World gold council

World gold council

What We Do

Supporting a vibrant and sustainable future for the gold market.

The World Gold Council was formed in 1987 by some of the world’s most forward-thinking mining companies.

There are three core pillars to our mission in serving the gold market and its participants. Learn more about our work in each of the following areas:

Improving Understanding

The comprehensive source of information on gold and its impact on society

Gold plays an important role in the financial system, healthcare, technology, and culture. We are keenly focused on increasing awareness of how gold is adapting to help navigate emerging challenges and changing societal needs.

The information and tools we provide help institutional and retail investors leverage gold as a strategic asset across a range of economic and geopolitical conditions.

Available in both English and Chinese, our website is the definitive source of gold data, insights, and analytical tools for professional investors.

This closed-door event convenes central banks, sovereign wealth funds, and government ministries for an intimate discussion on the key facets of gold reserve management and trends impacting official sector investments.

Beyond providing information for investors, we also create compelling content capturing the scope and depth of gold and the gold mining industry’s contributions to society.

This immersive, five-episode documentary series showcases gold’s impact on humanity’s past, present, and future. This is the story of gold: engineering super-material, biological instrument, symbolic creative medium, and economic pillar.

Our in-depth report explores the positive economic and social impact of gold mining in regions of operation around the globe.

Improving Access

Championing Industry Innovation

Discover how we drive positive change with a combination of new technologies, data, and partnerships with progressive organisations.

In partnership with State Street Global Advisors, the World Gold Council launched SPDR® Gold Shares (GLD) in 2004, providing a new, efficient way to invest in gold. Since then, more than 90 gold-backed ETFs have been launched around the world — including SPDR® Gold Mini Shares (GLDM SM ), the low-cost complement to GLD.

SafeGold

Supported by World Gold Council seed funding, this initiative catalysed the “digital gold” category in India — providing investors in the region with affordable and convenient access to gold.

The Insurance Asset Management Fund (IAMF)

Jointly designed by the World Gold Council and PICC Asset Management, the IAMF is the first-ever gold-driven fund of its kind in China. Launched in 2021, the IAMF opened a new chapter for multi-asset portfolios in the region.

Facilitating Greater Market Efficiency

Conceived in collaboration with policymakers, regulators, and industry experts, the following are examples of large-scale infrastructure projects intended to tackle investment barriers and unlock opportunities.

The Shanghai Gold Exchange

The World Gold Council played a key role in the evolution of China gold market with Shanghai Gold Exchange — now the world’s largest physical gold exchange.

The India Gold Spot Exchange

Launching in 2022, the gold spot exchange enables greater transparency and liquidity for the country’s gold market. The initiative was outlined in our Blueprint for Gold Spot Exchange report, developed along with key industry stakeholders in the region.

Improving Trust

Creators of Best Practices and Stewards of Industry Standards

Trust is earned when words and actions meet. In conjunction with our members and other market participants, we build confidence in the gold market by creating and upholding standards for transparency and integrity across the gold value chain.

The World Gold Council has partnered with the LBMA to develop and implement an international system of gold bar integrity. Participants from across the gold industry are piloting distributed ledger (blockchain) technology with the aim of expanding the trusted, closed-loop ecosystem which currently exists for the 400oz gold bar market to also include smaller bars, including kilo bars.

This framework, developed in consultation with industry stakeholders, sets out clear expectations for what constitutes responsible gold mining, considering environmental, social, and governance risks that need to be effectively managed.

We aim to create value and drive demand across the retail industry by introducing principles that raise the bar for gold product providers and encourage a greater level of trust among retail investors.

We provide gold producers with a common approach for assessing the way they extract their gold and assuring that they do not support or benefit from unlawful armed conflict or contribute to human rights abuses and breaches of international humanitarian law.

Strongly supported by the World Gold Council — coupled with the launch of the assaying training institute — hallmarking of gold jewellery became mandatory in India in 2021.

For more information on these initiatives and other work related to best practices, visit our dedicated Industry Standards page.

Read our latest press releases to learn more about recent activities.

World gold council

Discover the data you need to analyse and research gold. Utilise multiple charting tools and download options which allow you to work with the data.

Most Recently Updated

Gold ETFs holdings and flows

Central bank holdings

Annual central bank survey

Historical demand and supply

Gold spot prices

Returns

Price and premium

Benchmark gold prices, gold futures curves and local price premium/discount

Gold spot prices

A long-term time series of the gold price in a range of currencies from 1978.

Local gold price premium/discount

A time series of the difference between international US$ gold price and the local gold price paid by Indian and Chinese consumers in their respective markets.

Gold futures prices

Futures prices for gold across several key exchanges and future dates.

Performance metrics

Returns, volatility, correlations and trading volumes for gold, bonds, equities and other major asset classes

Returns

This data set provides monthly performance metrics for gold and various relevant asset classes in multiple currencies.

Volatility

LBMA Gold price volatility: Annualised daily return volatility based on LBMA gold price.

Correlations

A cross-sectional look at the correlation of gold to other major asset classes.

Trading volume

Overview/ aggregation of gold trading volumes across trading venues.

Demand and supply

Data on various sectors of gold demand and supply, as well as productions costs and futures market positioning

Historical demand and supply

A comprehensive time series of gold demand – broken down by sector and country – and gold supply – broken down by mine production, recycling and producer hedging.

Gold ETFs holdings and flows

Gold-backed ETFs and similar products account for a significant part of the gold market, with institutional and individual investors using them to implement many of their investment strategies.

Global mine production

A time series of global gold mine production by country.

Production costs

A time series of the global all-in sustaining cost (AISC) of gold production and cost curve for the most recent quarter.

Futures positioning

Current futures open interest on the nine major global gold futures exchanges.

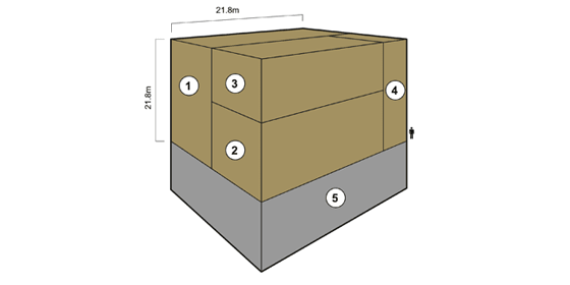

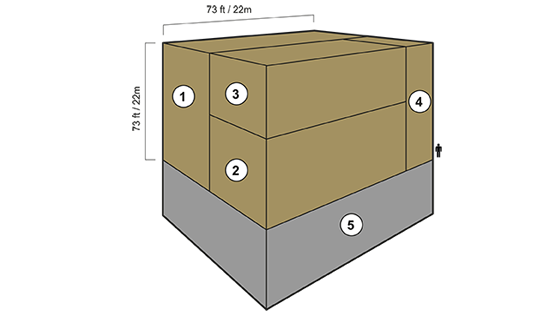

Above-ground stocks

A breakdown of the above-ground stock of gold, including a time series of how it has evolved since 2010, and the latest year-end estimate of below-ground stocks.

Central banks

Data on central bank gold holdings, sales and purchases, as well as insights from annual surveys into central bank attitudes towards gold.

Central bank holdings

A time series of official holdings of gold including an attribution of sales under the Central Bank Gold Agreement (CBGA).

Annual central bank survey

Gold continues to be viewed favourably by central banks as a reserve asset. According to the 2022 Central Bank Gold Reserves (CBGR) survey, 25% of respondents intend to increase their gold reserves in the next twelve months, an uptick from 21% of respondents in 2021.

Press Releases

An SRO for India’s gold industry

India’s gold industry has evolved and matured over recent years. Initiatives have been taken to create greater cohesion and consistency, improve compliance and foster confidence. That is why the time is right to establish a self-regulatory organisation (SRO) for India’s gold industry.

Gold demand defies Q2 headwinds with year-on-year recovery in first half of 2022

The World Gold Council’s latest Gold Demand Trends report reveals that gold demand (excluding OTC) in the second quarter was down 8% year-on-year to 948t. However, thanks to strong ETF inflows in Q1, gold demand for the first half of 2022 is up 12% compared to H1 2021 at 2,189t.

