World steel association

World steel association

2020 Press Releases

November 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 158.3 million tonnes (Mt) in November 2020. Read more

2020 Steel Statistical Yearbook published

The World Steel Association (worldsteel)’s Steel Statistical Yearbook presents a cross-section of steel industry statistics. It contains comprehensive statistics from 2010 to 2019 on crude steel production by country and process. Read more

worldsteel announces steelChallenge-15 World Championship Finalists

The Regional Championship took place online for 24 hours on 25 November 2020. This year’s steelChallenge attracted over 1200 participants. Read more

October 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 161.9 million tonnes (Mt) in October 2020. Read more

Sustainable steel – Indicators 2020 and steel applications

New Steel Industry Engineering Program Will Demonstrate Steel Architectures for MaaS Vehicles

Characterized by fully connected and autonomous electric vehicles. Read more

The steel industry in modern society

worldsteel Director General Edwin Basson presents at the Global Forum on Steel Excess Capacity (GFSEC) Ministerial meeting on 26 October 2020. Read more

September 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 156.4 million tonnes (Mt) in September 2020, a 2.9% increase compared to September 2019. Read more

Steel Safety Day and Safety and Health Recognition 2020

Today is Steel Safety Day, a day for worldsteel and its member companies to pause and dedicate their attention to the industry’s most important priority. Read more

worldsteel Short Range Outlook October 2020

The World Steel Association (worldsteel) today released an update to its Short Range Outlook (SRO) for 2020 and 2021. This SRO is showing a much more optimistic outlook than the previous SRO finalised in June. Read more

The 11th Steelie Award winners announced

The winners of the 11th Steelie Awards were announced on 14 October 2020. Read more

worldsteel elects new officers and welcomes new members

The Board of Members of the World Steel Association (worldsteel) has elected the Executive Board of Directors for the 2020/2021 period and has welcomed new members. Read more

11th Steelie Awards shortlist announced

The World Steel Association (worldsteel) has announced the shortlist for the 11th Steelie Awards. The Steelie Awards recognise member companies or individuals for their contribution to the steel industry over a one-year period in a series of categories impacting the industry. Read more

August 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 156.2 million tonnes (Mt) in August 2020, a 0.6% increase compared to August 2019. Read more

steelChallenge-15 registration open

steelChallenge is the world’s biggest steel industry competition. Read more

July 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 152.7 (Mt) in July 2020, a 2.5% decrease compared to July 2019. Read more

June 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 148.3 million tonnes (Mt) in June 2020, a 7.0% decrease compared to June 2019. Read more

May 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 148.8 million tonnes (Mt) in May 2020, an 8.7% decrease compared to May 2019. Read more

worldsteel Short Range Outlook June 2020

worldsteel today released its Short Range Outlook (SRO) for 2020 and 2021. In 2020 worldsteel forecasts that steel demand will contract by 6.4% due to the COVID-19 crisis. Read more

worldsteel announces the 2019 Steel Sustainability Champions

The World Steel Association (worldsteel) has recognised 9 companies as Steel Sustainability Championsfor their work in 2019. Read more

April 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 137.1 million tonnes (Mt) in April 2020, a 13.0% decrease compared to April 2019. Read more

March 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 147.1 million tonnes (Mt) in March 2020, a 6.0% decrease compared to March 2019. Read more

worldsteel announces the World Champions of steelChallenge-14

The World Steel Association (worldsteel) today announced the new world champions of the 14th steelChallenge. Read more

Interim steel demand economic statement

worldsteel has today published its interim steel demand economic statement in advance of its full Short Range Outlook (SRO) press release to be issued in June. Read more

April 2020 SRO postponement and other updates

In light of the unprecedented disruptions of the COVID-19 pandemic, worldsteel has taken the decision not to publish its April Short Range Outlook (SRO) for steel demand this month. Read more

February 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 142.4 million tonnes (Mt) in February 2020, a 2.1% increase compared to February 2019. Read more

January 2020 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 154.4 million tonnes (Mt) in January 2020, a 2.1% increase compared to January 2019. Read more

Global crude steel output increases by 3.4% in 2019

Global crude steel production reached 1,869.9 million tonnes (Mt) for the year 2019, up by 3.4% compared to 2018. Crude steel production contracted in all regions in 2019 except in Asia and the Middle East. Read more

World steel association

Avenue de Tervueren 270

B-1150 Bruxelles

Belgium

Рабочие связи

| Ссылка | Заголовок | Тип |

|---|---|---|

| ISO/TC 17 | Steel | A |

| ISO/TC 59/SC 17 | Sustainability in buildings and civil engineering works | A |

| ISO/TC 207 | Environmental management | A |

| ISO/TC 207/SC 1 | Environmental management systems | A |

| ISO/TC 207/SC 2 | Environmental auditing and related environmental investigations | A |

| ISO/TC 207/SC 4 | Environmental performance evaluation | A |

| ISO/TC 207/SC 5 | Life cycle assessment | A |

| ISO/TC 207/SC 7 | Greenhouse gas and climate change management and related activities | A |

| ISO/TC 323 | Circular economy | A |

Примечания

Liaisons A: Organizations that make an effective contribution to the work of the technical committee or subcommittee for questions dealt with by this technical committee or subcommittee.

Liaisons B: Organizations that have indicated a wish to be kept informed of the work of the technical committee or subcommittee.

Liaisons C: Organizations that make a technical contribution to and participate actively in the work of a working group.

Когда мировое сообщество достигает консенсуса

Мы гарантируем доступ к нашему сайту каждому. Если у вас возникли вопросы или предложения, касающиеся доступа к данной странице, пожалуйста свяжитесь с нами.

Steel Statistics

About our statistics

Our statistics and subscriptions

Steel Data Viewer

Monthly crude steel production

Annual steel data

Production, trade, and use

Short Range Outlook

Steel demand forecast

Top steel producers

List of steel producers by tonnage

Data reports

Steel statistical publications

Steel impact

Steel industry social and economic impact

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

Governance

The work of the World Steel Association (worldsteel) is guided by its members and overseen by its Executive Board of Directors.

The Executive Board of Directors is supported by an elected Executive Committee as well as by the Audit Committee and Nominating Committee. All worldsteel officers, including the Chairman and members of those Committees are elected during the general meetings of members under the advisement of the Nominating Committee.

Main member representatives of Regular and Affiliated members (referred to as Board of Members) can participate and vote during the general meeting of members. Each member has at least one vote and additional voting rights are set in Article 2 of the Internal Regulations of worldsteel.

Day to day operations of the association are administered by a Director General, who is appointed by the Executive Board. worldsteel’s current Director General is Edwin Basson.

2021-2022 Office Bearers

The following office bearers were elected for a one-year term in October 2021.

Chairman

Sajjan JINDAL JSW Steel Limited

Vice Chairman

Jeong-Woo CHOI, POSCO

Vice Chairman

Yong YU, HBIS Group Co., Ltd.

Treasurer

Mark VASSELLA, BlueScope Steel Limited

Chairperson of the International Stainless Steel Forum (ISSF)

Timoteo DI MAULO, Aperam

The Board of Members has also elected the 2021/2022 Executive Committee:

Membership

The World Steel Association (worldsteel) is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. worldsteel represents steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production.

