u0430\u043d\u0430, \u043f\u043e\u043b\u0443\u0447\u0438\u0442\u044c \u043a\u0440\u0435\u0434\u0438\u0442 \u0441 \u0432\u0438\u0434\u043e\u043c \u043d\u0430 \u0436\u0438\u0442\u0435\u043b\u044c\u0441\u0442\u0432\u043e? \u041d\u0430\u0445\u043e\u0436\u0443\u0441\u044c \u043d\u0430 \u0442\u0435\u0440\u0440\u0438\u0442\u043e\u0440\u0438\u0438 \u0420\u043e\u0441\u0441\u0438\u0438 \u0441 2016\u0433\u043e\u0434\u0430 \u0431\u0435\u0437 \u0432\u044b\u0435\u0437\u0434\u043d\u043e, \u0440\u0430\u0431\u043e\u0442\u0430\u044e \u043d\u0435 \u043e\u0444\u0438\u0446\u0438\u0430\u043b\u044c\u043d\u043e, 10\u043b\u0435\u0442 \u0432 \u0433\u0440\u0430\u0436\u0434\u0430\u043d\u0441\u043a\u043e\u043c \u0431\u0440\u0430\u043a\u0435, \u0434\u0432\u043e\u0435 \u0434\u0435\u0442\u0435\u0439

\u043f\u0440\u043e\u0448\u0443 \u0431\u043b\u043e\u043a\u0438\u0440\u043e\u0432\u0430\u0442\u044c \u041b\u041a \u0441 \u043d\u043e\u043c\u0435\u0440\u043e\u043c \u0442\u0435\u043b\u0435\u0444\u043e\u043d\u0430 89066950909, \u0437\u0430\u0440\u0435\u0433\u0438\u0441\u0442\u0440\u0438\u0440\u043e\u0432\u0430\u043d \u043c\u043e\u0448\u0435\u043d\u043d\u0438\u043a\u0430\u043c\u0438 «>,<"id":450186,"title":"\u0421\u0442\u0440\u0430\u0445\u043e\u0432\u043a\u0430 \u0437\u0430 \u0433\u0440\u0430\u043d\u0438\u0446\u0443","topicId":100,"hotLine":<"bankId":195706>,»topic»:<"id":100,"name":"\u0418\u043d\u044b\u0435 \u0432\u043e\u043f\u0440\u043e\u0441\u044b">,»createdAt»:»2022-08-29T09:01:49+03:00″,»status»:1,»userName»:»user7716034″,»questionText»:»

\u041f\u043e\u0434\u0441\u043a\u0430\u0436\u0438\u0442\u0435, \u043f\u043e\u0436\u0430\u043b\u0443\u0439\u0441\u0442\u0430, \u0432\u043e\u0437\u043c\u043e\u0436\u043d\u043e \u043b\u0438 \u0441\u0435\u0439\u0447\u0430\u0441 \u043e\u0442\u043a\u0440\u044b\u0442\u044c \u0440\u0443\u0431\u043b\u0435\u0432\u044b\u0439 \u0441\u0447\u0435\u0442 \u0438\u043d\u043e\u0441\u0442\u0440\u0430\u043d\u0446\u0443 \u0431\u0435\u0437 \u043f\u043e\u0441\u0435\u0449\u0435\u043d\u0438\u044f \u0420\u043e\u0441\u0441\u0438\u0438? \u0415\u0441\u043b\u0438 \u0434\u0430, \u0442\u043e \u0447\u0442\u043e \u0434\u043b\u044f \u044d\u0442\u043e\u0433\u043e \u043d\u0435\u043e\u0431\u0445\u043e\u0434\u0438\u043c\u043e? \u0411\u0443\u0434\u0443\u0442 \u043f\u043e\u0441\u0442\u0443\u043f\u0430\u0442\u044c \u0444\u0438\u043d\u0430\u043d\u0441\u044b \u043e\u0442 \u0440\u043e\u0441\u0441\u0438\u0439\u0441\u043a\u043e\u0433\u043e \u044e\u0440\u043b\u0438\u0446\u0430 \u043f\u043e \u0434\u043e\u0433\u043e\u0432\u043e\u0440\u0443 \u0413\u041f\u0425. «>,<"id":450183,"title":"\u0414\u043e\u0431\u0440\u044b\u0439 \u0434\u0435\u043d\u044c!","topicId":82,"hotLine":<"bankId":null>,»topic»:<"id":82,"name":"\u0412\u043a\u043b\u0430\u0434\u044b">,»createdAt»:»2022-08-29T08:10:05+03:00″,»status»:1,»userName»:»user-29879604903″,»questionText»:»