The World Gold Council welcomes Triple Flag Precious Metals as a new member

Triple Flag is a pure play, gold-focused, streaming and royalty company with proven execution capabilities and a focus on cash-generating mines and construction-ready, fully permitted projects.

aXedras Group AG Completes Series B Funding with Investment from The World Gold Council

aXedras Group AG (aXedras) announces it has concluded its Series B funding round, including a strategic investment from the World Gold Council (WGC) who will be represented on the Board of Directors by David Tait, CEO of WGC.

Gold remains resilient amid heightened global uncertainty

The global gold market saw a solid start to 2022, with first quarter demand (excluding OTC) up 34% year-on-year, thanks to strong ETF flows, reflecting gold’s status as a safe haven investment during times of geopolitical and economic uncertainty.

Gold Bar Integrity Programme

The London Bullion Market Association (LBMA) and the World Gold Council (WGC) are collaborating to develop and implement an international system of gold bar integrity, chain of custody and provenance.

ASGM report 2022 Press Release

In line with its commitment to promote formalisation of responsible artisanal and small-scale gold mining (ASGM), the World Gold Council has released a new report which looks at models for better managing the interactions between ASGM and large-scale mining (LSM).

Gold demand hits highest level in more than two years

The World Gold Council’s latest Gold Demand Trends Report revealed that annual demand (excluding OTC markets) has recovered many of the COVID-induced losses from 2020 to reach 4,021t for the full year in 2021.

28 January, 2022

Imports made up 86% of India’s gold supply between 2016-2020, continue to grow despite high import duty, highlights World Gold Council Report

The World Gold Council today launched a report titled ‘Bullion Trade in India’, as part of a series of in-depth analysis on the Indian gold market.

9 December, 2021

A new report by the World Gold Council highlights the role of its members, many of the world’s most forward-thinking gold mining companies, in contributing to socio-economic development in the countries and communities where they operate.

World Gold Council Governance

The World Gold Council is governed by our Board of Directors, comprised of member company representatives (Chairperson or Chief Executive Officer) and the World Gold Council’s Chief Executive Officer. The Board has a fiduciary responsibility to all Members in ensuring that the World Gold Council fulfills its mission and objectives.

The Board has established four committees; Administration, Audit,, Compensation and Governance and Nominations. For more information on their respective responsibilities, please see below.

The Administration Committee’s role is to advise the Board on business and financial plans developed by World Gold Council’s management as well as setting and assessing performance objectives. The committee is led by the Chair of the World Gold Council and includes the Vice Chair of World Gold Council and Chairs of the Audit, Compensation and Governance & Nomination Committees.

The Audit Committee assists the Board with responsibilities around financial reporting, systems and controls and processes for identifying, measuring and managing risk.

The Compensation Committee oversees compensation frameworks for World Gold Council employees. No employee plays a part in any discussion about their own remuneration.

The Nominations & Governance Committee is responsible for ensuring that Board governance processes are adhered to and spearheads the nomination process for selecting the Board Chair and Committee members.

Chairs of Board Committees

Randy Smallwood, President and CEO, Wheaton Precious Metals Corp.

Board Chair and Chair, Administration Committee

Sandeep Biswas, CEO, Newcrest Mining

Neal Froneman, CEO, Sibanye Stillwater

Chair, Nominations & Governance Committee

Scott Perry, President & CEO, Centerra Gold Inc.

Chair, Audit Committee

Tom Palmer, President & CEO, Newmont Corporation

Chair, Compensation Committee

For a full list of member companies, click here.

Additionally, the World Gold Council, through its US subsidiaries, operates as the sponsor of gold-backed ETF products including GLD®[1]. Each subsidiary company has its own Board of Directors, comprised of the Chief Executive Officer of the World Gold Council and three independent directors These Boards oversee the legal and regulatory responsibilities of the products.

Gold Mid-Year Outlook 2022

Balancing inflation, rate hikes and political uncertainty

Investors face a challenging environment during the second half of 2022, needing to navigate rising interest rates, high inflation and resurfacing geopolitical risks. In the near term, gold will likely remain reactive to real rates, driven by the speed at which global central banks tighten monetary policy in an effort to control inflation. Yet, in our view:

rate hikes may create headwinds for gold, but many of these hawkish policy expectations are priced in

concurrently, continued inflation and geopolitical risks will likely sustain demand for gold as a hedge

underperformance of stocks and bonds in a potential stagflationary environment may also be positive for gold.

Higher rates in 2022 outweighed inflation risks

Gold finished H1 0.6% higher, closing at US$1,817/oz. 1 The gold price initially rallied as the Ukraine war unfolded and investors sought high quality, liquid hedges amidst increased geopolitical uncertainty. But gold gave back some of those early gains as investors shifted their focus to monetary policy and higher bond yields. By mid-May, the gold price had stabilised in response to the tug of war between rising interest rates and a high-risk environment. The latter was a combination of persistently high inflation as well as likely support also from the extended conflict in Ukraine and its potential knock-off effects on global growth.

This was also reflected in both COMEX net long positioning and gold ETF flows. The latter saw strong investment early in the year before giving back some gains in May and June. Yet, by the end of June, gold ETFs had amassed US$15.3bn (242 tonnes) of inflows year-to-date.

Our Gold Return Attribution Model (GRAM) corroborates this. Rising opportunity costs – both from higher rates and a stronger dollar – were key headwinds to gold’s performance y-t-d, while rising risks – from inflation as well as geopolitics – pushed gold higher for much of the period (Chart 1).

Chart 1: Rates and inflation were two of the most important contributors to gold’s performance in 2022

Rates and inflation were two of the most important contributors to gold’s performance in 2022

Contributions from key drivers to monthly gold returns*

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council; Disclaimer

*As of 30 June 2022. Our short-term model is a multiple regression model of monthly gold price returns (based on XAU), which we group into the four key thematic driver categories of gold’s performance: economic expansion, market risk, opportunity cost, and momentum. These themes capture motives behind gold demand; most saliently, investment demand, which is considered the marginal driver of gold price returns in the short run. ‘Unexplained’ represents the percentage change in the gold price that is not explained by factors currently included in the model. Results shown here are based on analysis covering an estimation period from February 2007 to June 2022. On Goldhub, see: GRAM.

We believe that the geopolitical risk premium is also represented in the larger than normal ‘unexplained’ element of our GRAM model in recent months, which has made a strong positive contribution to gold’s price performance in tandem with the prolonged Russia-Ukraine war. For example, an often-used simple model based solely on US real rates and the dollar suggests that gold would normally be significantly lower, contrasting with its actual marginally positive performance (Chart 2).

Chart 2: Gold was supported by heightened risk: real rates and the USD alone suggest gold would have been be lower in H1

Gold was supported by heightened risk: real rates and the USD alone suggest gold would be lower

Simple model of gold price explained using US 10-year TIP yield and Broad US dollar index*

Sources: Bloomberg, World Gold Council; Disclaimer

*As of 30 June 2022. Model estimated using OLS, in levels, using data from Jan 2007 to June 2022.

Notably, even though the appreciation of the US dollar against a wide variety of currencies has been a headwind to the gold price (when measured in US-dollar terms), it has at the same time propped up gold’s performance in many other currencies, including the euro, yen and pound sterling, among others (Table 1).