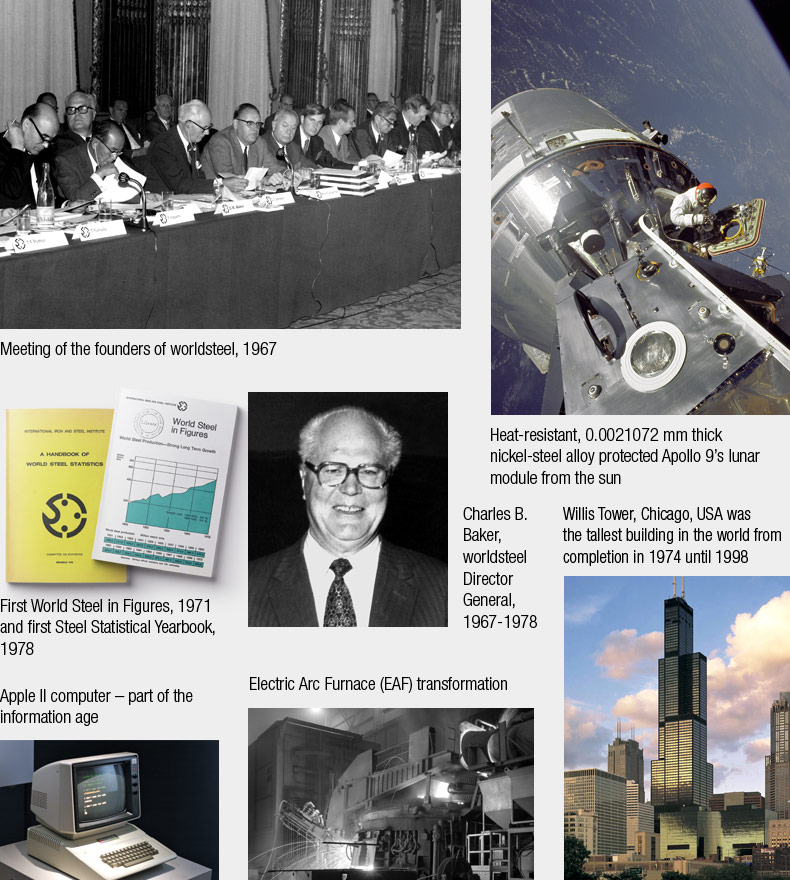

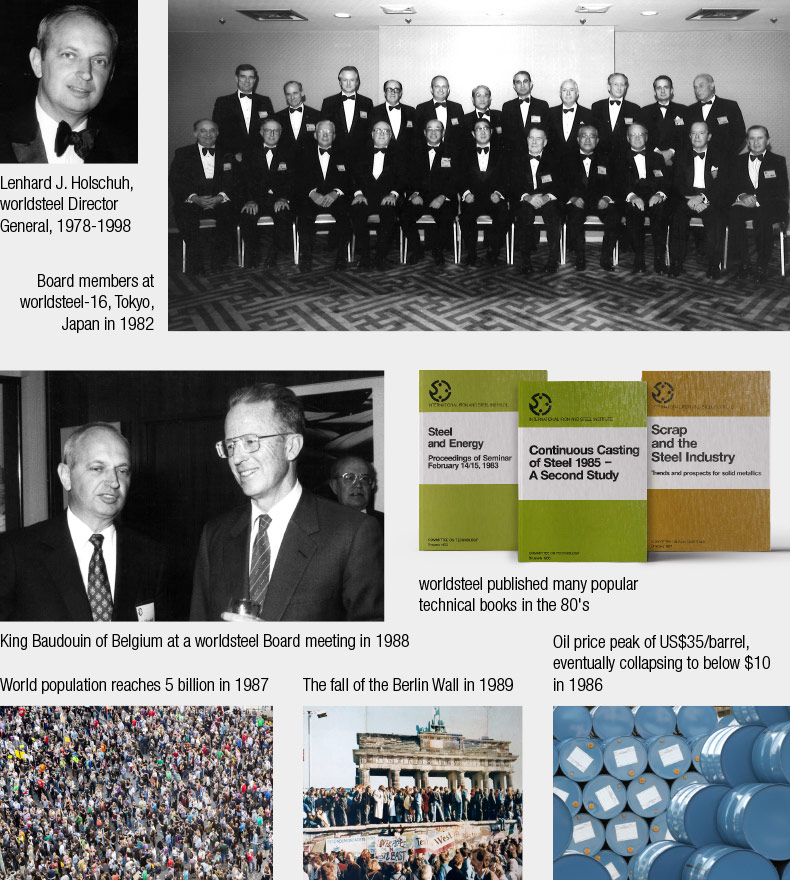

Membership has increased steadily since worldsteel (formerly the International Iron and Steel Institute) was founded in 1967.

worldsteel’s mission is to:

Who can become a member?

There are 2 categories of worldsteel membership:

As a member you will be able to:

The association exerts no pressure or politics on its members. worldsteel is not involved in competitive issues between steel companies.

Who we are

The World Steel Association (worldsteel) is a non-profit organisation with headquarters in Brussels, Belgium. A second office in Beijing, China, opened in April 2006.

worldsteel is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. worldsteel represents steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production.

It was founded as the International Iron and Steel Institute on 10 July 1967. It changed its name to the World Steel Association on 6 October 2008. The association celebrated its 50th anniversary in 2017.

Our goals

Our activities

To find out more, click here.

Our relationship with international organisations

worldsteel maintains relations with several international organisations, including:

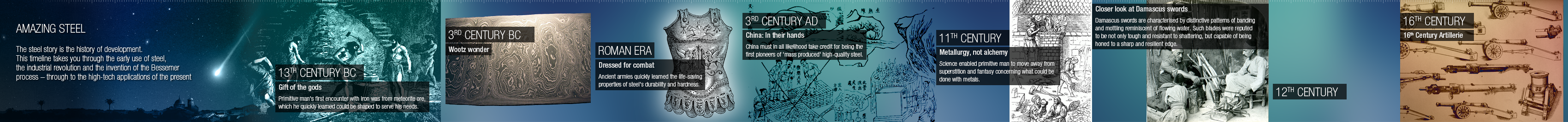

Our history

1967

1970s

1980s

1990s

2000s

2010s

About steel

Steel is the world’s most important engineering and construction material. It is used in every aspect of our lives; in cars and construction products, refrigerators and washing machines, cargo ships and surgical scalpels. It can be recycled over and over again without loss of property.

What is steel?

Iron is made by removing oxygen and other impurities from iron ore. When iron is combined with carbon, recycled steel and small amounts of other elements it becomes steel.

Steel is an alloy of iron and carbon containing less than 2% carbon and 1% manganese and small amounts of silicon, phosphorus, sulphur and oxygen.

Steel is the world’s most important engineering and construction material. It is used in every aspect of our lives; in cars and construction products, refrigerators and washing machines, cargo ships and surgical scalpels.

How is steel made?

Steel is produced via two main routes: the blast furnace-basic oxygen furnace (BF-BOF) route and electric arc furnace (EAF) route. Variations and combinations of production routes also exist.

The key difference between the routes is the type of raw materials they consume. For the BF-BOF route these are predominantly iron ore, coal, and recycled steel, while the EAF route produces steel using mainly recycled steel and electricity. Depending on the plant configuration and availability of recycled steel, other sources of metallic iron such as direct-reduced iron (DRI) or hot metal can also be used in the EAF route.

A total of around 70% of steel is produced using the BF-BOF route. First, iron ores are reduced to iron, also called hot metal or pig iron. Then the iron is converted to steel in the BOF. After casting and rolling, the steel is delivered as coil, plate, sections or bars.

Steel made in an EAF uses electricity to melt recycled steel. Additives, such as alloys, are used to adjust to the desired chemical composition. Electrical energy can be supplemented with oxygen injected into the EAF. Downstream process stages, such as casting, reheating and rolling, are similar to those found in the BF-BOF route. About 30% of steel is produced via the EAF route.

Another steelmaking technology, the open hearth furnace (OHF), makes up about 0.4% of global steel production. The OHF process is very energy-intensive and is in decline owing to its environmental and economic disadvantages.

More details relating to the data above is available from our Steel Statistical Yearbook.

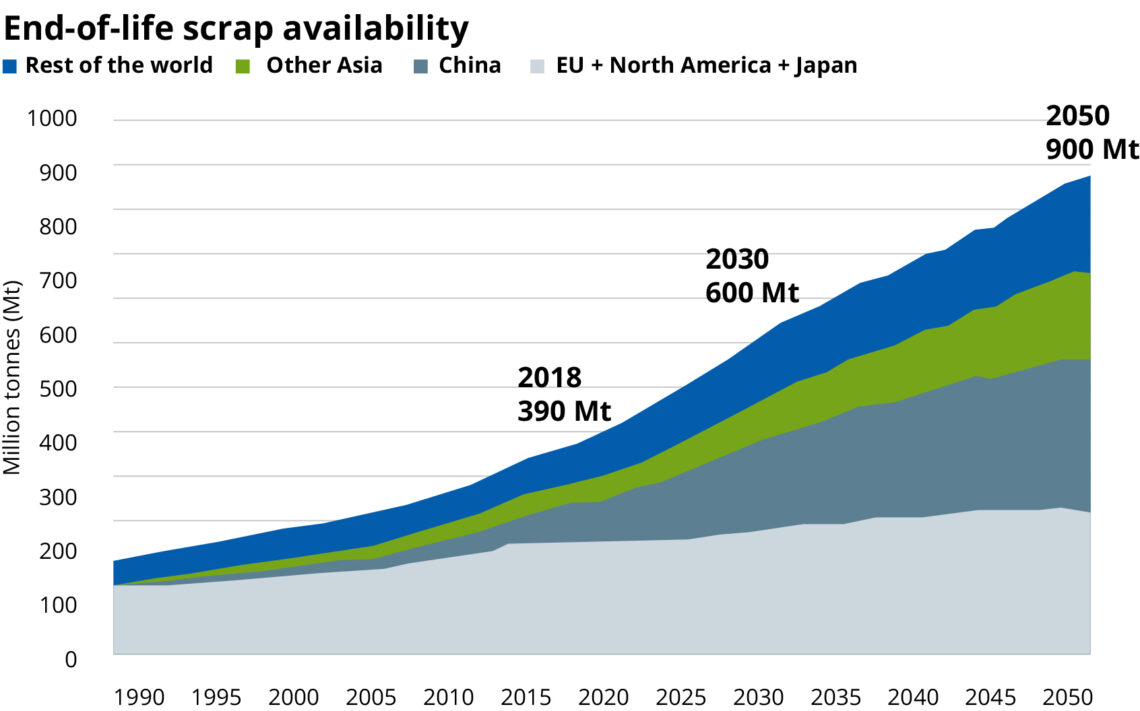

Most steel products remain in use for decades before they can be recycled. Therefore, there is not enough recycled steel to meet growing demand using the EAF steelmaking method alone. Demand is met through the combined use of the BF-BOF and EAF production methods.

All of these production methods can use recycled steel scrap as an input. Most new steel contains recycled steel.