По сделанному в ГПБ свифт переводу банк предоставил только распечатку поручения на перевод в формате MT-103. Но для отслеживания прохождения платежа мне нужно получить SWIFT GPI код (он же UETR код). Газпромбанк к этой системе подключен, отправил перевод через нее и естественно имеет информацию по коду/идентификатору отслеживания платежа. В чем проблема его предоставить клиенту. В Тинькове я этот код вижу в один клик в приложении, а в ГПБ не помогает и личное обращение к директору по премиальному обслуживанию в офисе. Никакие розыски платежа для этого не нужны. Банк, подключенный к сервису SWIFT GPI видит прохождение своего платежа (SWIFT list) за одно нажатие клавиши мышкой на терминале SWIFT. В чем вообще проблема в передаче этой информации клиенту. Или вы думаете, что списали деньги со счета, взяли немалую комиссию за перевод и все? Дальше это проблемы клиента?

SWIFT gpi for capital markets

Reducing friction in cross-border securities and foreign exchange transactions

SWIFT gpi is shaping the future of cross-border payments. A community of thousands of financial institutions are already leveraging gpi to deliver cross-border transactions that are near real time, transparent, cost effective, and secure.

Shifting regulation and a pressure to reduce costs and risk, combined with increasing customer expectations, are more than ever key areas of focus for the capital markets community. SWIFT gpi can help in a number of ways, including reducing the operational costs associated with processing cash payments, decreasing risks associated with incorrect allocations or missed deadlines, and enabling more informed cash management decisions.

SWIFT gpi can improve the payments process in many operational areas, including settlement and reconciliation, collateral management, corporate actions, foreign exchange and fund processing.

SWIFT gpi for capital markets

Reducing friction in cross-border securities and foreign exchange transactions

SWIFT gpi is shaping the future of cross-border payments. A community of thousands of financial institutions are already leveraging gpi to deliver cross-border transactions that are near real time, transparent, cost effective, and secure.

Shifting regulation and a pressure to reduce costs and risk, combined with increasing customer expectations, are more than ever key areas of focus for the capital markets community. SWIFT gpi can help in a number of ways, including reducing the operational costs associated with processing cash payments, decreasing risks associated with incorrect allocations or missed deadlines, and enabling more informed cash management decisions.

SWIFT gpi can improve the payments process in many operational areas, including settlement and reconciliation, collateral management, corporate actions, foreign exchange and fund processing.

Swift gpi code

With SWIFT gpi for Corporates (g4C), gpi flows are now directly integrated into corporate treasury applications (TMS/ERP), allowing multi-bank corporates to initiate and track their outgoing payments (Pay and trace) and to be notified about incoming payments (Inbound tracking) in a bank-agnostic way.

gpi for Corporates delivers the following benefits:

Multi-bank unique end-to-end reference generated at payment initiation

Full visibility on outgoing and incoming cross-border transactions (time, routing, number of intermediaries, fees)

Certainty and visibility on receivables with structured payment advice information, allowing for accelerated reconciliation and optimized liquidity management

Improved supplier relationship with certainty of payment, proof of execution and proactive issue-resolution

With this set of APIs, g4C payment tracking is now real-time. The APIs can be used by corporates (to track their own payments) as well as by banks (to track their customers’ payments). Being subscribed to gpi for Corporates is a pre-requisite to the use of these APIs over the SWIFT network.