Table 1: Gold’s price performance was positive across major currencies

Gold price and annual return in key currencies*

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | RUB (g) | ZAR (g) | AUD (oz) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| H1 2022 return | 0.6% | 9.4% | 18.7% | 12.2% | 2.8% | 5.7% | 6.9% | 5.7% | 26.5% | -26.6% | 3.3% | 6.4% |

| 30 June price | 1,817.0 | 1,738.0 | 7,936.4 | 1,496.2 | 2,343.8 | 1,739.5 | 46,134.0 | 391.1 | 30,337.5 | 3,198.4 | 957.0 | 2,642.3 |

| H1 high | 2,039.1 | 1,874.6 | 8,135.2 | 1,555.3 | 2,623.8 | 1,894.3 | 50,417.4 | 413.9 | 31,989.3 | 9,648.9 | 1,003.3 | 2,806.9 |

| H1 low | 1,788.2 | 1,570.1 | 6,621.7 | 1,317.1 | 2,271.8 | 1,645.4 | 42,708.4 | 365.9 | 23,543.8 | 3,124.0 | 880.1 | 2,493.6 |

*As of 30 June 2022. Based on the LBMA Gold Price PM in local currencies: US dollar (USD), euro (EUR), Japanese yen (JPY), pound sterling (GBP), Canadian dollar (CAD), Swiss franc (CHF), Indian rupee (INR), Chinese yuan (RMB), Turkish lira (TRY), Russian rouble (RUB), South African rand (ZAR), and Australian dollar (AUD).

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Further, at first glance, gold’s flat year-to-date performance may seem dull, but gold was nonetheless one of the best performing assets during H1. It not only delivered positive returns, but it did so with below average volatility (Chart 3).

As such, gold has actively helped investors mitigate losses during this volatile period. Especially considering that both equities and bonds, which usually make up the largest portion of investors’ portfolios, posted negative returns during the period.

Chart 3: Gold has held up well so far in 2022

Gold has held up well so far in 2022

Year-to-date nominal asset returns and annualised volatilities in USD*

Sources: Bloomberg, World Gold Council; Disclaimer

Looking ahead: investors walking a tightrope

We believe that investors will continue to face significant challenges during the second half of the year. As such, they will need to balance several competing risks compounded by a fair degree of uncertainty about their magnitude.

Monetary policy uncertainty will likely ramp up volatility

Most central banks were expected to lift policy rates this year, but many have stepped up their actions in response to persistently high inflation. 2 The Fed hiked its funding rate by 1.5% so far this year, the Bank of England has increased its base rate five times since November 2021, to 1.25%, and the Swiss National Bank hiked rates for the first time in 15 years. And although the ECB hasn’t yet raised rates, it has indicated it is prepared to do so. Among developing economies, the Royal Bank of India is also expected to considerably increase its repo rate by the end of the year.

These actions have had a significant impact on financial markets, including gold. Indeed, data suggests that investor expectations of future monetary policy decisions – expressed through bond yields – have historically been a key influence on gold price performance. And as we discussed in our Gold Outlook 2022, historical analysis shows that gold has underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike (Chart 4). Contrastingly, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.

Chart 4: Gold has typically outperformed following the first rate hike of a Fed tightening cycle

Gold has typically outperformed following the first rate hike of a Fed tightening cycle

Median return of gold, US stocks, and the US dollar over the past four Fed tightening cycles*

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council; Disclaimer

*Median returns based on the past four tightening cycles starting in February 1994, June 1999, June 2004, and December 2015. US dollar performance based on the Fed trade-weighted dollar index prior to 1997 and the DXY index thereafter, due to data availability.

It’s also worth noting that, while most market participants still expect significant policy rate increases, some analysts argue that central banks may not tighten monetary policy as much as expected. Their reasons include potential economic slowdowns that may result in contractions, but also in some cases a switch from supply constraints to supply surpluses in non-commodity consumer sectors.

Inflation may linger even if it peaks

Inflation remains at historically high levels, and while investors expect inflation to cool down eventually, we believe it will remain high.

In particular, due to:

Gold has historically performed well amid high inflation. In years when inflation was higher than 3%, gold’s price increased 14% on average, and in periods where US CPI averaged over 5% on a y-o-y basis – currently at

Chart 5: Gold historically performs well in periods of high inflation

Gold historically performs well in periods of high inflation

Gold and commodity nominal returns in US dollars as a function of annual inflation*

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council; Disclaimer

*Based on y-o-y changes of the LBMA Gold Price, Bloomberg Commodity Index and US CPI between 1971 and 30 June 2022. Number of observations for each tranche: Low = 12, Moderate = 27, High = 12. The buckets were determined based on a 2% Fed target rating, a recent CPI number above 5% and a proportional amount of observations in each tranche.

Amid opposing forces, real rates will likely remain low

Despite forthcoming rate hikes by various central banks, nominal rates will remain low from a historical perspective (Chart 6). This is important for gold since gold’s short- and medium-term performance often tends to respond to real rates, which combine two important drivers of gold performance: “opportunity cost” and “risk and uncertainty”.

Chart 6: Both nominal and real interest rates are at or near historically low levels

Both nominal and real interest rates are at or near historically low levels

US 10-year Treasury nominal and real yield*

Sources: Bloomberg, Bureau of Labour Statistics, World Gold Council; Disclaimer

*As of 30 June 2022. Real yield computed using US 10-year Treasury nominal yield minus seasonally adjusted US CPI y-o-y change.

Investors are facing difficult choices in terms of asset allocation

Further stock market pullbacks are likely in the face of faltering economic growth combined with persistent high inflation against a backdrop of simmering geopolitical tensions. Similarly, the risk of a stagflationary environment has increased materially. And our analysis shows that while gold has tend to lag during reflationary periods, it still has performed well and it has also significantly outperformed in stagflationary periods (Chart 7).

Chart 7: Major asset returns per cycle phase since 1973: gold a clear winner in stagflation

Major asset returns per cycle phase since 1973: gold a clear winner in stagflation

AAAR % for major asset classes since Q1 1973*

Sources: Bloomberg, World Gold Council; Disclaimer

* As of Q2 2021. AAAR % – annualised average (stagflation) adjusted returns. Please see Appendix A.2 for AAAR definition.

Further, questions remain on the ability of bonds to provide the diversification that investors need. High-quality government bonds have been a favoured safe-haven asset over the last 20 years because of low inflation and interest rates. But higher inflation weakens the appeal of government bonds as a diversifier, increasing both yields and the correlation to stocks.

At the same time inflation-linked bonds, designed to track CPI, may not provide investors with the refuge they need. Since the start of the year inflation-linked bonds have fallen despite the rapid rise in CPI levels. The Bloomberg Global Inflation-linked Bond Index has declined 18% year-to-date (Chart 8).

Chart 8: Inflation-linked bonds have unperformed y-t-d as rate increases have curtailed inflation-contributed gains

Inflation-linked bonds have unperformed y-t-d as rate increases have curtailed inflation-contributed gains

Bloomberg Global Inflation-Linked Total Return Index Value Unhedged USD*

Sources: Bloomberg, World Gold Council; Disclaimer

*As of 30 June 2022.

Consumer demand will likely face hurdles

The challenging environment also has implications for consumer demand for gold over the rest of the year. While many markets should continue to benefit from the post-COVID recovery, we expect widespread economic slowdown to pressure consumer demand for gold, particularly with many markets seeing notably higher local gold prices.

China is especially susceptible to weakness as the government pursues its zero-COVID policy, with possible mobility restrictions which cast a shadow over future growth.

Indian demand is also facing challenges, although to a lesser degree than those in China. High local inflation, uncertainty about the economic outlook and the surprise increase of the import duty for gold – aimed in part to mitigate the impacts of rupee weakness – will likely weigh on the recovery of gold consumer demand.

Gold’s behaviour will depend on which factors tip the scale

We believe that gold will face two key headwinds during the second half of 2022:

However, the negative effect from these two drivers may be offset by other, more supportive factors, including:

In this context, gold’s both strategic and tactical role will likely remain relevant to investors, particularly while uncertainty stays elevated.

Download the Gold Mid-Year Outlook for 2022

Footnotes

1 Based on the LBMA Gold Price PM as of 30 June 2022.

2 In contrast, the Bank of Japan has maintained its accommodative stance despite increased pressure on the yen, and the PBoC has cut lending rates to provide support for the economic recovery on the back of COVID-led lockdowns in major cities.