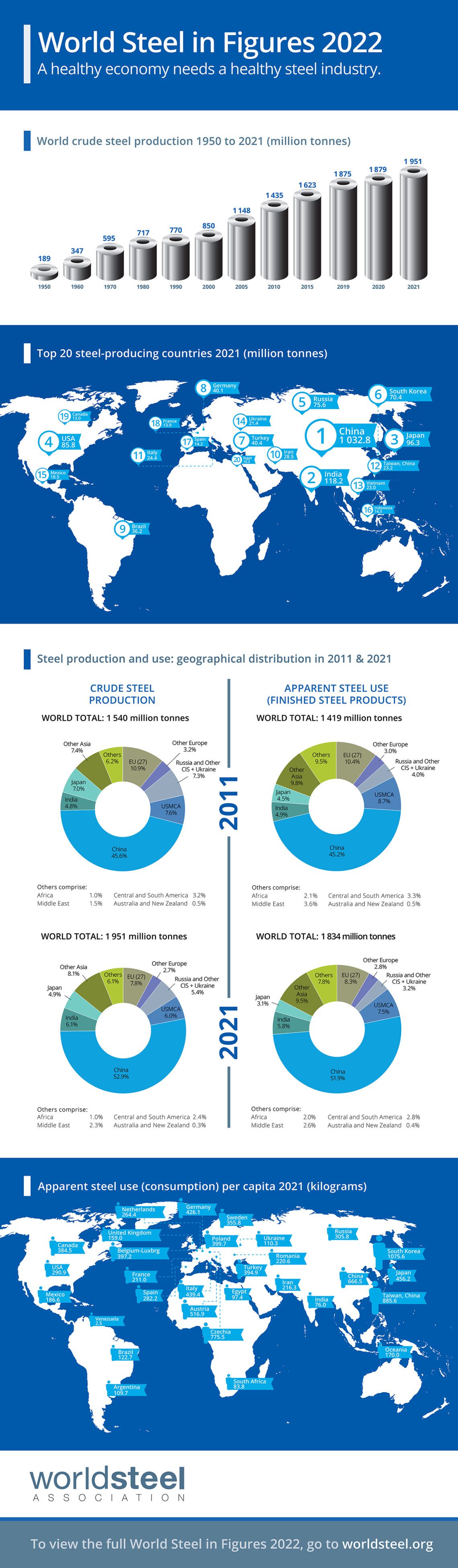

Check out our publication World Steel in Figures for more information.

How many types of steel are there?

Steel is not a single product. There are more than 3,500 different grades of steel with many different physical, chemical, and environmental properties.

Approximately 75% of modern steels have been developed in the past 20 years. If the Eiffel Tower were to be rebuilt today, the engineers would only need one-third of the steel that was originally used.

Modern cars are built with new steels that are stronger but up to 35% lighter than in the past.

How much steel is produced in a year?

World crude steel production reached 1,950.5 million tonnes (Mt) for the year 2021. Our press releases contain the most up to date recent information relating to steel production.

For more information, check out our publication World Steel in Figures issued each year in June or refer to our Steel Statistical Yearbook released each year in December.

What is smart manufacturing?

Smart manufacturing does not just mean having a smart factory. It is a significant transformation in the way we source raw materials, manufacture, and market our products through horizontal and vertical supply chain integration. It is a profoundly customer-focused concept.

This change is not a one-step process as there are obvious challenges of trust and data security to overcome between diverse parties in the supply chain. There are a number of examples of early adopters within the steel industry; especially in vertical integration within business segments where building blocks of smart factories are being put together.

Is steel environmentally friendly and sustainable?

Steel is completely recyclable, possesses great durability, and, compared to other materials, requires relatively low amounts of energy to produce. Innovative lightweight steels (such as those used in in automobiles and buidlings) help to save energy and resources. The steel industry has made immense efforts to limit environmental pollution in the last decades. Producing one tonne of steel today requires just 40% of the energy it did in 1960. Dust emissions have been reduced by even more.

Can steel be recycled?

Yes, very easily. Steel’s unique magnetic properties make it an easy material to recover from the waste stream to be recycled. The properties of steel remain unchanged no matter how many times the steel is recycled.

The electric arc furnace (EAF) method of steel production can use exclusively recycled steel. The blast furnace-basic oxygen furnace (BF-BOF) route can use up to 30% recycled steel.

Which country makes the most steel?

worldsteel updates the list of steel-producing countries in the annual World Steel in Figures publication which is issued in early June. The list may be subject to further revisions in the Steel Statistical Yearbook which is issued in November/December.

Every month worldsteel produces country steel production statistics for the current and previous year via the Steel Data Viewer.

Which company produces the most steel?

worldsteel updates the list of major steel-producing companies in the annual World Steel in Figures publication. For a more extended list, check out this page on this website.

Who invented steel?

A British inventor, Henry Bessemer, is generally credited with the invention of the first technique to mass produce steel in the mid 1850s. Steel is still produced using technology based on the Bessemer Process of blowing air through molten pig iron to oxidise the material and separate impurities. For more information, check out our White Book of Steel available from the column on the right of this page.

Why does steel rust?

Many elements and materials go through chemical reactions with other elements. When steel comes into contact with water and oxygen there is a chemical reaction and the steel begins to revert to its original form – iron oxide.

In most modern steel applications this problem is easily overcome by coating. Many different coating materials can be applied to steel. Paint is used to coat cars and enamel is used on refrigerators and other domestic appliances. In other cases, elements such as nickel and chromium are added to make stainless steel, which can help prevent rust.

2021 Press Releases

November 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 143.3 million tonnes (Mt) in November 2021, a 9.9% decrease compared to November 2020. Read more

2021 Steel Statistical Yearbook published

The World Steel Association (worldsteel)’s Steel Statistical Yearbook presents a cross-section of steel industry statistics. It contains comprehensive statistics from 2011 to 2020 on crude steel production by country and process, and more. Read more

worldsteel announces steelChallenge-16 World Championship Finalists

The Regional Championship of steelChallenge-16 took place online for 24 hours on 24 November 2021. This year’s steelChallenge attracted 1,480 participants. Read more

Design unveiled for connected steel autonomous vehicle for future sustainable urban mobility

WorldAutoSteel and Ricardo have designed a fully autonomous Mobility-as-a-Service (MaaS) steel-enabled vehicle inspired by contemporary urban architecture trends and focused on passenger safety and comfort. Read more

October 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 145.7 million tonnes (Mt) in October 2021, a 10.6% decrease compared to October 2020. Read more

Sustainability Indicators 2021 and our sustainability journey

The World Steel Association (worldsteel) today publishes Sustainable steel – Sustainability Indicators 2021 and our sustainability journey. Read more

September 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 144.4 million tonnes (Mt) in September 2021, an 8.9% decrease compared to September 2020. Read more

steeluniversity recognised

steeluniversity welcomes recognition from SIDEREX during its STEEL TECH Congress & Expo held 19-21 October 2021 in Bilbao, Spain. Read more

worldsteel Short Range Outlook October 2021

The World Steel Association (worldsteel) today released an update of its Short Range Outlook (SRO) for 2021 and 2022. worldsteel forecasts that steel demand will grow by 4.5% in 2021. Read more

worldsteel elects new officers and welcomes new members

The Board of Members of the World Steel Association (worldsteel) has elected the following Executive Board of Directors for the 2021/2022 period. Read more

The 12th Steelie Award winners announced

The Steelie Awards recognise member companies for their contribution to the steel industry over a one-year period. Read more

Safety and Health Recognition 2021

As part of its commitment to the highest safety and health standards, the World Steel Association (worldsteel) recognises excellence in six of its member companies. Read more

Contribution GFSEC minsterial

Today Edwin Basson, Director General, World Steel Association made an address at a meeting of the Global Forum on Steel Excess Capacity (GFSEC). Read more

12th Steelie Awards shortlist announced

The World Steel Association (worldsteel) has announced the shortlist for the 12th Steelie Awards. The Steelie Awards recognize member companies for their contribution to the steel industry. Read more

August 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 156.8 million tonnes (Mt) in August 2021. Read more

Steel industry releases fully updated AHSS Application Guidelines Version 7.0

The leading source for technical best practices on the forming and joining of Advanced High-Strength Steels (AHSS) for vehicle manufacture is released today by WorldAutoSteel. Read more

steelChallenge-16 open!