For more information on gpi for Corporates, see SWIFT.com

Types of g4c API

Allow corporates and their servicing bank(s) to track Pay and trace and/or Inbound tracking transactions in real-time. 2 queries are available:

UETR search: provides the status and the related transaction-level information regarding a specific (incoming or outgoing) transaction.

Time-window search: provides the status of all transactions (incoming or outgoing) that have been updated within the specified timeframe.

g4C Notification Management (g4C banks only)

Allow g4C banks to configure criteria to only enable the reception of g4C notifications for a pre-defined list of customers and/or transactions.

Supported Developer Toolkit

This API will be supported by SWIFT SDK and SWIFT Microgateway.

Ordering and Provisioning

Subscribe to gpi for Corporates and start using the APIs.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

SWIFT gpi for banks document centre

Download the latest resources.

Hear from Raouf Soussi, BBVA.

Hear from Isabel Schmidt, BNY Mellon.

Hear from Jean-François Mazure, Société Générale.

Find out how J.P. Morgan is leveraging SWIFT’s stop and recall service to streamline and automate the halting of.

Download this ebook to learn how financial institutions can deliver a better payments experience.

First National Bank of Omaha leverages SWIFT gpi payments data to support international business growth across the.

Find out how China Minsheng Bank is delivering value-added services for its corporate customers using the gpi Stop and.

Imagine a world where cross-border payments could be made by consumers and small businesses in an easy, predictable.

Cross-border payments are fast, transparent and fully traceable thanks to SWIFT gpi. Now a new phase of innovation is.

Find out how one of Russia’s leading banks is delivering a transformed payments experience for its corporate customers.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

SWIFT gpi for banks document centre

Download the latest resources.

Hear from Raouf Soussi, BBVA.

Hear from Isabel Schmidt, BNY Mellon.

Hear from Jean-François Mazure, Société Générale.

Find out how J.P. Morgan is leveraging SWIFT’s stop and recall service to streamline and automate the halting of.

Download this ebook to learn how financial institutions can deliver a better payments experience.

First National Bank of Omaha leverages SWIFT gpi payments data to support international business growth across the.

Find out how China Minsheng Bank is delivering value-added services for its corporate customers using the gpi Stop and.

Imagine a world where cross-border payments could be made by consumers and small businesses in an easy, predictable.

Cross-border payments are fast, transparent and fully traceable thanks to SWIFT gpi. Now a new phase of innovation is.

Find out how one of Russia’s leading banks is delivering a transformed payments experience for its corporate customers.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

SWIFT gpi for banks document centre

Download the latest resources.

Hear from Raouf Soussi, BBVA.

Hear from Isabel Schmidt, BNY Mellon.

Hear from Jean-François Mazure, Société Générale.

Find out how J.P. Morgan is leveraging SWIFT’s stop and recall service to streamline and automate the halting of.

Download this ebook to learn how financial institutions can deliver a better payments experience.

First National Bank of Omaha leverages SWIFT gpi payments data to support international business growth across the.

Find out how China Minsheng Bank is delivering value-added services for its corporate customers using the gpi Stop and.

Imagine a world where cross-border payments could be made by consumers and small businesses in an easy, predictable.

Cross-border payments are fast, transparent and fully traceable thanks to SWIFT gpi. Now a new phase of innovation is.

Find out how one of Russia’s leading banks is delivering a transformed payments experience for its corporate customers.

Does your payments system vendor support gpi and universal confirmations?

We have a number of initiatives to support vendors in integrating gpi into their platforms.

Application vendors can play a major role in helping you implement universal payment confirmations. To date, 16 of the major global vendors used by SWIFT members have confirmed their support for SWIFT gpi capability. Through a structured and phased approach, we’re supporting the broader vendor community to help grow gpi adoption.

SWIFT has recently initiated a self-attestation programme for the Application provider community, where third-party financial applications can self-attest to their support for SWIFTgpi Universal Payment Confirmations.