4 Qaurum is a web-based quantitative tool powered by the Gold Valuation Framework (GVF). An academically validated methodology, GVF is based on the principle that the price of gold and its performance can be explained by the interaction of demand and supply. In turn, demand and supply are influenced by macroeconomic scenarios that can be customised to calculate gold’s implied performance based on these hypothetical conditions over various time periods. See Important information and disclosures at the end of this report.

Important information and disclosures

© 2022 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates (collectively, “WGC”) or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus, Refinitiv GFMS or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

WGC does not guarantee the accuracy or completeness of any information nor accepts responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”).

This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. WGC does not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. WGC assumes no responsibility for updating any forward-looking statements.

Information regarding Qaurum SM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither WGC nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.

Our History

Our history timeline

2007-2017 Open/Close timeline

Launched LMEprecious reinvigorating the London gold market

Launched the SPDR® Long Dollar Gold Trust ETF (GLDW)

Collaborated with the Shanghai Gold Exchange on the launch of the Shanghai Gold Benchmark

Executive Programme in Reserve Asset Management at University of Cambridge Judge Business School

Announced partnership with Shanghai Gold Exchange to develop the Shanghai Free Trade Zone

Launch Singapore Gold Kilobar Contract in collaboration with the Singapore Exchange

Convened cross-industry workshops on the modernisation of the London Gold Fix

Launched LoveGold jewellery marketing in the digital age

Launched Gold for Health film and campaign on World Malaria Day

Published first series of reports detailing gold’s socio-economic contribution

Launched first Chinese gold investment gifting bar with Industrial and Commercial Bank of China

Announced investment in online gold platform BullionVault

Announced strategic partnership with Industrial and Commercial Bank of China to further develop China’s gold market

Announced India Post gold coin scheme

Launched Gold Expressions in Japan and Russia

Launched Only Gold jewellery marketing campaign in US, China and Italy

Launched coin programme with Dubai Multi Commodities Centre in Dubai

Launched the Reliance pure gold coin in India

1997-2006 Open/Close timeline

Launched Gold Investment Bars in China

Launched Gold Accumulation Plan in Vietnam

Launched Utilise Gold online platform to encourage wider usage of gold as a technical material

Launched Gold Pension and Inheritance initiative in Japan

Launched Gold Expressions Italian Jewellery collection

Sponsored prototypes demonstrating gold as a catalyst and anti-pollutant

Launched Gold Bullion Securities ETF in London

Trading commenced on the Shanghai Gold Exchange

James Burton appointed as CEO

Publication of Deregulation of gold in India

Establishment of the China Gold Association

Abolition of China’s retail price controls

Joint publication, with China’s State Development Research Centre, of Opening China’s gold market in a new era: Related policy research and suggestions, proposing liberalisation of the country’s gold market

World Gold Council Members

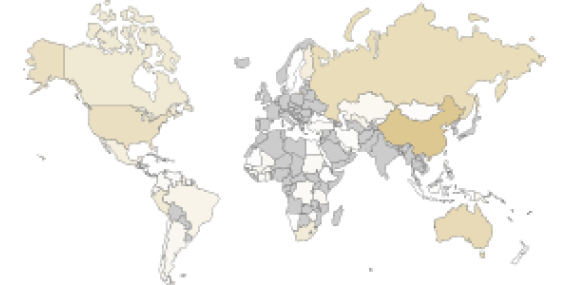

The World Gold Council’s 32 Members are some of the world’s most forward-thinking gold mining companies. They are headquartered across the world and have mining operations in over 45 countries.

Our Members share our vision of ensuring a sustainable gold mining industry, based on a deep understanding of gold’s role in society, now and in the future.

We support our Members in many of their endeavours to ensure modern gold mining is demonstrating their commitment to responsible and sustainable business practices, and high standards of environmental, social and governance performance. We also support their place in a vibrant and sustainable gold supply chain by stimulating demand in new and existing markets through research, insight and partnerships with leaders in investment, jewellery, industry and academia. We work across the entire supply chain, from sustainable and responsible gold mining through to the consumer marketplace.

World Gold Council Member Operations

Members mining map

Data as of 10 June, 2020

Note: Some assets of WGC Member streaming and royalty companies may not be included; China mine/project details are not comprehensive. ‘Other’ productive mines are those owned by companies that are not members of the World Gold Council.

Agnico-Eagle Mines Limited

Agnico-Eagle Mines operates mines and exploration activities in Canada, Finland, Mexico and the United States. Listed on the Toronto and New York Stock Exchanges, Agnico-Eagle’s 2016 production was almost 1.6m ounces.

Alamos Gold Inc.

Alamos Gold operates mines and exploration activities in Canada, Mexico, Turkey and the US. Listed on the Toronto and New York Stock Exchanges, the company was formed from the merger of Alamos Gold and AuRico Gold in 2015. Annual production totalled 392,000 ounces in 2016.

AngloGold Ashanti

Headquarters: South Africa

AngloGold Ashanti is the third largest mining company in the world, with 17 gold mines in nine different countries and exploration programmes across the globe. Quoted on the Johannesburg, Australian and New York Stock Exchanges, AngloGold Ashanti produced more than 3.6m ounces of gold in 2016.

Aura Minerals

Aura is a gold and copper production company focused on the development and operation in the Americas with operations in Brazil, Honduras, Mexico and USA and projects in Brazil and Colombia. Aura Combines fast growth with robust dividend policy and aims to be one of the most trusted, responsible, well respected and results driven mining companies.

B2Gold

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has three operating gold mines and numerous development and exploration projects in various countries including Mali, the Philippines, Namibia, Colombia, Finland and Uzbekistan.

Barrick Gold Corporation

Barrick is the largest gold mining company in the world, with a portfolio of 27 operating mines and with advanced exploration and development projects across the globe. Listed on the Toronto and New York Stock Exchanges, Barrick’s annual production totalled more than 5.5m ounces in 2016.

Compania de Minas Buenaventura S.A.A.

Compania de Minas Buenaventura is the largest, publicly traded precious metals company in Peru. Engaged in the processing, development and exploration of gold, Buenaventura is quoted on the Lima and New York Stock Exchanges. Directly and through minority stakes, Buenaventura’s annual production was more than 627,000 ounces in 2016.

Calibre Mining Corp

Calibre Mining is a Canadian-listed gold mining and exploration company with two 100%-owned operating gold mines in Nicaragua. The Company is focused on sustainable operating performance and a disciplined approach to growth.

Centerra Gold Inc.

Centerra is a gold mining and exploration company engaged in the operation, exploration, development and acquisition of gold properties in Kyrgyz Republic, Mongolia, Turkey and several other markets across the world. Quoted on the Toronto Stock Exchange, Centerra produced almost 600,000 ounces of gold in 2016.

中国黄金集团公司

China National Gold Corporation (China Gold) is the largest producer of gold in China. Involved in exploration, development and production, China Gold also refines and processes gold, including the manufacture of gold bars for investment. China Gold’s president Song Xin, also chairs the China Gold Association.

Eldorado Gold Corporation

Eldorado Gold is engaged in operating mines and development and exploration programmes in Brazil, China, Greece, Romania and Turkey. Quoted on the Toronto and New York Stock Exchanges, Eldorado produced more than 485,000 ounces of gold in 2016.

Endeavour Mining Corporation

Equinox Gold

Equinox Gold is growth-focused gold producer that operates entirely in the Americas, with a portfolio of producing mines and expansion projects in the United States, Mexico and Brazil.

Franco-Nevada Corporation

Franco-Nevada Corporation is a gold-focused royalty company with additional interests in platinum metals, oil and gas and other assets. Quoted on the Toronto and New York Stock Exchanges, Franco-Nevada has one of the largest and most diversified portfolios of cash-flow producing assets in the royalty sector.

Gold Fields Limited

Gold Fields Limited is a globally diversified gold producer with nine operating mines and one project in Australia, Chile, Ghana (including our Asanko Joint Venture), Peru and South Africa, with total attributable annual gold-equivalent production of 2.24Moz. It has attributable gold-equivalent Mineral Reserves of 52.1Moz and gold Mineral Resources of 116.0Moz. Gold Fields has a primary listing on the Johannesburg Stock Exchange and an additional listing on the New York Stock Exchange.