The World Steel Association (worldsteel) opened registration for the 16th edition of steelChallenge. Read more

July 2021 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 161.7 million tonnes (Mt) in July 2021, a 3.3% increase compared to July 2020. Read more

June 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 167.9 million tonnes (Mt) in June 2021, an 11.6% increase compared to June 2020. Read more

May 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 174.4 million tonnes (Mt) in May 2021, a 16.5% increase compared to May 2020. Read more

World Steel in Figures 2021 now available

worldsteel has published the 2021 edition of World Steel in Figures. The publication provides a comprehensive overview of steel industry activities, stretching from crude steel production to iron ore production and trade. Read more

April 2021 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 169.5 million tonnes (Mt) in April 2021, a 23.3% increase compared to April 2020. Read more

Climate change and the production of iron and steel

worldsteel today releases a public policy paper. The paper outlines the steel industry’s challenges and opportunities with respect to reducing CO2 emissions in line with the aims of the Paris Agreement. Read more

March 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 169.2 million tonnes (Mt) in March 2021, a 15.2% increase compared to March 2020. Read more

worldsteel Short Range Outlook April 2021

The World Steel Association (worldsteel) today released its Short Range Outlook (SRO) for 2021 and 2022. Read more

worldsteel announces the World Champions of steelChallenge-15

The World Steel Association (worldsteel) today announced the new world champions of the 15th steelChallenge. Read more

worldsteel announces the 2020 Steel Sustainability Champions

worldsteel has recognised 9 companies as Steel Sustainability Champions for their work in 2020. Find out which 9 companies have been recognised. Read more

February 2021 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 150.2 million tonnes (Mt) in February 2021, a 4.1% increase compared to February 2020. Read more

January 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 162.9 million tonnes (Mt) in January 2021. Read more

Global crude steel output decreases by 0.9% in 2020

Global crude steel production reached 1,864.0 million tonnes (Mt) for the year 2020, down by 0.9% compared to 2019. Read more

Media enquiries

Bradley Forder

Press releases

Sign up to receive all our press releases by e-mail. You can easily unsubscribe at any time.

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

World Steel Association

World Steel Association, often abbreviated as worldsteel, is the international trade body for the iron and steel industries. This non-profit organisation, headquartered in Brussels, Belgium and Beijing, China, is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. [1] World Steel Association, founded in 1967, represents steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production. [1]

The World Steel Association publishes a list of the top steel-producing companies every year. [2]

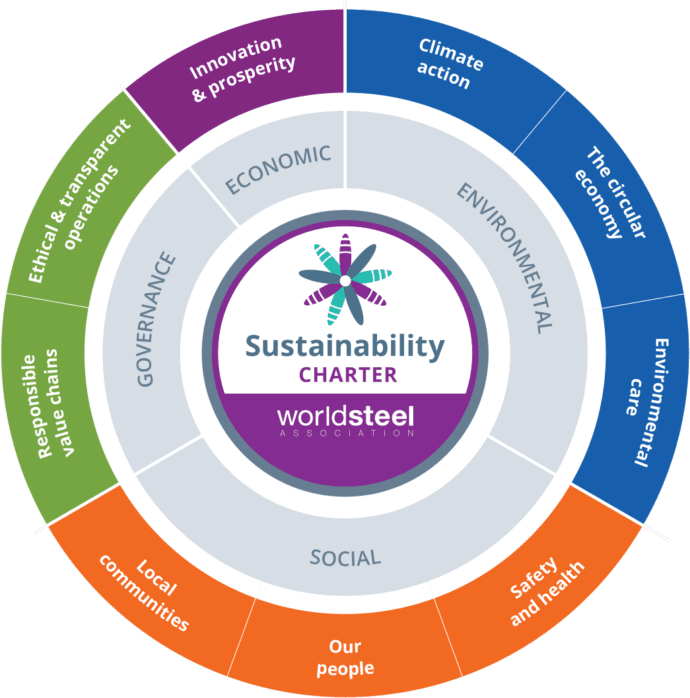

Climate Change and Sustainability

The World Steel Association has developed a global approach to tackle climate change. The World Steel Association has a position paper on the reduction of CO2 emissions. [3]

The association and its member companies have formulated a policy on sustainable development to measure the industry’s economic, environmental and social performance. [4] The World Steel Association publishes a sustainability report every year. The last edition was issued in October 2018 and was titled «Sustainable Steel: Indicators 2018 and industry initiatives» [5]

History

The World Steel Association was founded as the International Iron and Steel Institute (IISI) in Brussels, Belgium on 10 July 1967. [6] IISI opened a second office in Beijing, China, in April, 2006. [1] The organisation changed its name to World Steel Association in October, 2008. [6]

References

External links

Wikipedia also has an article on World Steel Association (World Steel Association). This article may use content from the Wikipedia article under the terms of the Creative Commons Attribution-ShareAlike 3.0 Unported License].

World Steel Association

From Wikipedia, the free encyclopedia

World Steel Association, often abbreviated as worldsteel, is the international trade body for the iron and steel industry. The association is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. worldsteel represents steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production.

It is a non-profit organisation with its headquarters in Brussels, Belgium and a second office in Beijing, China, whose purpose is to promote steel and the steel industry to customers, the industry, media and the general public.

Steel markets

Automotive

Steel use in today and tomorrow’s cars

Building and infrastructure

How is steel used in construction

Energy

Steel in energy production and distribution

Steel packaging

A sustainable and safe option

Transport

Steel in rail, road and at sea

Tools and machinery

Steel helps make our products

As populations grow and nations around the world seek to improve their standards of living, it is inevitable that the demand for steel will increase.

Steel is critical simply because no other material has the same unique combination of strength, formability and versatility.

New generations of steel continue to be developed that make it possible for manufacturers and builders to implement durable, lightweight designs.

Going forward, materials that are ever stronger and meet higher environmental standards will be needed.

Without being aware of it, society now depends on steel.

Humankind’s future success in meeting challenges such as climate change, poverty, population growth, water distribution and energy limited by a lower carbon world depends on applications of steel.

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

More News

Update on EU sanctions and Russian members

Voluntary withdrawal as of Thursday, 16 June 2022

June 2022 constructsteel newsletter

An interview with Dr Kazuaki Suzuki from Nippon Steel on the development of high-performance steel materials and technologies for disaster-resistant steel structural buildings. Plus, a look at net-zero building and construction.

Decarbonising steel: end-to-end solutions

worldsteel’s Director General Edwin Basson discusses the steel industry’s decarbonisation opportunities with energy technology company Baker Hughes.

Meet the world stainless association

After 26 years, the International Stainless Steel Forum (ISSF) has become the world stainless association.

World Steel in Figures 2022 is now available

worldsteel has published the 2022 edition of World Steel in Figures. The publication provides a comprehensive overview of steel industry activities, stretching from crude steel production to iron ore production and trade.

April 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 162.7 million tonnes (Mt) in April 2022, a 5.1% decrease compared to April 2021.

Recycling to be made more efficient with steel-built home processing unit

A revolutionary new approach to recycling aims to bring the process into people’s homes, guaranteeing closed loop recycling and product remanufacture.

How advanced high-strength steels will enable sustainable future transportation?

The Steel E-Motive project demonstrates the suitability of the latest advanced high-strength steel grades for use in fully autonomous electric vehicles. Kate Hickey from WorldAutoSteel explains how.

May 2022 constructsteel newsletter

Updates from our member BlueScope on three initiatives. Plus, an analysis of the impact of eliminating greenhouse-gas emissions on the world’s stock of infrastructure assets.

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

2022 Press Releases

July 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 149.3 million tonnes (Mt) in July 2022, a 6.5% decrease compared to July 2021. Read more

June 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 158.1 million tonnes (Mt) in June 2022, a 5.9% decrease compared to June 2021. Read more

May 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 169.5 million tonnes (Mt) in May 2022, a 3.5% decrease compared to May 2021. Read more

World Steel in Figures 2022 now available

worldsteel has published the 2022 edition of World Steel in Figures. The publication provides a comprehensive overview of steel industry activities, stretching from crude steel production to iron ore production and trade. Read more

April 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 162.7 million tonnes (Mt) in April 2022, a 5.1% decrease compared to April 2021. Read more

March 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 161.0 million tonnes (Mt) in March 2022, a 5.8% decrease compared to March 2021. Read more

worldsteel Short Range Outlook April 2022

The World Steel Association (worldsteel) today released its Short Range Outlook (SRO) for 2022 and 2023. worldsteel forecasts that steel demand will grow by 0.4% in 2022. Read more

steelChallenge-16 World Champions announcement

The World Steel Association (worldsteel) today announced the new world champions of the 16th steelChallenge. Read more

worldsteel announces the 2022 Steel Sustainability Champions

worldsteel has recognised 10 companies as Steel Sustainability Champions for their work in 2021. Read more

worldsteel welcomes new members

The Board of Members of the World Steel Association (worldsteel) has today welcomed new regular and affiliated members. Read more

February 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 142.7 million tonnes (Mt) in February 2022, a 5.7% decrease compared to February 2021. Read more

worldsteel releases updated Sustainability Charter

The World Steel Association (worldsteel) has today released its revised and expanded Sustainability Charter. The new Charter reflects the industry’s increasing focus on sustainability and its responsibility to generate positive impacts on people, our planet, and the prosperity of society. Read more

January 2022 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 155.0 million tonnes (Mt) in January 2022, a 6.1% decrease compared to January 2021. Read more

December 2021 crude steel production and 2021 global crude steel production totals

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 158.7 million tonnes (Mt) in December 2021, a 3.0% decrease compared to December 2020. Read more

Steelie Awards

The Steelie Awards recognise member companies for their contribution to the steel industry over a one-year period in a series of categories impacting the industry.

The nomination period for 2022 opens at the beginning of May and closes on 31st July 2022.

The selection process for nominations varies between awards. Entries are judged by selected expert panels using agreed performance criteria.

Some general rules apply:

The winners will be announced at the worldsteel Annual Dinner taking place in Brussels, Belgium on Monday, 17 October.