The applications listed below have confirmed and shared their commitment to support at least one of the automated SWIFT gpi universal confirmations’ channels (MT 199/APIs) as per the universal confirmations’ rulebook and as part of the yearly standard release support for all the customers using their application.

SWIFT do not test or audit the product’s readiness, resilience, performance, overall quality, usability, scalability, supportability, or other generic commercial features.

If you need more information on how the support will be offered, please reach out to the respective application provider. If your application provider is not in the list, please share the details of the application provider below with SWIFT and SWIFT will reach out to the application provider to support them and take their input on SWIFT gpi Universal confirmations.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

SWIFT gpi for banks document centre

Download the latest resources.

Leading corporates have successfully implemented multi-bank gpi payments and tracking through their treasury.

This briefing, published by the European Association of Corporate Treasurers (EACT), dicusses how SWIFT gpi will address.

For corporate treasurers at the forefront of global trade, the experience of sending and receiving payments.

How payment market infrastructures can support gpi payments.

SWIFT Professional Services for gpi offers comprehensive support for all your gpi assistance needs. From kick-off to.

80% of Santander’s cross-border payments to be on SWIFT gpi by year-end

SWIFT lanza la herramienta gpi Observer Analytics

SWIFT lance l’outil gpi Observer Analytics

SWIFT gpi proporcionará detección de errores en los mensajes de pago y transparencia de los costes por adelantado

Related content

SWIFT platform evolution

We’re evolving our capabilities to enable frictionless and instant payments and securities transactions from one account.

Payment Pre-validation

Eliminate frictions in international payments by upfront verification of account details in real time.

Case resolution

Streamline and automate your exception management processes with gpi Case Resolution.

Ordering

The SWIFT gpi for corporates service allows your institution to benefit from the below SWIFT gpi for corporates capabilities:

Place orders

SWIFT gpi for corporates services

The ordering of the SWIFT gpi for corporates service, and the provisioning of your entity/ies under the appropriate gpi for corporates capability/ies, is a procedure which follows the below procedure:

1. Subscribe to the SWIFT gpi for corporates service

You can subscribe to the SWIFT gpi for corporates service as a financial institution or as a corporate. If you subscribe as a financial institution, the latter must first be subscribed to SWIFT gpi.

Once the first eform will be placed, you will be subscribed to the SWIFT gpi for corporates service and will then be entitled to decide which gpi for corporates capability/ies should be ordered. Depending on your needs, you can order the gpi Pay and trace and/or gpi Inbound tracking capability/ies. More precisely:

gpi Pay and trace

2. Order the gpi Pay and trace Closed User Group (Test)

3. Order the gpi Pay and trace Closed User Group (Live)

gpi Inbound tracking

4. Order the gpi Inbound tracking Closed User Group (Test)

5. Order the gpi Inbound tracking Closed User Group (Live)

Please note that the above eforms should be placed at the level of your parent destination. Once subscribed to the SWIFT gpi for corporates service, you should first order the Test Closed User Group before the Live one.

SWIFT gpi for banks

Transform your customers’ cross-border payment experience and reduce your costs.

SWIFT gpi for banks document centre

Download the latest resources.

Corporate challenges with cross-border payments.

Open letter from international corporates

Intesa Sanpaolo takes a ‘business first’ approach to SWIFT gpi adoption

Hear from Nordea about how they took an agile approach to implementing SWIFT gpi using a small team of in-house.

UniCredit quick to seize benefits of SWIFTgpi

The SWIFT gpi initiative

Press release – Russian version

Press release – Italian version

Press release – French version

Press release – Spanish version

Related content

SWIFT platform evolution

We’re evolving our capabilities to enable frictionless and instant payments and securities transactions from one account.

Payment Pre-validation

Eliminate frictions in international payments by upfront verification of account details in real time.

Case resolution

Streamline and automate your exception management processes with gpi Case Resolution.

SWIFT gpi for payment application providers

Cross-border payments, transformed

Enable global payments innovation

Payment application providers are crucial to the adoption of gpi by the global financial community. SWIFT is working closely to support providers in integrating the gpi requirements into their application offering.