Hummingbird Resources

Hummingbird Resources engages in the exploration, evaluation and development of mineral properties in West Africa with a primary focus on gold. Founded in 2005, Hummingbird listed on the London Stock Exchange in 2010. The company currently has two operations, Yanfolila, a high grade, producing mine in south west Mali; and Dugbe, a large undeveloped gold deposit in Liberia.

IAMGOLD

Headquarters: Canada

IAMGOLD has four operational gold mines in North and South America and West Africa. It is also involved in development and exploration and seeks to grow through acquisition. Listed on the Toronto and New York Stock Exchanges, IAMGOLD produced more than 810,000 ounces of gold in 2016.

Kinross Gold Corporation

Kinross Gold is a gold mining company with mines and projects in Brazil, Canada, Chile, Ecuador, Ghana, Mauritania, Russia and the US. Quoted on the Toronto and New York Stock Exchanges, the company employs approximately 8,000 people worldwide and produced more than 2.7m ounces of gold in 2016.

Newcrest

Headquarters: Australia

Newcrest is one of the world’s largest gold mining companies. Headquartered in Melbourne, Australia, Newcrest owns and operates a portfolio of mines in Australia, Canada, and Papua New Guinea. Newcrest is listed on the Australian Stock Exchange (ASX) and the Port Moresby Stock Exchange (POMSoX).

Newmont

Headquarters: United States

Newmont is the world’s leading gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social and governance practices. The Company is an industry leader in value creation, supported by robust safety standards, superior execution and technical proficiency. Newmont was founded in 1921 and has been publicly traded since 1925.

OceanaGold

OceanaGold is a global gold mining company with a strong presence in the Philippines, New Zealand and the US. Quoted on the Toronto and Australian Stock Exchanges, OceanaGold produced more than 416,000 ounces of gold in 2016.

Resolute

Headquarters: Australia

Resolute is a gold producer with over 25 years’ experience of continuous gold production, exploration, development and innovation. Resolute currently operates mines in Mali, West Africa and Queensland, Australia, and is one of the largest gold producers listed on the Australian Securities Exchange

Royal Gold Inc.

Royal Gold is engaged in the acquisition, and management of precious metals royalties. Quoted on Nasdaq, Royal Gold’s portfolio includes 38 producing and 22 development-stage royalties or similar interests.

Sandstorm Gold Royalties

Sandstorm Gold Royalties is a growth company providing financing for precious metal mining companies in the form of royalty transactions. An upfront payment to companies in need of capital gives Sandstorm the right to a percentage of mine production. Sandstorm’s growing portfolio of over 200 royalties consists of a stable base of cash-flowing assets providing significant upside for investors.

Shandong Gold Group

Headquarters: China

Shandong Gold Group was established in 1996 and converted in 2015 into a state-owned capital investment company directly under Provincial Government. As a large state-owned enterprise, the Group takes the lead in China’s gold industry in terms of gold output, resource reserve, economic benefits, scientific and technological level and talent advantages.

Website:

Sibanye Stillwater

Sibanye-Stillwater is a global precious metal mining group, producing a unique mix of metals that includes gold and the platinum group metals (PGMs). Domiciled in South Africa, and quoted on the New York and Johannesburg Stock Exchanges, Sibanye-Stillwater is the third largest producer of palladium and platinum and features among the world’s top ten gold producing companies.

Torex Gold Resources Inc

Headquarters: Canada

Torex Gold Resources Inc. is an intermediate gold producer based in Canada, engaged in the exploration, development and operation of its 100% owned Morelos Gold Property in the highly prospective Guerrero Gold Belt in Mexico. Listed on the Toronto Stock Exchange (TSX:TXG), Torex is currently the second-largest gold producer in Mexico.

Triple Flag

Triple Flag is a pure play, gold-focused, streaming and royalty company with proven execution capabilities and a focus on cash-generating mines and construction-ready, fully permitted projects.

Wheaton Precious Metals

Wheaton Precious Metals is the largest precious metals streaming company in the world.

Yamana Gold Inc.

Yamana Gold is a gold producer with significant gold production, development, exploration activities and land positions in Argentina, Brazil, Chile and Mexico. Quoted on the Toronto Stock and New York Stock Exchanges, Yamana produced approximately 1.27m ounces of gold in 2016.

Zhaojin Group

Shandong Zhaojin Group undertakes gold mining and related activities, including the largest gold smelter in China. Zhaojin Mining Co., Ltd., a subsidiary has been listed on the Hong Kong stock exchange since 2006. In 2019, the Group Company achieved sales revenue of RMB65.7 billion yuan, with a focus on safe and environmentally-friendly production. Zhaojin has been listed as one of China’s top 500 enterprises.

Zijin Mining Group Co., Ltd.

Zijin Mining Group Co., Ltd. is a multinational mining group principally engaged in the exploration and mining of gold, copper and other mineral resources. The company has a dual listing in Hong Kong Stock Exchange and Shanghai Stock Exchange. Zijin Mining ranked 778th in the list of “Forbes Global 2000” in 2020, of which 3rd among global gold corporations. Zijin Mining has gold resource reserves of more than 2,300 tonnes.

Agnico-Eagle Mines operates mines and exploration activities in Canada, Finland, Mexico and the United States. Listed on the Toronto and New York Stock Exchanges, Agnico-Eagle’s 2016 production was almost 1.6m ounces.

Alamos Gold operates mines and exploration activities in Canada, Mexico, Turkey and the US. Listed on the Toronto and New York Stock Exchanges, the company was formed from the merger of Alamos Gold and AuRico Gold in 2015. Annual production totalled 392,000 ounces in 2016.

Headquarters: South Africa

AngloGold Ashanti is the third largest mining company in the world, with 17 gold mines in nine different countries and exploration programmes across the globe. Quoted on the Johannesburg, Australian and New York Stock Exchanges, AngloGold Ashanti produced more than 3.6m ounces of gold in 2016.

Aura is a gold and copper production company focused on the development and operation in the Americas with operations in Brazil, Honduras, Mexico and USA and projects in Brazil and Colombia. Aura Combines fast growth with robust dividend policy and aims to be one of the most trusted, responsible, well respected and results driven mining companies.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has three operating gold mines and numerous development and exploration projects in various countries including Mali, the Philippines, Namibia, Colombia, Finland and Uzbekistan.

Barrick is the largest gold mining company in the world, with a portfolio of 27 operating mines and with advanced exploration and development projects across the globe. Listed on the Toronto and New York Stock Exchanges, Barrick’s annual production totalled more than 5.5m ounces in 2016.

Compania de Minas Buenaventura is the largest, publicly traded precious metals company in Peru. Engaged in the processing, development and exploration of gold, Buenaventura is quoted on the Lima and New York Stock Exchanges. Directly and through minority stakes, Buenaventura’s annual production was more than 627,000 ounces in 2016.

Calibre Mining is a Canadian-listed gold mining and exploration company with two 100%-owned operating gold mines in Nicaragua. The Company is focused on sustainable operating performance and a disciplined approach to growth.

Centerra is a gold mining and exploration company engaged in the operation, exploration, development and acquisition of gold properties in Kyrgyz Republic, Mongolia, Turkey and several other markets across the world. Quoted on the Toronto Stock Exchange, Centerra produced almost 600,000 ounces of gold in 2016.

China National Gold Corporation (China Gold) is the largest producer of gold in China. Involved in exploration, development and production, China Gold also refines and processes gold, including the manufacture of gold bars for investment. China Gold’s president Song Xin, also chairs the China Gold Association.

Eldorado Gold is engaged in operating mines and development and exploration programmes in Brazil, China, Greece, Romania and Turkey. Quoted on the Toronto and New York Stock Exchanges, Eldorado produced more than 485,000 ounces of gold in 2016.