Six Steelie Awards categories

Category 1 | Excellence in low-carbon steel production

The production of steel remains a CO2 and energy-intensive activity. However, the steel industry is committed to continuing to reduce the footprint from its operations and the use of its products. This award recognises work that improves energy and CO2 efficiency in steel manufacturing, reduces emissions by working with partners and neighbours to create synergies, deploys breakthrough technologies, maximises scrap use and recovery, or deploys renewable energy technology.

Category 2 | Innovation of the year

This award recognises the most innovative nomination for technical improvement or environment mitigation. Nominations are sought through the worldsteel technology committee and judged by the technology and environment committee steering committee.

Category 3 | Excellence in sustainability

The excellence in sustainability award recognises a member company or a national or regional association for a specific sustainability initiative that has made a positive impact, or provided benefits in all three areas of sustainability – including economic, environmental and social performance. Additional criteria include the level of community/stakeholder communication & outreach related to the initiative. Nominations are called for through the Sustainability Reporting Expert Group and judged by a panel of internal and external judges.

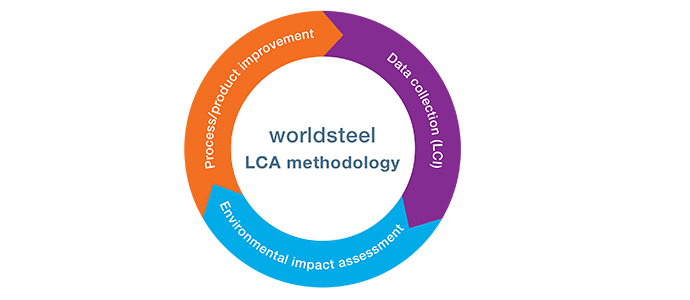

Category 4 | Excellence in Life Cycle Assessment

This award recognises member companies that have played a key role in utilising the concept of life cycle thinking for overall environmental improvement in marketing and/or regulatory influence, project application and new product development. Member nominations in the form of a detailed questionnaire are called for by worldsteel. The nominations are judged by a panel of external LCA experts from around the world to ensure fair competition and raise awareness of this award outside of the global steel industry.

Category 5 | Excellence in education and training

This award recognises member companies for their contributions to worldsteel’s education and training programme and leadership in enhancing the skills of the steel workforce for today and tomorrow. Member nominations are called for by the worldsteel education and training committee and followed by an evaluation based on a points system.

Category 6 | Excellence in communications programmes

This award recognises investment and innovation in major communications programmes (internal and external) that promote the steel industry or steel as a competitive material. The programmes allowed to enter can be product promotion, corporate reputation (environment, sustainability, safety and local community/CSR) or employee communications programmes. The award covers all channels from advertising, print, marketing promotion and digital.

For more information, member companies are invited to visit the page dedicated to the Steelie Awards on the extranet (link).

worldsteel Short Range Outlook April 2022

The World Steel Association (worldsteel) today released its Short Range Outlook (SRO) for 2022 and 2023. worldsteel forecasts that steel demand will grow by 0.4% in 2022 to reach 1,840.2 Mt after increasing by 2.7% in 2021. In 2023 steel demand will see further growth of 2.2% to reach 1,881.4 Mt. The current forecast is made against the backdrop of the war in Ukraine and is subject to high uncertainty.

Inflation and uncertainty cloud the outlook for steel demand

Commenting on the outlook, Mr Máximo Vedoya, Chairman of the worldsteel Economics Committee, said, “This Short Range Outlook is issued in the shadow of the human and economic tragedy following the Russian invasion of Ukraine. We all wish for as rapid and peaceful an end to this war as possible.

In 2021, recovery from the pandemic shock turned out to be stronger than expected in many regions, despite continuing supply chain issues and COVID waves. However, a sharper than anticipated deceleration in China led to lower global steel demand growth in 2021. For 2022 and 2023, the outlook is highly uncertain. The expectation of a continued and stable recovery from the pandemic has been shaken by the war in Ukraine and rising inflation.”

General

The magnitude of the impact of this conflict will vary across regions, depending on their direct trade and financial exposure to Russia and Ukraine. There is an immediate devastating effect on Ukraine, consequences for Russia, and major impact on the EU due to its reliance on Russian energy and its geographic proximity to the conflict area. The impact will also be felt globally via higher energy and commodity prices – especially raw materials for steel production – and continued supply chain disruptions, which were troubling the global steel industry even before the war. Furthermore, financial market volatility and heightened uncertainty will undermine investment.

Such global spillovers from the war in Ukraine, along with low growth in China, point to reduced growth expectations for global steel demand in 2022. There are further downside risks from the continued surge in virus infections in some parts of the world, especially China, and rising interest rates. The expected tightening of US monetary policies will hurt financially vulnerable emerging economies.

The outlook for 2023 is highly uncertain. Our forecast assumes that the confrontation in Ukraine will come to an end in the course of 2022 but that the sanctions on Russia will largely remain.

Additionally, the geopolitical situation surrounding Ukraine poses significant long-term implications for the global steel industry. Among them are a possible readjustment in global trade flows, a shift in energy trade and its impact on energy transitions, and continued reconfiguration of global supply chains.

China

Chinese steel demand saw a major slowdown in 2021 due to the tough government measures on real estate developers. Steel demand in 2022 will remain flat as the government tries to boost infrastructure investment and stabilise the real estate market. The stimuli introduced in 2022 are likely to support small positive growth in steel demand in 2023. There is upside potential from more substantial stimulus measures, which is likely if the economy faces more challenges from the deteriorating external environment.

Advanced economies

Despite the sporadic COVID infection waves and the manufacturing sector’s supply chain constraints, steel demand recovered strongly in 2021, especially in the EU and the US. However, the outlook for 2022 has weakened due to inflationary pressure, which is further reinforced by the events surrounding Ukraine. The impact of the war will be particularly pronounced in the EU due to its high dependence on Russian energy and refugee inflows. Steel demand in the developed world is forecast to increase by 1.1% and 2.4% in 2022 and 2023 respectively, after recovering by 16.5% in 2021.

Developing economies excluding China

In the developing economies, recovery from the pandemic faced more challenges with the continued impact of the pandemic and surging inflation, which prompted a monetary tightening cycle in many emerging economies. After falling by 7.7% in 2020, steel demand in the developing world excluding China grew by 10.7% in 2021, slightly less than our earlier forecast. In 2022 and 2023, the emerging economies excluding China will continue to face challenges from the worsening external environment, the Russia-Ukraine war, and US monetary tightening, leading to low growth of 0.5% in 2022 and 4.5% in 2023.

Steel using sectors

Global construction activity continued to recover from the lockdowns to record growth of 3.4% despite a contraction in China in 2021. The recovery was driven by an infrastructure push as part of recovery programmes in many countries, and these and investments related to the energy transition will likely drive the construction sector’s growth for years to come. However, the construction sector faces some headwinds from rising costs and interest rates.

The recovery of the global auto industry in 2021 was disappointing as the supply chain bottlenecks arrested the recovery momentum in the second half of the year. The war in Ukraine is likely to delay any return to normal of the supply chain issues, especially in Europe. Despite the slump in global auto production, the EV segment grew exponentially during the pandemic. Global sales of EVs in 2021 reached 6.6 million units, almost doubling from 2020. The share of EVs in total car sales increased from 2.49% in 2019 to 8.57% in 2021.

World steel association

Search filters

Categories

Inspecting stacks of steel slab in storage

Loading slabs for export onto ship at the facility port

Views from outreach day for workers and their families

Loading slabs for export onto ship at the facility port

Loading slabs for export onto ship at the facility port

Views of loading slabs onto ship for export at the facility port

Cutting steel slab

Cutting steel slab

Steel sheet in production

Moving hot steel slab by crane

Moving steel coils in the storage facility

Transporting steel slab by rail

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

World steel association

4th century. The Iron Pillar of Delhi

The Iron Pillar is a 7 metre column in the Qutb complex, notable for the rust-resistant composition of its metals. The pillar has attracted the attention of archaeologists and metallurgists and has been called ‘a testament to the skill of ancient Indian blacksmiths’.

The process of the location of iron production on the raw-material base began to be realised in the 10th-13 th centuries. Metallurgy was a key component in the system of craftsmanship of the early Middle Ages and already in this time progress in many areas of economy began to depend on it. Approx. 250 iron works existed in the 13th-16th centuries in Bohemia, for example.

A ball bearing is a type of rolling-element bearing that uses balls to maintain the separation between the bearing races.

The purpose of a ball bearing is to reduce rotational friction and support radial and axial loads. Because the balls are rolling they have a much lower coefficient of friction than if two flat surfaces were sliding against each other.

Deere ploughs ahead

John Deere was an Illinois blacksmith and manufacturer. Early in his career, Deere and an associate designed a series of farm ploughs then, in 1837, Deere designed the first cast steel plough that greatly assisted the Great Plains farmers. The large plows made for cutting the tough prairie ground were called ‘grasshopper plows’. The plough was made of wrought iron and had a steel share that could cut through sticky soil without clogging. By 1855, John Deere’s factory was selling more than 10,000 steel plough per year.

Where there’s muck. there’s steel

Both in Europe and the US, farming gradually becomes mechanised, employing machines that rely on the strength of steel. Agriculture goes industrial, particularly in the virgin land of the US, where the steel plough greatly accelerates agricultural development, joined later by steel reapers and the the combine harvester. Steel is also used for irrigation, planting and harvesting.