To bring further transparency to application providers and their customers, SWIFT has launched the approved gpi Label programme. Providers can use the gpi Label to demonstrate that their applications are gpi-ready. The programme builds on the successful implementation of gpi by several large application providers at nearly 20 global banks.

Application providers are essential to the rapid and efficient adoption of gpi. We welcome more providers to join the gpi Label programme so they can promote their gpi capability to the banking community and help their customers go live on gpi.

Wim Raymaekers, Head of Banking Markets and SWIFT gpi at SWIFT

SWIFT global payments innovation (gpi)

Global banks are working together to make a dramatic change in cross-border payments

In today’s digital world, when you make a cross-border payment you expect the service to be delivered at the touch of a button. Yet, in reality, cross-border payments can take days, can’t be tracked, there’s a lack of transparency on fees and remittance data can get altered in the process.

Today, SWIFT gpi is transforming the cross-border payment experience entirely, by:

SWIFT gpi has already been adopted by more than 150 banks around the world and more than 100 billion USD in SWIFT gpi messages are being sent every day – enabling payments to be credited to end beneficiaries within minutes or seconds. SWIFT gpi payments now represent nearly 10% of SWIFT’s cross-border payments traffic, sent daily across 220 international payment corridors.

SWIFT gpi is set to be the standard for all cross-border payments by the end of 2020.

Value for gpi banks

SWIFT gpi enables banks to:

Value for corporates

SWIFT gpi enables bank’s corporate customers to:

What is a Unique End-to-end Transaction Reference (UETR)?

A Unique End-to-end Transaction Reference (commonly known as a UETR) is a string of 36 unique characters featured in all payment instruction messages carried over SWIFT.

What is a UETR?

A Unique End-to-end Transaction Reference (commonly known as a UETR) is a string of 36 unique characters featured in all payment instruction messages carried over SWIFT.

UETRs are designed to act as a single source of truth for a payment and provide complete transparency for all parties in a payment chain, as well as enable functionality from SWIFT gpi, such as the payment Tracker.

How do they work?

A UETR is very much like the tracking number couriers use when you send or receive a parcel. The sender issues a unique, unalterable reference which allows a payment to be located at any time, by any of the parties in the chain. UETRs are fully digitised and totally transparent − leading to fast, efficient processing. The sender is also automatically notified of any status changes applied by any banks handling the payment and − crucially − confirmation that the funds have been credited to the beneficiary or rejected at any point in the payment chain.

Why are UETRs so important?

In today’s digital world, banking services are being driven by developments in the consumer space. People now expect clear, accurate and real-time payment information.

UETRs are fundamental to meeting these demands by delivering genuine transparency and true end-to-end tracking of international payments.

When a payment is delayed, the beneficiary needs and expects to be able to find out quickly where the funds are and why that delay has occurred. The consequence of not having this visibility is a series of frustrating manual interventions, friction, and delays to the flow of goods and services. For beneficiary banks, UETRs drastically reduce exceptions and investigations as banks involved earlier in the process can view, in real-time, the latest payment status – meaning they no longer have to contact the beneficiary bank.

Who should provide a UETR?

All SWIFT users (whether gpi members or non-gpi members) originating payments must provide a UETR as standard for each of the following message types:

What benefits do UETRs bring?

UETRs allow banks to easily trace their payments in real-time, regardless of complexity or the number of counterparties involved.

They also remove the need for a chain of references between the originating, intermediary and beneficiary banks, ensuring that all parties are using the same end-to-end reference. This reduces errors and the likelihood of conflict, saving time and money on reconciliation.

They also provide a number of other benefits, including:

How do I ensure compliance?

When ordering institutions generate a payment message, their internal systems are required to generate and include a UETR for all of the message types (listed above) in the 121 field of the message.

Intermediary institutions must not generate a new UETR when routing payments, but their internal systems must be able to receive, copy and pass on the code that was present in the received message to other parties in the chain. Therefore, intermediary bank systems must also be able to handle UETRs.