Equinox Gold is growth-focused gold producer that operates entirely in the Americas, with a portfolio of producing mines and expansion projects in the United States, Mexico and Brazil.

Franco-Nevada Corporation is a gold-focused royalty company with additional interests in platinum metals, oil and gas and other assets. Quoted on the Toronto and New York Stock Exchanges, Franco-Nevada has one of the largest and most diversified portfolios of cash-flow producing assets in the royalty sector.

Gold Fields Limited is a globally diversified gold producer with nine operating mines and one project in Australia, Chile, Ghana (including our Asanko Joint Venture), Peru and South Africa, with total attributable annual gold-equivalent production of 2.24Moz. It has attributable gold-equivalent Mineral Reserves of 52.1Moz and gold Mineral Resources of 116.0Moz. Gold Fields has a primary listing on the Johannesburg Stock Exchange and an additional listing on the New York Stock Exchange.

Hummingbird Resources engages in the exploration, evaluation and development of mineral properties in West Africa with a primary focus on gold. Founded in 2005, Hummingbird listed on the London Stock Exchange in 2010. The company currently has two operations, Yanfolila, a high grade, producing mine in south west Mali; and Dugbe, a large undeveloped gold deposit in Liberia.

Headquarters: Canada

IAMGOLD has four operational gold mines in North and South America and West Africa. It is also involved in development and exploration and seeks to grow through acquisition. Listed on the Toronto and New York Stock Exchanges, IAMGOLD produced more than 810,000 ounces of gold in 2016.

Kinross Gold is a gold mining company with mines and projects in Brazil, Canada, Chile, Ecuador, Ghana, Mauritania, Russia and the US. Quoted on the Toronto and New York Stock Exchanges, the company employs approximately 8,000 people worldwide and produced more than 2.7m ounces of gold in 2016.

Headquarters: Australia

Newcrest is one of the world’s largest gold mining companies. Headquartered in Melbourne, Australia, Newcrest owns and operates a portfolio of mines in Australia, Canada, and Papua New Guinea. Newcrest is listed on the Australian Stock Exchange (ASX) and the Port Moresby Stock Exchange (POMSoX).

Headquarters: United States

Newmont is the world’s leading gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social and governance practices. The Company is an industry leader in value creation, supported by robust safety standards, superior execution and technical proficiency. Newmont was founded in 1921 and has been publicly traded since 1925.

OceanaGold is a global gold mining company with a strong presence in the Philippines, New Zealand and the US. Quoted on the Toronto and Australian Stock Exchanges, OceanaGold produced more than 416,000 ounces of gold in 2016.

Headquarters: Australia

Resolute is a gold producer with over 25 years’ experience of continuous gold production, exploration, development and innovation. Resolute currently operates mines in Mali, West Africa and Queensland, Australia, and is one of the largest gold producers listed on the Australian Securities Exchange

Royal Gold is engaged in the acquisition, and management of precious metals royalties. Quoted on Nasdaq, Royal Gold’s portfolio includes 38 producing and 22 development-stage royalties or similar interests.

Sandstorm Gold Royalties is a growth company providing financing for precious metal mining companies in the form of royalty transactions. An upfront payment to companies in need of capital gives Sandstorm the right to a percentage of mine production. Sandstorm’s growing portfolio of over 200 royalties consists of a stable base of cash-flowing assets providing significant upside for investors.

Headquarters: China

Shandong Gold Group was established in 1996 and converted in 2015 into a state-owned capital investment company directly under Provincial Government. As a large state-owned enterprise, the Group takes the lead in China’s gold industry in terms of gold output, resource reserve, economic benefits, scientific and technological level and talent advantages.

Website:

Sibanye-Stillwater is a global precious metal mining group, producing a unique mix of metals that includes gold and the platinum group metals (PGMs). Domiciled in South Africa, and quoted on the New York and Johannesburg Stock Exchanges, Sibanye-Stillwater is the third largest producer of palladium and platinum and features among the world’s top ten gold producing companies.

Headquarters: Canada

Torex Gold Resources Inc. is an intermediate gold producer based in Canada, engaged in the exploration, development and operation of its 100% owned Morelos Gold Property in the highly prospective Guerrero Gold Belt in Mexico. Listed on the Toronto Stock Exchange (TSX:TXG), Torex is currently the second-largest gold producer in Mexico.

Triple Flag is a pure play, gold-focused, streaming and royalty company with proven execution capabilities and a focus on cash-generating mines and construction-ready, fully permitted projects.

Wheaton Precious Metals is the largest precious metals streaming company in the world.

Yamana Gold is a gold producer with significant gold production, development, exploration activities and land positions in Argentina, Brazil, Chile and Mexico. Quoted on the Toronto Stock and New York Stock Exchanges, Yamana produced approximately 1.27m ounces of gold in 2016.

Shandong Zhaojin Group undertakes gold mining and related activities, including the largest gold smelter in China. Zhaojin Mining Co., Ltd., a subsidiary has been listed on the Hong Kong stock exchange since 2006. In 2019, the Group Company achieved sales revenue of RMB65.7 billion yuan, with a focus on safe and environmentally-friendly production. Zhaojin has been listed as one of China’s top 500 enterprises.

Zijin Mining Group Co., Ltd. is a multinational mining group principally engaged in the exploration and mining of gold, copper and other mineral resources. The company has a dual listing in Hong Kong Stock Exchange and Shanghai Stock Exchange. Zijin Mining ranked 778th in the list of “Forbes Global 2000” in 2020, of which 3rd among global gold corporations. Zijin Mining has gold resource reserves of more than 2,300 tonnes.

Central Banks

Our central banks programme provides authoritative research, key statistical data, insightful commentary from trusted external experts, as well as education and training on the gold market to help stakeholders navigate changes and make informed decisions about using gold to meet reserve management, investment, or policy portfolio objectives.

Our work with central banks is centred on three pillars:

Engaging: We engage bilaterally with central banks and official sector investors, providing information and training on the gold market. We also organise gold training programmes exclusively for official institutions.

Informing: We are thought leaders on the gold market, providing research and insight into how gold matters for official institutions. This includes central bank surveys and research that focuses on the needs of official institutions.

Leading: We lead initiatives that provide guidance and clarity on gold matters for the official sector, including our Guidance on Accounting for Monetary Gold, Guidance on Domestic Purchase Programmes, or our previous work on the Central Bank Gold Agreement.

A Central Banker’s Guide to Gold as a Reserve Asset

We publish a compendium of all relevant information on gold as a reserve asset, available here.

Official Gold Holdings

Download the most up to date information available on the official gold holdings of 126 countries in the Official holdings section.

About Gold

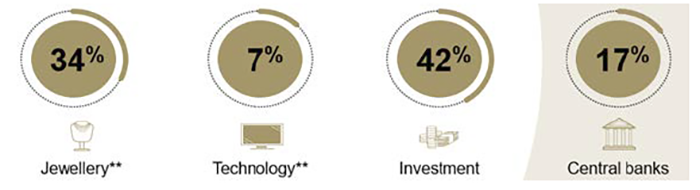

Regional Diversity of Gold Demand

Gold is a precious metal bought by people across the world for different reasons, often influenced by socio-cultural factors, market conditions, and macro-economic drivers in their country.

Gold Market Structure and Flows

This set of infographics details the sources of gold supply and demand, demonstrating the structure and flows of the global gold market.

How Gold is Mined: The Lifecycle

Gold mining is a far longer, more complex process than most would think — on average, it takes between 10-20 years before a mine is even ready to produce material that can be refined. Find out more about this process here.

Yanacocha Mine, Peru, Newmont

Gold Mining

Gold Mining describes the process of extracting ore – metal-rich rock – from the earth’s crust. Find out more about gold mining and the geological processes involved here.

Meadowbank Complex, Nunavut Territory, Canada, Agnico Eagle

World gold council

Discover the data you need to analyse and research gold. Utilise multiple charting tools and download options which allow you to work with the data.