Open-hearth process brings steel in bulk

Sir Carl Wilhelm Siemens developed the Siemens regenerative furnace in the 1850s, and claimed in 1857 to be recovering enough heat to save 70–80% of the fuel. This furnace operates at a high temperature by using regenerative preheating of fuel and air for combustion.

In 1865, French engineer Pierre-Émile Martin took out a license from Siemens and first applied his regenerative furnace for making steel. Their process was known as the Siemens-Martin process, and the furnace as an ‘open-hearth’ furnace, in which excess carbon and other impurities are burnt out of pig iron to produce steel. The open hearth process overcame the insufficient temperatures generated by normal fuels and furnaces, enabling steel to be produced in bulk for the first time.

Railways open up US

In the years after the Civil War, the American steel industry grew with astonishing speed as the nation’s economy expanded to become the largest in the world. Andrew Carnegie (1835-1919) was a Scottish-American industrialist who led the enormous expansion of the American steel industry in the late 19th century, and was also one of the most important philanthropists of his era.

Wire fence in the American West

Barbed wire played an important role in the protection of range rights in the U.S. West. Although some ranchers put notices in newspapers claiming land areas, and joined stockgrowers associations to help enforce their claims, livestock continued to cross range boundaries. Fences of smooth wire did not hold stock well, and hedges were difficult to grow and maintain. Barbed wire’s introduction in the West in the 1870s dramatically reduced the cost of enclosing land.

US Steel founded

The U.S. Steel Recognition Strike of 1901 (which failed) was an attempt by the Amalgamated Association of Iron, Steel and Tin Workers (the AA) to reverse its declining fortunes and organize large numbers of new members following the foundation of US Steel by American financier, banker, philanthropist and art collector J.P. Morgan, who dominated corporate finance and industrial consolidation during his time.

In 1892, Morgan had arranged the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric. After financing the creation of the Federal Steel Company, he merged with the Carnegie Steel Company and several other steel and iron businesses, including Consolidated Steel and Wire Company owned by William Edenborn, to form the United States Steel Corporation (US Steel) in 1901.

A Community comes together

The European Coal and Steel Community (ECSC) is formed following the Treaty of Paris (1951) by ‘the inner six’: France, Italy, the Benelux countries (Belgium, Netherlands and Luxembourg) and West Germany. The common market was opened on 10 February 1953 for coal, and on 1 May 1953 for steel. During the existence of the ECSC, steel production would improve and increase fourfold. The ECSC helped deal with crises in the industry and ensured balanced development and distribution of resources.

Electric arc furnace (EAF) develops

The die is cast

Continuous casting, also called strand casting, is the process whereby molten metal is solidified into a ‘semifinished’ billet, bloom, or slab for subsequent rolling in the finishing mills. Prior to the introduction of continuous casting in the 1950s, steel was poured into stationary molds to form ingots. Since then, continuous casting has evolved to achieve improved yield, quality, productivity and cost efficiency. It allows lower-cost production of metal sections with better quality, due to the inherently lower costs of continuous, standardised production of a product, as well as providing increased control over the process through automation. This process is used most frequently to cast steel (in terms of tonnage cast).

Innovation in the East – Japan

The rise of Asia, particularly Japan. Many innovations in products and technology arrive from Japan, but the country is restricted by its lack of resources however and must import.

Decline in the West

The western steel industry sees its first decline in Europe (particularly UK steel) and in the US.

Duplex stainless

Duplex stainless steels developed that resist oxidation.

From an environmental viewpoint, the industry remains a notable emitter of carbon dioxide (CO2), accounting for between 7 and 9% of global direct emissions from the use of fossil fuels. Efforts are being made to tackle this through the research of innovative steelmaking technologies. During the past 50 years, the energy required to produce a tonne of steel has fallen by a dramatic 60%.

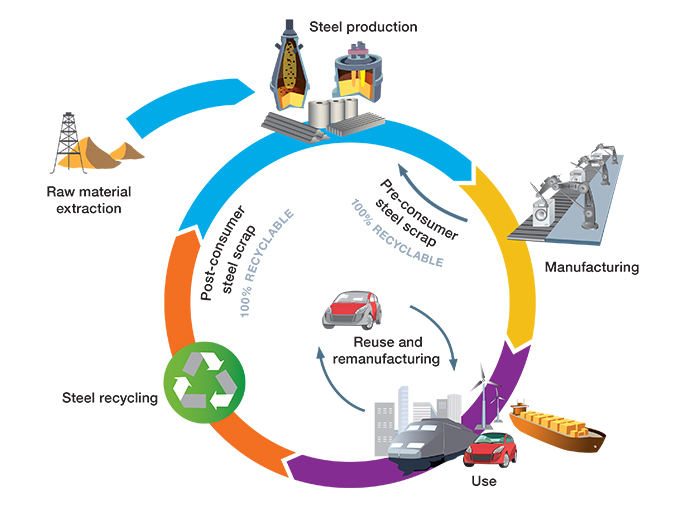

Steel – the permanent material in the circular economy

As a permanent material which can be recycled over and over again without losing its properties, steel is fundamental to the circular economy. In the sustainable future, new economic models will maximise the value of raw materials by encouraging practices such as reuse and remanufacturing. The weight of many steel products will be reduced, losses will be minimised, and the already high recycling rate for steel will increase, resulting in more recycled steel to make new steel products.

Pre-consumer recycling from the steelmaking and manufacturing processes will decrease due to increased process efficiencies and collaboration between steelmakers and their customers to reduce yield losses. For society the benefits will include durable products, local jobs, reduced emissions, and the conservation of raw materials for future generations.

More News

July 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 149.3 million tonnes (Mt) in July 2022, a 6.5% decrease compared to July 2021.

June 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 158.1 million tonnes (Mt) in June 2022, a 5.9% decrease compared to June 2021.

May 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 169.5 million tonnes (Mt) in May 2022, a 3.5% decrease compared to May 2021.

World Steel in Figures 2022 is now available

worldsteel has published the 2022 edition of World Steel in Figures. The publication provides a comprehensive overview of steel industry activities, stretching from crude steel production to iron ore production and trade.

April 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 162.7 million tonnes (Mt) in April 2022, a 5.1% decrease compared to April 2021.

March 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 161.0 million tonnes (Mt) in March 2022, a 5.8% decrease compared to March 2021.

February 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 142.7 million tonnes (Mt) in February 2022, a 5.7% decrease compared to February 2021.

January 2022 crude steel production

World crude steel production for the 64 countries reporting to worldsteel was 155.0 million tonnes (Mt) in January 2022, a 6.1% decrease compared to January 2021.

December 2021 crude steel production and 2021 global crude steel production totals

December 2021 crude steel production, global annual total 2021 and top 40 steel producing countries in 2021 are now available.

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

December 2021 crude steel production and 2021 global crude steel production totals

December 2021 crude steel production

World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 158.7 million tonnes (Mt) in December 2021, a 3.0% decrease compared to December 2020.

Crude steel production by region

Africa produced 1.2 Mt in December 2021, down 9.6% on December 2020. Asia and Oceania produced 116.1 Mt, down 4.4%. The CIS produced 8.9 Mt, down 3.0%. The EU (27) produced 11.1 Mt, down 1.4%. Europe, Other produced 4.3 Mt, down 0.8%. The Middle East produced 3.9 Mt, up 22.1%. North America produced 9.7 Mt, up 7.5%. South America produced 3.5 Mt, down 8.7%.

| Table 1. Crude steel production by region | |||||

| Dec 2021 (Mt) | % change Dec 21/20 | Jan-Dec 2021 (Mt) | % change Jan-Dec 21/20 | ||

| Africa | 1.2 | -9.6 | 16.0 | 26.7 | |

| Asia and Oceania | 116.1 | -4.4 | 1,382.0 | 0.6 | |

| CIS | 8.9 | -3.0 | 105.6 | 5.6 | |

| EU (27) | 11.1 | -1.4 | 152.5 | 15.4 | |

| Europe, Other | 4.3 | -0.8 | 51.2 | 11.6 | |

| Middle East | 3.9 | 22.1 | 41.2 | 1.2 | |

| North America | 9.7 | 7.5 | 117.8 | 16.6 | |

| South America | 3.5 | -8.7 | 45.6 | 17.8 | |

| Total 64 countries | 158.7 | -3.0 | 1,911.9 | 3.6 | |

The 64 countries included in this table accounted for approximately 98% of total world crude steel production in 2020. Regions and countries covered by the table:

Top 10 steel-producing countries

China produced 86.2 Mt in December 2021, down 6.8% on December 2020. India produced 10.4 Mt, up 0.9%. Japan produced 7.9 Mt, up 5.4%. The United States produced 7.2 Mt, up 11.9%. Russia is estimated to have produced 6.6 Mt, the same as in December 2020. South Korea produced 6.0 Mt, up 1.1%. Germany produced 3.1 Mt, up 0.1%. Turkey produced 3.3 Mt, down 2.3%. Brazil produced 2.6 Mt, down 11.4%. Iran is estimated to have produced 2.8 Mt, up 15.1%.

| Table 2. Top 10 steel-producing countries | ||||||

| Dec 2021 (Mt) | % change Dec 21/20 | Jan-Dec 2021 (Mt) | % change Jan-Dec 21/20 | |||

| China | 86.2 | -6.8 | 1,032.8 | -3.0 | ||

| India | 10.4 | 0.9 | 118.1 | 17.8 | ||

| Japan | 7.9 | 5.4 | 96.3 | 14.9 | ||

| United States | 7.2 | 11.9 | 86.0 | 18.3 | ||

| Russia | 6.6 | e | 0.0 | 76.0 | 6.1 | |

| South Korea | 6.0 | 1.1 | 70.6 | 5.2 | ||

| Turkey | 3.3 | -2.3 | 40.4 | 12.7 | ||

| Germany | 3.1 | 0.1 | 40.1 | 12.3 | ||

| Brazil | 2.6 | -11.4 | 36.0 | 14.7 | ||

| Iran | 2.8 | e | 15.1 | 28.5 | -1.8 | |

2021 global crude steel production totals

Total world crude steel production was 1,950.5 Mt in 2021, a 3.7% increase compared to 2020. Please see the Steel Data Viewer for the complete listing of annual production totals by country.