Likewise, beneficiary banks (even if they are not gpi customers), must be able to receive and process UETRs to reconcile payments.

Institutions issuing cover payments must be able to create a copy of the original UETR and pass it over to the cover payment message.

Universal confirmations

From the end of 2020, all SWIFT member banks will be required to provide confirmation of payments status to the Tracker once they have been credited to the end beneficiary’s account − this must include whether payments have been rejected. As of Standards MT release 2020, universal confirmations will apply to every single customer payment (MT 103 on FIN).

SWIFT also recommends providing a status update if the payment is transferred to an agent outside of FIN or when the payment cannot be processed immediately. This will give customers certainty on the status of their payments, a demand that is being intensified by the proliferation of domestic real-time payment infrastructures and consumer pressure for payments to be delivered in real-time.

The Basic Tracker

Finally, to extend the benefit of payments tracking and confirmations to all SWIFT financial institutions, we are introducing the Basic Tracker. Our free Basic Tracker enables financial institutions to track all their payments from end to end in real time. It also allows banks to manually confirm payments and meet the requirements around universal confirmations. It does though lack the advanced features of the UETR leveraging, paid-for SWIFT gpi Tracker, such as the tracking of intermediary routing, cover payments and value-added services − such as being able to stop and recall payments through the Tracker.

Everything you need to know about SWIFT gpi

With SWIFT announcing its new SWIFT gpi network, extensively covered at Sibos 2017, we’ve pulled together an overview and the best SWIFT gpi articles on bobsguide. Firstly, define SWIFT. If you’re a corporate or bank you’ve probably used SWIFT, or to use their far catchier name, the Society for Worldwide Interbank Financial Telecommunications. The SWIFT …

With SWIFT announcing its new SWIFT gpi network, extensively covered at Sibos 2017, we’ve pulled together an overview and the best SWIFT gpi articles on bobsguide.

Firstly, define SWIFT.

If you’re a corporate or bank you’ve probably used SWIFT, or to use their far catchier name, the Society for Worldwide Interbank Financial Telecommunications. The SWIFT network is responsible for processing, transmitting and messaging secure information from one financial institution to another.

In many cases, this means that the coffee retailer in London can send money to the coffee vendor in Colombia by providing the right account number and corresponding bank SWIFT code. SWIFT sends a message code to release the funds from the retailer’s account in London and to be received in the vendor’s account. Simple, the postal service for digital payments.

SWIFT took over the mantle of international correspondent banking from Telex. This was largely due to the free format of messaging, where a central switchboard operator interpreted the request and executed the transaction. This was fraught with latency issues as well as human error. SWIFT’s standardised coding eliminates the middleman.

So what is SWIFT gpi?

Gpi, or Global Payments Innovation, looks to improve upon the SWIFT system. Indeed, SWIFT’s website promises it is “the biggest thing to happen to correspondent banking in 30 years” for the 110+ banks who’ve already signed up since January 2017.

The first phase of gpi (currently live) promises to enable:

In effect, the first phase seeks to provide faster payments by making transferred funds available providing they are transferred before SWIFT’s cut-off point. The cloud correspondent tool also seeks to address the pain point around payment visibility from corporate treasurers. SWIFT gpi uses real-time tracking, end-to-end view of payments thanks to the unique tracking codes which will enable a notification lifecycle of the settlement i.e. you will know when the payment has reached its destination. The ability to settle transactions in the same day optimises liquidity with improved cash forecasts.

The second phase (for 2018-2019) will feature:

The immediate stopping of a payment

The idea is to give banks more control over cases of fraud or duplicate payments by allowing building in the ability of cancelling a payment anywhere in the payment chain. This is made possible by the unique tracking code that also enables the payment tracking provided in the first phase. This greatly aids in fraud prevention, but also in operational cost and wasting time making administrative cancellation requests.

The additional transfer of rich payment data

The complex nature of many transactions requires more information to be sent along with the payments. Previously this was left to email liaising between corporate clients and their banks. Naturally, cutting this out makes the system quicker and more efficient.