Most Recently Updated

Gold ETFs holdings and flows

Central bank holdings

Annual central bank survey

Historical demand and supply

Gold spot prices

Returns

Price and premium

Benchmark gold prices, gold futures curves and local price premium/discount

Gold spot prices

A long-term time series of the gold price in a range of currencies from 1978.

Local gold price premium/discount

A time series of the difference between international US$ gold price and the local gold price paid by Indian and Chinese consumers in their respective markets.

Gold futures prices

Futures prices for gold across several key exchanges and future dates.

Performance metrics

Returns, volatility, correlations and trading volumes for gold, bonds, equities and other major asset classes

Returns

This data set provides monthly performance metrics for gold and various relevant asset classes in multiple currencies.

Volatility

LBMA Gold price volatility: Annualised daily return volatility based on LBMA gold price.

Correlations

A cross-sectional look at the correlation of gold to other major asset classes.

Trading volume

Overview/ aggregation of gold trading volumes across trading venues.

Demand and supply

Data on various sectors of gold demand and supply, as well as productions costs and futures market positioning

Historical demand and supply

A comprehensive time series of gold demand – broken down by sector and country – and gold supply – broken down by mine production, recycling and producer hedging.

Gold ETFs holdings and flows

Gold-backed ETFs and similar products account for a significant part of the gold market, with institutional and individual investors using them to implement many of their investment strategies.

Global mine production

A time series of global gold mine production by country.

Production costs

A time series of the global all-in sustaining cost (AISC) of gold production and cost curve for the most recent quarter.

Futures positioning

Current futures open interest on the nine major global gold futures exchanges.

Above-ground stocks

A breakdown of the above-ground stock of gold, including a time series of how it has evolved since 2010, and the latest year-end estimate of below-ground stocks.

Central banks

Data on central bank gold holdings, sales and purchases, as well as insights from annual surveys into central bank attitudes towards gold.

Central bank holdings

A time series of official holdings of gold including an attribution of sales under the Central Bank Gold Agreement (CBGA).

Annual central bank survey

Gold continues to be viewed favourably by central banks as a reserve asset. According to the 2022 Central Bank Gold Reserves (CBGR) survey, 25% of respondents intend to increase their gold reserves in the next twelve months, an uptick from 21% of respondents in 2021.

Goldhub

The definitive source of gold data and insight

Latest Research

Looking for insight and analysis on gold? Our team of experts produce market-leading research and macroeconomic commentary on gold.

Investment Update: Gold amid higher inflation and rising bond yields in India

As food and fuel prices in India have risen, inflation has surged: in June, the wholesale price index (WPI) and the consumer price index (CPI) remained elevated at 15.18% and 7.01% respectively. Meanwhile, the 10-year Indian government bond rose by 1% between the end of November 2021 and July 2022.

Gold Market Commentary

Gold fell 3.5% in July, leaving it down 2.9% on the year at US$1,753/oz. A strong US dollar and sticky real yields weighted on gold in the first half of a July. But softer inflation expectations mid-month and jobless claims a few days later in the US nudged the dollar and real rates down. These reversals also coincided with extended positioning in futures markets for currencies, gold and to a lesser extent, rates.

Monthly ETF Commentary

Global gold ETFs registered outflows of 81t (-US$4.5bn) in July. This was the third consecutive month of outflows and the worst since March 2021. A stronger US dollar and COMEX net long positioning – the lowest since April 2019 – helped push the gold price down through the US$1,800/oz support level. Gold finished the month at US$1,753/oz, down 2.8% on the year.

Gold and ESG

In recent years, we have seen increased focus from a growing number of consumers and investors on environmental, social and governance (ESG) factors and the sustainability of our planet. An increasing number of consumers and investors want to understand if the products they buy have been responsibly produced and sourced and if they contribute to societal progress.

We firmly believe that responsible gold mining supports sustained socio-economic development in the countries and communities where gold is found. It creates well-paid jobs, valuable tax revenues for host governments and generates sustained benefits for local communities. In addition, there is a credible pathway for the gold mining industry to decarbonise and reach net zero by 2050, in alignment with the Paris Agreement.

Gold also plays an important role in supporting technologies that enable our daily lives, as well as supporting the transition to a low carbon economy. There is increasing evidence that including gold can make investment portfolios more robust and resilient in light of climate risks.

Responsible Gold Mining

Agnico Eagle Mines, Pinos Altos mine, Mexico

The WGC and our Members believe that it is important for investors, consumers and other stakeholders to understand that the gold they purchase has been ethically and sustainably sourced.

Gold’s contribution to society

Since 2013, Buenaventura Mining has been sponsoring the Aprender para Crecer (“Learning to grow”) programme in Peru as part of its work to contribute to SDG 4.

The WGC has long believed that responsible gold mining supports sustained socio-economic development in countries and communities that host gold mining operations, through its contribution to jobs, tax revenue and investment in local communities. The gold industry makes a meaningful contribution to the UN’s Sustainable Development Goals. Gold itself also plays a critical role in supporting societies’ needs and is considered important across cultures globally. It is deeply understood and recognised as a source of financial security and is critical to numerous technological and healthcare applications.

Gold and Climate Change

The World Gold Council and its members recognise that climate change imposes very substantial risks to the global economy and socio-economic development. We also believe that gold has a role to play in addressing these risks.

In order to provide a greater understanding of the role that gold and the gold mining industry can play, we have undertaken a programme of research, in collaboration with leading sustainability experts and academics. This research looks at the current emissions profile of the sector and the opportunities for decarbonisation in the gold sector, as well as the important role that gold can play in helping investors build portfolios that are more resilient in the face of climate impacts.

Artisanal and Small-Scale Gold Mining

The World Gold Council and our member companies support the responsible mining and trading of gold from all legitimate sources, including artisanal and small-scale mining (ASM). The responsible development of gold resources both through large-scale mining (LSM) and ASM, especially when coupled with sound governance, has the potential to deliver broad social and economic benefits to individuals, communities, and countries.

Research

Looking for insight and analysis on gold? Our expert team produces market-leading research and macroeconomic commentary on gold.

Latest

Investment update: Gold amid higher inflation and rising bond yields in India

As food and fuel prices in India have risen, inflation has surged: in June, the wholesale price index (WPI) and the consumer price index (CPI) remained elevated at 15.18% and 7.01% respectively.

Gold Market Commentary

Gold fell 3.5% in July, leaving it down 2.9% on the year at US$1,753/oz. A strong US dollar and sticky real yields weighted on gold in the first half of a July.

Monthly ETF Commentary

Global gold ETFs registered outflows of 81t (-US$4.5bn) in July. This was the third consecutive month of outflows and the worst since March 2021.

Gold Demand Trends Q2 2022

Gold demand softened in Q2. Despite Q2 weakness, strong first quarter ETF inflows fuelled a notable H1 recovery.

Investment Update: Why should Japanese investors own gold?

While major Japanese and global assets have witnessed declines in H1, gold has delivered a 19% return in local currency over the same period.

Gold Mid-Year Outlook 2022

Investors face a challenging environment during the second half of 2022, needing to navigate rising interest rates, high inflation and resurfacing geopolitical risks.

Gold refining and recycling: India gold market series

India’s gold refining industry has seen significant growth over recent years. It is estimated that from 2013 to 2021 capacity increased by 1,500t (500%).

Topics

Library

Investment Update: Gold amid higher inflation and rising bond yields in India

Gold Market Commentary

Gold fell 3.5% in July, leaving it down 2.9% on the year at US$1,753/oz. A strong US dollar and sticky real yields weighed on gold in the first half of July.

Strong gold ETF outflows in July, driven by a weaker gold price and momentum

Global gold ETFs registered outflows of 81t (-US$4.5bn) in July. This was the third consecutive month of outflows and the worst since March 2021. A stronger US dollar and COMEX net long positioning – the lowest since April 2019 – helped push the gold price down through the US$1,800/oz support level.