Presentations

Climate change and the production of iron and steel: an industry view | Åsa Ekdahl, Head, Environment and Climate Change | May 2021

Climate change is the biggest issue for the steel industry in the 21st century. At the steelTalks session organised on 19 May, Åsa Ekdahl, worldsteel’s Head of Environment and Climate Change, introduced the steel industry’s approach to support the transformation to low-carbon manufacturing.

COVID-19 and the steel industry | Nae Hee Han, Director, Economics Studies | April 2021

Speaking at the opening panel of the International Steel Symposium held on 15 April 2021, Dr Nae Hee Han, worldsteel Director Economics Studies, discusses the impact of COVID-19 on steel demand and looks beyond COVID-19 at the arising societal and steel use trends.

Recycling of steel | Clare Broadbent, Head, Sustainability | December 2020

Addressing the 54th ECCA Autumn Congress on 1 December 2020, Clare Broadbent, Head, Sustainability, worldsteel, discusses the role of steel recycling in the transition towards decarbonisation and why steel is fundamental to a circular economy.

Global steel industry overview | Baris Bekir Çiftçi, Head, Strategic Initiatives and Raw Materials Markets | December 2020

Addressing steelorbis New Horizons in Steel Markets virtual conference on 1 December 2020, Dr Baris Bekir Çiftçi, Head, Strategic Initiatives and Raw Materials Markets, worldsteel, reviews the state of the industry today, the effects of COVID-19 on steel demand and the raw materials markets and the key megatrends emerging from the pandemic.

Outlook for a sustainable steel industry | Edwin Basson, Director General | November 2020

At the online #steeltalks lecture held on 26 November 2020, worldsteel Director General Edwin Basson presented the latest economic data and outlined the steel industry’s environmental and social performance. steelTalks is a monthly lecture series on topics of interest to the global steel community.

The global steel industry in the post-pandemic era | Nae Hee Han, Director Economics Studies | November 2020

Addressing the Asia Steel Forum 2020 on 16 November 2020, Dr Nae Hee Han, worldsteel Director Economics Studies, discussed the impact of COVID-19 on the global steel industry and the megatrends arising from the crisis.

Circular economy in the steel industry | Edwin Basson, Director General | July 2020

Speaking at the OECD Virtual meeting of the Global Forum on Steel Excess Capacity (GFSEC) Event on 7 July 2020, worldsteel Director General Dr Edwin Basson focused on steel’s crucial role in the remanufacturing industry.

The pandemic and the global steel industry | Nae Hee Han, Director, Economics Studies | June 2020

Speaking at the 2020 SEAISI e-conference meeting on 30 June 2020, Dr Nae Hee Han, worldsteel Director Economics Studies, addressed the impact of COVID-19 on the global steel industry.

Press releases

Sign up to receive all our press releases by e-mail. You can easily unsubscribe at any time.

worldsteel news

Sign up to receive our e-newsletter. You can easily unsubscribe at any time.

World Steel Association спрогнозировала спад потребления стали в РФ на 20%

По прогнозу WSA, мировой спрос на сталь в 2022 году увеличится лишь на 0,4% и составит 1,84 млрд тонн (1,834 млрд тонн в 2021 году). В 2023 году спрос на сталь повысится на 2,2%, до 1,881 млрд тонн.

Совокупный спрос на сталь в России, странах СНГ и на Украине в этом году, по прогнозам WSA, упадет на 23,6%, до 44,6 млн тонн (58,5 млн тонн в 2021 году). В 2023 году ожидается повышение на 1,1%, до 45,1 млн тонн.

Топ-10 стран по объемам потребления стали в 2021 г (млн тонн):

| Страна | 2021 г | динамика | 2022 г | динамика | 2023 г | динамика |

| Китай | 952 | -5,4% | 952 | 0% | 961,6 | 1,0% |

| Индия | 106,1 | 18,8% | 114,1 | 7,5% | 120,9 | 6,0% |

| США | 97,1 | 21,3% | 99,8 | 2,8% | 102,1 | 2,4% |

| Япония | 57,5 | 9,3% | 58,2 | 1,2% | 58,8 | 1,0% |

| Южная Корея | 55,6 | 13,5% | 56,2 | 1,2% | 56,8 | 1,0% |

| Россия | 43,9 | 3,8% | 35,1 | -20,0% | 35,1 | 0% |

| Германия | 35,2 | 12,9% | 35,0 | -0,6% | 37,6 | 7,6% |

| Турция | 33,4 | 13,2% | 35,5 | 6,4% | 37,0 | 4,2% |

| Бразилия | 26,4 | 23,2% | 24,2 | -8,5% | 25,4 | 5,0% |

| Италия | 25,9 | 27,1% | 25,4 | -2,1% | 26,3 | 3,5% |

Top steel-producing companies 2021

Below is a ranking of the 50 top steel-producing companies. This list is updated in early June every year.

An extended listing of top steel producers 2020/2021 is available from the PDF under the table.

Tonnage is expressed in million tonnes (Mt).

| RANK | COMPANY | TONNAGE 2021 |

| 1 | China Baowu Group (1) | 119.95 |

| 2 | ArcelorMittal (2) | 79.26 |

| 3 | Ansteel Group (3) | 55.65 |

| 4 | Nippon Steel Corporation (4) | 49.46 |

| 5 | Shagang Group | 44.23 |

| 6 | POSCO | 42.96 |

| 7 | HBIS Group | 41.64 |

| 8 | Jianlong Group | 36.71 |

| 9 | Shougang Group | 35.43 |

| 10 | Tata Steel Group | 30.59 |

| 11 | Shandong Steel Group | 28.25 |

| 12 | Delong Steel Group | 27.82 |

| 13 | JFE Steel Corporation | 26.85 |

| 14 | Valin Group | 26.21 |

| 15 | Nucor Corporation | 25.65 |

| 16 | Fangda Steel | 19.98 |

| 17 | Hyundai Steel | 19.64 |

| 18 | Liuzhou Steel | 18.83 |

| 19 | JSW Steel Limited | 18.59 |

| 20 | Steel Authority of India Ltd. (SAIL) | 17.33 |

| 21 | Novolipetsk Steel (NLMK) | 17.29 |

| 22 | IMIDRO (5) | (e) 16.70 |

| 23 | Baotou Steel | 16.45 |

| 24 | United States Steel Corporation (6) | 16.30 |

| 25 | Cleveland-Cliffs (7) | (e) 16.30 |

| 26 | China Steel Corporation | 15.95 |

| 27 | Jingye Group | 15.38 |

| 28 | Techint Group | 14.91 |

| 29 | Sinogiant Group | 14.34 |

| 30 | Gerdau S.A. | 14.20 |

| 31 | CITIC Pacific | 13.97 |

| 32 | Magnitogorsk Iron & Steel Works (MMK) | 13.59 |

| 33 | Rizhao Steel | 13.57 |

| 34 | EVRAZ | 13.57 |

| 35 | Zenith Steel | 12.76 |

| 36 | Shaanxi Steel | 12.39 |

| 37 | Tsingshan Holding | 12.37 |

| 38 | Shenglong Metallurgical | 12.16 |

| 39 | thyssenkrupp | (e) 12.00 |

| 40 | Severstal | 11.65 |

| 41 | Nanjing Steel | 11.58 |

| 42 | Metinvest Holding LLC | 11.48 |

| 43 | Sanming Steel | 11.40 |

| 44 | Donghai Special Steel | 10.42 |

| 45 | Xinyu Steel | 10.14 |

| 46 | Steel Dynamics, Inc. | 9.84 |

| 47 | Anyang Steel | 9.50 |

| 48 | Erdemir Group | 9.02 |

| 49 | Jiuquan Steel | 8.75 |

| 50 | SSAB | 8.18 |

Notes:

(1) Includes tonnage of Taiyuan Steel and Kunming Steel

(2) Includes 60% AM/NS India (former Essar Steel)

(3) Includes tonnage of Benxi Steel

(4) Includes Nippon Steel Stainless Steel Corporation, Sanyo Special Steel, Ovako, 40% AM/NS India and 31.4% USIMINAS

(5) Estimated combined tonnage of Mobarrakeh Steel, Esfahan Steel, Khuzestan Steel and NISCO

(6) Includes Big River Steel

(7) Includes AK Steel operations subsequent to 13 March 2020 and former ArcelorMittal USA operations subsequent to 9 December 2020

Notes on company ownership and tonnage calculations:

For worldsteel members, the data was sourced from their official tonnage declarations. For Chinese companies, the official CISA tonnage publication was used, unless especially noted. In case of more than 50% ownership, 100% of the subsidiary’s tonnage is included, unless specified otherwise. In cases of 30%-50% ownership, pro-rata tonnage is included. Unless otherwise specified in the declaration, less than 30% ownership is considered a minority and therefore, not included. Figures represent ownership ending 31 December 2021.