The use of an international payment assistant

This essentially acts as an information source to speed up payments by providing the relevant information at the touch of a button, whilst also avoiding incorrect and bounced payments.

Further reading on SWIFT

Editor, Alex Hammond, examines the mood at Sibos 2017 around SWIFT gpi.

Editor, Alex Hammond, looks at the key pain points for banks and corporates.

Alessandra Riccardi, Business Expert at TAS Group, gives a good evolutionary overview of correspondent banking and why the future is a mixture of SWIFT gpi with emerging technologies.

SWIFT gpi

The new norm

in cross-border payments

By embracing SWIFT gpi – the new standard in global payments – financial institutions are now sending and receiving funds quickly and securely to anyone, anywhere in the world, with full transparency over where a payment is at any given moment. SWIFT gpi dramatically improves cross-border payments across the correspondent banking network, and not least for corporates for whom speed, certainty and a smooth international payments experience is an absolute must.

SWIFT Platform evolution

Our vision is for instant and frictionless payments, from account to account, anywhere in the world.

A SOLUTION FOR EACH STEP OF THE TRANSACTION

Transactional services

Our core gpi services make sending cross-border payments fast, transparent and trackable.

Pre and post-transaction services

Our pre and in-flight payment services reduce friction and make your cross-border transactions even more seamless.

Services for corporates

Our services for corporates will deliver all the benefits of gpi directly to your corporate customers in their back office systems.

SWIFT gpi enables you to

Deliver a transformed customer experience

Your customers expect the best. Whether it’s a pizza, a parcel or a cross-border payment, they expect their payment to be trackable right to the beneficiary. That’s what you can deliver with SWIFT gpi.

Cut costs in your back office

How many man hours do you spend checking on the status of payments? With the gpi Tracker at your fingertips, you and your customers can access real-time payments data any time.

Reduce friction with your counterparts

When payment exceptions occur and an investigation is needed, you want to close the case as quickly as possible. Our transaction services enable you to automate many cumbersome manual processes.

Unlocking payment confirmations for all

The vast majority of payments on SWIFT are now confirmed.

What to do if you’re already a SWIFT gpi customer

Universal Confirmations brings the benefits of end-to-end tracking to all cross-border payments sent on SWIFT. For gpi customers, this brings added value as all your payments, regardless of whether they’re sent as gpi or not, will now be fully trackable to the end beneficiary

How will SWIFT gpi customers be impacted by Universal Confirmations?

The requirement to update the SWIFT Tracker will be for all MTs 103 received on FIN that do not immediately result in another MT 103 on FIN. The gpi rules and their related benefits apply in addition for payment messages sent with field 111 Service Type Identifier in the header and for received payments according to your gpi Directory scope for your BICs registered for SWIFT gpi.

Otherwise, for all incoming transactions, across all currencies, corridors, subsidiaries and branches, you’ll need to update the Tracker within two business days as per Universal Confirmations rules, including:

Will gpi customers be forced to register all their BICs for gpi?

No, you can keep the split to register some but not all of your BICs on gpi.

As gpi customers, are we going to receive confirmation from the Tracker automatically on behalf of a non-gpi institution?

When a gpi-enabled MT 103 (field 111) is sent over FIN by a gpi customer, the Tracker will automatically generate confirmations and distribute it to the relevant gpi customers per status update. This will also occur when the Tracker receives the confirmation from a non-gpi bank when there were gpi customers involved in previous legs of the transaction. Those confirmations will have the same format as gpi confirmation (incl STI=001). gpi customers must however be ready to receive confirmations with less data elements when provided by non-gpi banks, for example, providing details on deducts in payment confirmations are not mandatory for non-gpi banks.

Fast customer credit transfers

Customer expectations around cross-border payments are higher than ever.

Your customers demand that payments are fast, that they are trackable from end-to-end with final confirmation of credit, and that the remittance data should be unaltered between parties so they can be easily reconciled.

With SWIFT gpi, you can deliver exactly that.

Status of the service: live

Our solution