Gold Demand Trends Q2 2022

Gold demand softened in Q2. Despite Q2 weakness, strong first quarter ETF inflows fuelled a notable H1 recovery Gold demand (excluding OTC) was 8% lower y-o-y at 948t. Combined with Q1 this took H1 demand to 2,189t, up 12% y-o-y.

Investment Update: Why should Japanese investors own gold?

While major Japanese and global assets have witnessed declines in H1, gold has delivered a 19% return in local currency amid a combination of rising inflation, geopolitical risks and a weaker yen.

Gold Mid-Year Outlook 2022

Investors face a challenging environment during the second half of 2022, needing to navigate rising interest rates, high inflation and resurfacing geopolitical risks. In the near term, gold will likely remain reactive to real rates, which in turn will respond to the speed at which global central banks tighten monetary policy and their effectiveness in controlling inflation.

Gold ETF demand strong year-to-date despite outflows in June

Global gold ETFs registered 28t (US$1.7bn) of outflows in June. This was the second consecutive month of outflows, following the 53t (US$3.1bn) that left these funds in May. While the recent flows were enough to push Q2 into net outflows of 39t (US$2bn), year-to-date net inflows remained positive at 234t (US$14.8bn). Total holdings at the end of June stood at 3,792t (US$221.7bn), up 6% y-t-d.

Gold refining and recycling: India gold market series

As India’s demand for gold outpaces its domestic mine supply, demand is fulfilled by imports as well as gold recycled locally. Recycling in India is a Rs440bn industry making up 11% of the average local annual supply.

May outflows from gold ETFs partially reverse recent gains

Global gold ETFs ended their four-month run of positive inflows in May, with outflows of 53t (US$3.1bn). While this was the largest monthly outflow since March 2021, total holdings remain 8% higher year-to-date at 3,823t (US$226bn).

Gold Market Commentary

Weaker investor interest weighed on gold in May

About Gold Jewellery

Throughout history, gold has been treasured for its natural beauty and radiance. For this reason, many cultures have imagined gold to represent the sun.

Colour

Yellow gold jewellery is still the most popular colour, but today gold is available in a diverse palette. The process of alloying—mixing other metals with pure 24 carat gold—gives malleable gold more durability, but can also be used to change its colour.

White gold is created through alloying pure gold with white metals such as palladium or silver. In addition it is usually plated with rhodium to create a harder surface with a brighter shine. White gold has become the overwhelming choice for wedding bands in the US.

The inclusion of copper results in the soft pink complexion of rose gold while the more unusual colours such as blue and purple can be obtained from the addition of patinas or oxides on the alloy surface. Black gold for example derives its colour from cobalt oxide.

Caratage

The weight of gold is measured in troy ounces (1 troy ounce = 31.1034768 grams), however its purity is measured in ‘carats’.

‘Caratage’ is the measurement of purity of gold alloyed with other metals. 24 carat is pure gold with no other metals. Lower caratages contain less gold; 18 carat gold contains 75 per cent gold and 25 per cent other metals, often copper or silver.

The minimum caratage for an item to be called gold varies by country. In the US, 10 carat is the legal minimum accepted standard of gold caratage, 14 carat being the most popular. In France, the UK, Austria, Portugal and Ireland, 9 carat is the lowest caratage permitted to be called gold. In Denmark and Greece, 8 carat is the legal minimum standard.

Fineness

Fineness is another way of expressing the precious metal content of gold jewellery, and represents the purity in parts per thousand. When stamped on jewellery, usually this is stated without the decimal point.

This chart shows some examples of the composition of various caratages of gold.

| Caratage | Gold(Au) | Silver (Ag) | Copper (Cu) | Zinc (Zn) | Palladium (Pd) | |

| Yellow Gold | 9k | 37.5% | 42.50% | 20% | ||

| Yellow Gold | 10k | 41.70% | 52% | 6.30% | ||

| Yellow Gold | 14k | 58.30% | 30% | 11.70% | ||

| Yellow Gold | 18k | 75% | 15% | 10% | ||

| Yellow Gold | 22k | 91.70% | 5% | 2% | 1.30% | |

| White Gold | 9k | 37.5% | 62.5% | |||

| White Gold | 10k | 41.7% | 47.4% | 0.9% | 10% | |

| White Gold | 14k | 58.30% | 32.20% | 9.50% | ||

| White Gold | 18k | 75% | 25% (or Pt) | |||

| White Gold | 22k | N/A | N/A | N/A | N/A | N/A |

| Rose Gold | 9k | 37.5% | 20% | 42.5% | ||

| Rose Gold | 10k | 41.70% | 20% | 38.3% | ||

| Rose Gold | 14k | 58.30% | 9.2% | 32.5% | ||

| Rose Gold | 18k | 75% | 9.2% | 22.2% | ||

| Rose Gold | 22k | 91.7% | 8.40% |

Notes:

The alloying metal compositions above are typical of those used by the jewellery industry to arrive at the colour/caratage combinations shown, but these are not the only ways to arrive at these combinations.

White gold compositions listed here are nickel free. Nickel-containing white gold alloys form a small/very small percentage of white gold alloys and generally contain other base metals such as copper and zinc.

The following are the common standards of fineness that are used:

.375 = 9 carat (England and Canada)

.583 (.585) = 14 carat

.833 = 20 carat (Asia)

.999 (1000) = 24 carat pure gold

Similarly, 24 carat should be 1.0 (24/24 = 1.00). However, in practice, there is likely to be a very slight impurity in any gold, and it can only be refined to a fineness level of 999.9 parts per thousand. This is stated as 999.9.

Accepted tolerances on purity vary from market to market. In China, Chuk Kam (which is Cantonese for ‘pure gold’ or literally ‘full gold’) still comprises the majority of sales and is defined as 99.0 per cent minimum gold, with a 1.0 per cent negative tolerance allowed.

Что такое Всемирный Совет по Золоту

Лидеры мировой добычи и производства желтого металла объединены в некоммерческую ассоциацию, именуемую Всемирным советом по золоту (eng. World Gold Council, аббревиатура: WGC). В эту структуру входят 25 добывающих и иных компаний, стремящихся развивать и контролировать рынки драгметалла.

Всемирный совет по золоту создан для развития рынка в золотодобывающей промышленности. Сама организация видит свою цель в том, чтобы стимулировать и поддерживать спрос на золото, обеспечивать лидерство в отрасли и быть мировым авторитетом на рынке золота.

Другими словами Всемирный золотой совет был сформирован, чтобы лоббировать интересы своих членов, исследовать рыночную ситуацию, проводить активную маркетинговую политику в поддержку составляющих его компаний и манипулировать спросом и предложением на рынке золота. Головной офис организации размещен в Лондоне. Отсюда контролируется примерно 3/4 золотого оборота в мире.

Всемирный совет по золоту стремится активизировать потребление. Его задача — защищать, поддерживать и увеличивать имеющийся спрос на драгметалл для дальнейшего развития отрасли. С этой целью структура выделяет средства для мониторинга рынков, исследовательских программ в области продвижения золотосодержащих продуктов и поиска новых сфер применения для драгметалла. Это направление деятельности Всемирного золотого совета уже позволило получать металл с чистотой выше 99%.

Историки считают, что впервые золото было выплавлено и использовано в качестве драгоценного металла еще в XXXVII веке до нашей эры в Древнем Египте. Дойдя в этом качестве до наших дней, сегодня оно применяется для производства ювелирных украшений, медицинского оборудования, электроники, а также используется, как эффективный инструмент инвестиций.

По данным Всемирного совета по золоту, наибольший объем добычи желтого металла пришелся на период после II Мировой войны и современное время. Сегодня разработка месторождений драгметалла ведется повсеместно на всей планете, за исключением Антарктики. С каждым новым десятилетием растет число золотодобывающих государств. Поэтому добыча уже не имеет такой узкой локальной концентрации, как в прошлом и равномерно распределена по всему миру. Активно добывают золото в Перу, Китае, Южно-Африканской Республике, Австралии, Канаде, России и Соединенных Штатах Америки.