World Steel in Figures 2022

Link to publication

worldsteel is one of the largest and most dynamic industry associations in the world, with members in every major steel-producing country. worldsteel represents steel producers, national and regional steel industry associations, and steel research institutes. Members represent around 85% of global steel production. Check out who our members are here.

World Steel Association AISBL

Registered office:

Avenue de Tervueren 270 – 1150 Brussels – Belgium

T: +32 2 702 89 00 – F: +32 2 702 88 99 – E: steel@worldsteel.org

Beijing office

C413 Office Building – Beijing Lufthansa Center – 50 Liangmaqiao Road

Chaoyang District – Beijing 100125 – China

T: +86 10 6464 6733 – F: +86 10 6468 0728 – E: china@worldsteel.org

worldsteel news

Sign up to receive our e-newsletter.

You can easily unsubscribe at any time.

Glossary

The language of steel

This glossary provides an introduction to the world of steel.

Alloy

A material with metallic properties that is composed of two or more substances, of which at least one must be a metal.

Annealing

The heat treatment process by which steel products are reheated to a suitable temperature to remove stresses from previous processing and to soften them and/or improve their machinability and cold-forming properties.

Apparent steel use (ASU)

ASU is obtained by adding up deliveries (defined as what comes out of the steel producer’s facility gate) and net direct imports. As a unit of measurement worldsteel uses the metric tonne.

Bar

A finished steel product, commonly in flat, square, round or hexagonal shapes. Rolled from billets, bars are produced in two major types: merchant and special.

Basic oxygen steelmaking

Making steel through oxidation by injecting oxygen through a lance above a molten mixture of pig iron and scrap steel.

Bessemer process

A process for making steel by blowing air into molten pig iron through the bottom of a converter.

Billet

A semi-finished steel product with a square cross-section up to 155mm x 155mm. This product is either rolled or continuously cast and is then transformed by rolling to obtain finished products like wire rod, merchant bars and other sections. The range of semi-finished products above 155 mm x 155 mm are called blooms.

Blank

Steel sheet of high dimensional precision, in simple or complex form, sometimes multi-thickness, constituting principally automobile body parts.

Blast furnace

A furnace used for smelting iron from iron ore.

Bloom

Breakthrough technology

Breakthrough technology produces low-carbon steel in a radically different way to the conventional blast furnace, DRI or EAF technology. Examples of breakthrough technology being developed include hydrogen reduction, the application of CCS, the electrolysis of iron ore, a suite of carbon capture usage and storage (CCUS) technologies and new smelting reduction processes.

Carbon-free

Carbon-free is a difficult expression to relate to steel as steel without carbon is iron, and the carbon content of steel is precisely controlled to achieve the properties demanded in a specific batch. Carbon will need to be added to hydrogen reduced iron in order to turn it into steel through the refining process.

Carbon-neutral steel (or net-zero steel)

If a balance can be achieved between the greenhouse gases put into the atmosphere when producing steel and emissions taken out of the atmosphere by sinks, the resulting steel can be referred to as carbon-neutral steel (or net-zero steel). The production of carbon-neutral steel may require offsets in other sectors to achieve true neutrality, and it is important that if claims of carbon neutrality are made producers are transparent about boundaries, their accounting methodologies, and the quality and credibility of any offsets used.

Carbon steel

A type of steel of which the main alloying element is carbon.

Carburising

Increasing the carbon content of steel by diffusing carbon into the surface, allowing the surface to be heat-treated to become a hard, wear-resistant layer.

Cast

An object formed by using a mould.

Clean steel

Clean steel is a technical expression used in the steel sector to refer to steels containing low levels of impurities, oxides, inclusions, or low or ultra-low level of carbon dissolved in the metal. The phrase is in common use, including by worldsteel in our 2004 ‘Study on Clean Steel’, and means something specific. As such worldsteel does not refer to “clean steel” in the context of climate change.

Coal

The primary fuel used by integrated iron and steel producers.

Coating

Applying a protective layer to the outside of material using various methods such as galvanising.

Coil

A finished steel product such as sheet or strip which has been wound or coiled after rolling.

Coke

A form of carbonised coal burned in blast furnaces to reduce iron ore pellets or other iron-bearing materials iron.

Coke ovens

Ovens where coke is produced. Coal is usually dropped into the ovens through openings in the roof, and heated by gas burning in flues in the walls within the coke oven battery. After heating for about 18 hours, the end doors are removed and a ram pushes the coke into a quenching car for cooling before delivery to the blast furnace.

Cold rolling

Passing a sheet or strip that has previously been hot rolled and picked through cold rolls (below the softening temperature of the metal). Cold rolling makes a product that is thinner, smoother and stronger than can be made by hot rolling alone.

Continuous casting

A process for solidifying steel in the form of a continuous strand rather than individual ingots. Molten steel is poured into open-bottomed, water-cooled moulds. As the molten steel passes through the mould, the outer shell solidifies.

CRC

Cold rolled coil (see cold rolling)

Crude steel

Steel in the first solid state after melting, suitable for further processing or for sale. Synonymous with raw steel.

Direct reduction

A group of processes for making iron from ore without exceeding the melting temperature. No blast furnace is needed.

Electric arc furnace

A furnace that melts steel scrap using the heat generated by a high power electric arc. During the melting process, elements are added to achieve the correct chemistry and oxygen is blown into the furnace to purify the steel.

Electrical steels

Specially manufactured cold-rolled sheet and strip containing silicon, processed to develop definite magnetic characteristics for use by the electrical industry.

Green steel

Green steel is being used and interpreted by many different parties to mean different things, often in the context of marketing new more environmentally conscious products. It has been used to refer to steel manufactured using breakthrough technology, steel produced from scrap, reused and remanufactured steel, and conventional steel with emissions offset through the retirement of carbon units or allowances. Given this inherent lack of clarity and diversity of meanings ‘green steel’ is not an expression worldsteel uses.

Fossil-free steel

Fossil-free steel is steel manufactured without using any fossil fuels such as coal or natural gas, nor any fossil fuel-derived energy.

Fossil hydrogen

Fossil fuel hydrogen is made from unabated fossil fuels, chiefly:

Hydrogen

Hydrogen is a key vector that will allow GHG emissions from the iron and steel sector to be significantly reduced, and many of worldsteel’s members are exploring this technology option. Hydrogen is often attributed to a colour, depending on its low-carbon credentials.

When worldsteel talks about low carbon hydrogen, we mean:

Flat products

A type of finished rolled steel product like steel strip and plate.

Hot dip galvanisation

A process by which steel is given long-term corrosion protection by coating it with molten zinc.

Hot and cold rolling mill

Hot-rolling mill: Equipment on which solidified steel preheated to a high temperature is continuously rolled between two rotating cylinders.

Cold rolling mill: Equipment that reduces the thickness of flat steel products by rolling the metal between alloy steel cylinders at room temperature.

Hot metal

Molten iron produced in the blast furnace.

HRC

Hot-rolled coil (see hot rolling)

Indirect steel

Indirect trade in steel takes place through exports and imports of steel containing goods and is expressed in finished steel equivalent of products used.

Ingot

A metal block cast in a particular shape for convenient further processing.

In-line strip production (ISP)

ISP produces hot-rolled coil down to finished gauges of 1mm, and has its origins in joint development work by Arvedi with German plant maker Mannesmann Demag in the late 1980s.

Integrated mill

Large-scale plant combining iron smelting and steelmaking facilities, usually based on basic oxygen furnace. May also include systems for turning steel into finished products.

Iron ore

The primary raw material in the manufacture of steel.

Ladle metallurgy

The process whereby conditions (temperature, pressure and chemistry) are controlled within the ladle of the steelmaking furnace to improve productivity in preceding and subsequent steps, as well as the quality of the final product.

Limestone

Used by the steel industry to remove impurities from the iron made in blast furnaces. Limestone containing magnesium, called dolomite, is also sometimes used in the purifying process.

Line pipe

Used for transportation of gas, oil or water generally in a pipeline or utility distribution system.

Long products

A type of finished rolled steel product like rail and steel bars.

Lost time injury

Any work-related injury, resulting in the company, contractor or third party contractor employee not being able to return to work for their next scheduled work period. Returning to work with work restrictions does not constitute a lost time injury status, no matter how minimal or severe the restrictions, provided it is at the employee’s next scheduled shift. Lost Time Injury Frequency Rate (LTIFR) is calculated as number of Lost Time Injuries per million man hours.

Low-carbon steel